Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Aug, 2025

By Brian Scheid

President Donald Trump's decision to fire the head of the Bureau of Labor Statistics could stoke volatility in markets and cause investors to question the validity of future government jobs and inflation data, economic strategists said.

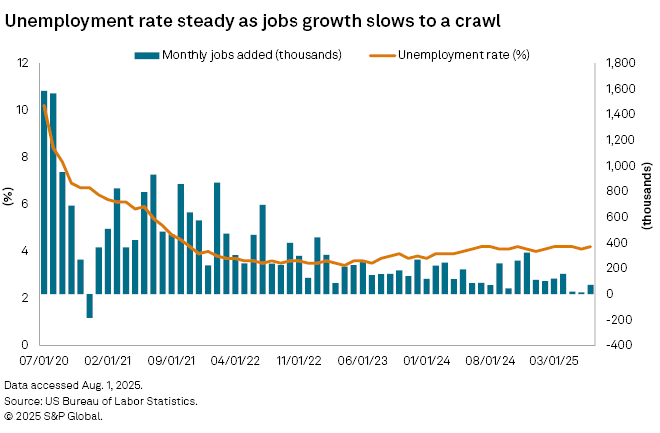

Trump announced Aug. 1 that he was removing Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer, saying that the agency's data cannot be trusted. The announcement came just hours after the agency's July jobs report showed significant downward revisions for recent domestic jobs growth.

The direction of the financial markets is often dictated by jobs and inflation data, and early market moves could be triggered as Trump attempts to reshape leadership at the BLS and the perception of the agency's data potentially shifts.

"Initially, there will be unsophisticated buying on the expectations that data reports will be positive and monetary policy will be easy," said Michael O'Rourke, chief market strategist with JonesTrading. "Institutional investors will likely react with caution."

George Pearkes, a global macro strategist at Bespoke Investment Group, said the market is unlikely to view BLS data as untrustworthy in the near term, though, particularly as William Wiatrowski, the agency's deputy commissioner since 2015, is acting commissioner.

"Markets will likely assume that the data is good until given an explicit reason otherwise," Pearkes said. "That explicit reason could be whistleblowers stepping forward, or underlying details showing inconsistencies. Either way, until we get hard evidence, I think markets will behave as usual on any given report."

Once the Senate confirms a Trump appointee to head the BLS, however, the agency's data releases, especially the jobs report and monthly inflation numbers, may face more scrutiny, Pearkes said.

The change in leadership may not impact market liquidity. However, as views on government data on inflation and jobs evolve, the importance of data releases from the private market will likely strengthen as investors look for signals in which they have more confidence, O'Rourke said.

"With these types of changes, investors will lack confidence in the government reports," O'Rourke said. "The other [private sector] reports will carry greater weight. There is a very high likelihood that the politicization of economic data will drive increased market volatility."

Negative development

The politicization of economic data is viewed as a medium-term negative structural development and most often associated with emerging market economies, such as Argentina and Turkey, said Paul Mielczarski, head of global macro strategy at Brandywine Global.

"It remains to be seen how this latest controversy plays out, but the US risks giving global investors additional reasons to reduce US asset exposures while putting more downward pressure on the dollar," Mielczarski said.

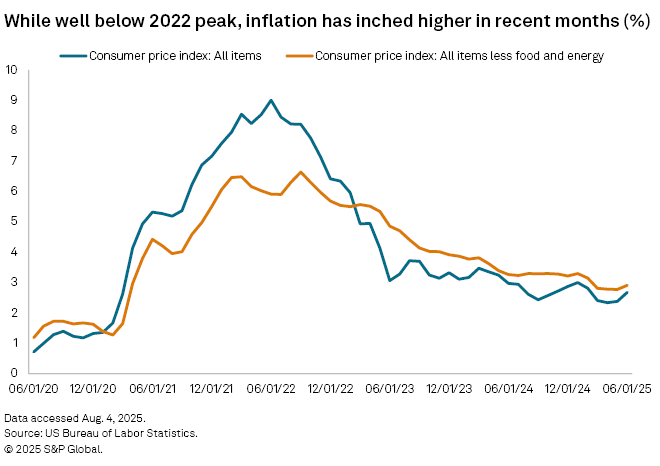

While upcoming data — such as the latest consumer price index report to be released Aug. 12 — will unlikely be impacted, an overtly political pick to head the BLS could raise questions about future reports.

"Markets may distrust any strong reports or upside revisions to data," Mielczarski said. "First, it's possible we see more volatility around releases as markets question the data integrity. But if investors perceive nonfarm payroll releases as being politically managed, markets eventually will end up downplaying the reports over time, just like we generally downplay Chinese data releases today."

Trump's firing of McEntarfer was at least partly motivated by revisions in the total nonfarm payroll employment for May and June, as noted in his Truth Social post on Aug. 1. May's number was revised down to just 19,000 from 144,000 jobs added that month, and the number in June went down to 14,000 from 147,000.

But heavy revisions to jobs data are hardly new. BLS revised down the benchmark payroll growth by more than 800,000 jobs for the year ended March 2024. The data was released in August 2024, during former US President Joe Biden's tenure in the White House.

"The fact is, whether the head of the BLS is a Trump appointee or not, the same problems will remain," said Michael Hewson, an independent market analyst. "The numbers are the numbers, and unless the new head of the BLS deals with the collation process, we will always get revisions in the numbers. I don't think it will change how markets react to the numbers as investors will simply treat the headlines around this story as what they are."

Still, Trump could use doubts about the validity of the data to deflect blame if the US economy starts to slow in the second half of this year, Hewson said.

'Innocent until proven guilty'

While BLS data remains the world's "gold standard" for economic data, Trump's decision to fire McEntarfer may undermine confidence in this data and cause permanent damage to public trust, said Garrett Melson, portfolio strategist at Natixis Investment Managers.

Melson said the market impact is likely to be "fairly limited" in the short and medium term.

A Trump-appointed commissioner is not expected to be approved anytime soon due to the constraints of the legislative calendar. Any changes to data collection or calculation would take longer, Melson said.

According to Melson, Trump's decision to fire the head of BLS may have the most impact on the Treasury Inflation-Protected Securities market, which is linked to consumer price index data.

"If there is any doubt in the reliability and accuracy of the CPI data, that could very well be reflected in real yields given the naturally lower liquidity in a market that has historically been dominated by buy-and-hold investors," Melson said. "A higher liquidity premium would translate to higher real yields and lower breakeven inflation rates."

Markets could continue to trade on initial signals from jobs and inflation data.

"The data remains innocent until proven guilty of being compromised and will continue to rank atop the list of critical data releases," Melson said. "While data surprises are as much a part of economic forecasting and investing as revisions are to the payrolls process, with so much official, alternative and earnings data, it's incredibly difficult to fudge the facts."