Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Aug, 2025

Black Hills Corp. and NorthWestern Energy Group Inc. executives see the proposed combination of the South Dakota-headquartered utilities fulfilling what has become an immediate need for scale and growth.

Black Hills and NorthWestern announced Aug. 19 that they are merging in an all-stock, tax-free transaction with an enterprise value of approximately $15.4 billion.

The combined entity is expected to have a pro forma market capitalization of about $7.8 billion and serve approximately 2.1 million electric and natural gas customers across eight states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming.

"The states of [these] combined service territories are going to cover 20% of the continental United States, which allows the combined company to be exposed to incremental accretive growth projects across electric and natural gas and now with the financial scale to better capture those opportunities," Brian Bird, NorthWestern Energy's president and CEO, said during a conference call Aug. 19 following the deal announcement.

"Overall, we believe the combined company will be in a stronger position to capture incremental accretive growth opportunities more than either company could achieve independently."

Under the terms of the deal, Black Hills agreed to acquire NorthWestern for $3.6 billion, with NorthWestern shareholders receiving 0.98 share of Black Hills for each share they own. At closing, Black Hills shareholders will own about 56% of the combined company, with the remaining 44% held by NorthWestern shareholders.

Bird will serve as CEO of the combined company, which will be based in Rapid City, where Black Hills' headquarters are located. NorthWestern is based in Sioux Falls.

Black Hills and NorthWestern have had conversations "on and off for decades" about a potential combination, Bird said.

No better time than now

Utility analysts questioned why a proposed merger was not announced sooner.

"From our perspective, it's just what is happening in the utility space today and this expectation of significant growth, something we haven't seen in the last two decades," Bird said. "And the necessity to be able to capture that. Scale is going to be extremely important for us to do that."

Black Hills President and CEO Linn Evans, who will retire when the transaction closes, echoed Bird's remarks.

"These jurisdictions just overlay so nicely, not adding any new states from the Black Hills perspective, so we can continue on and be very aggressive with growth in that service territory," Evans said.

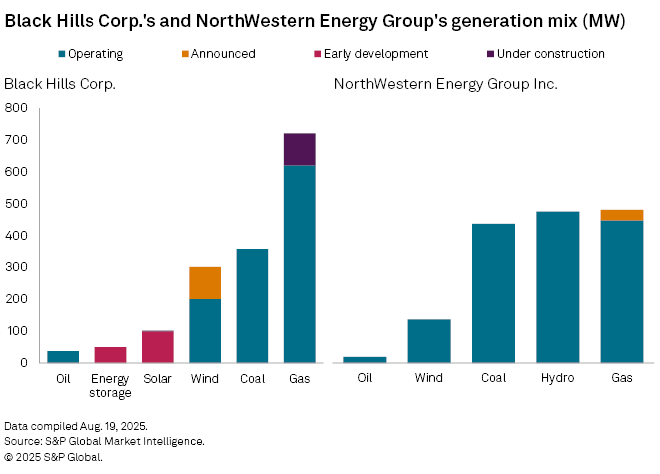

The combined electric utility will serve about 700,000 customers, operate 38,000 miles of electric lines and own about 2.9 GW of generation capacity.

Executives said they see all of the states as ideal places to add generation to help serve growing demand, largely attributed to energy-intensive datacenters.

"Much to be done as far as what that build-out looks like. But what we know today is that we're in a good place from a capacity perspective with a good diverse mix," Marne Jones, senior vice president and chief utility officer at Black Hills, said during the call. Jones will transition to COO of the combined company.

The combined natural gas utility will serve about 1.4 million customers and operate about 59,000 miles of natural gas lines.

"Our combined geographic footprint expands investment opportunities in areas that may not be available to either company on a stand-alone basis across datacenters and other traditional utility growth projects," Bird said.

"The balanced contribution by jurisdiction supports the company's ability to manage the regulatory outcomes and supports a stable earnings and cash flow profile with no single jurisdiction representing more than one-third of rate base," Bird added.

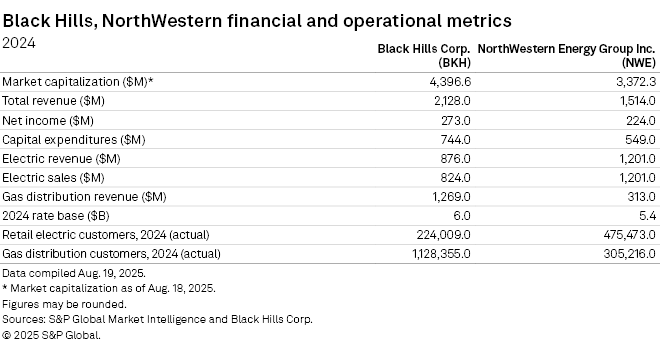

The companies have a combined 2024 rate base of approximately $11.4 billion and a five-year, $7.4 billion capital plan through 2029.

Stronger balance sheet

The merger is expected to be accretive to each company's earnings per share in the first full year and support a long-term growth rate of 5% to 7%. This is up from a long-term EPS growth rate of 4% to 6% on an individual basis.

"From a financial perspective, our combined size and scale will provide the opportunity to grow while maintaining the strength of our balance sheet and our credit profile," NorthWestern Energy CFO Crystal Lail said during the call.

Lail will assume the same role at the combined company, and Black Hills CFO Kimberly Nooney will become chief integration officer.

The transaction will solidify the newly combined company "as a regional leader and will move us from the SMID-cap space to a midcap utility," Bird said. Black Hills and NorthWestern are considered small and midsize utility companies with market capitalization of approximately $4.4 billion and approximately $3.4 billion, respectively, as of Aug. 18.

NorthWestern shares jumped on Aug. 19 before closing up more than 6% at $58.41 in nearly four times average trading volume.

Black Hills shares finished the day up less than 1% in double average trading volume, closing at $60.87.

Analyst reaction

While the combined company will be "financially stronger," Scotia Capital (USA) analyst Andrew Weisel said the firm is not sure that Black Hills "needed a partner given its meaningfully improved standalone outlook."

Black Hills executives have said they anticipate a pipeline of more than 1 GW of datacenter demand over the next decade, including 500 MW by 2029.

"A new datacenter in [Wyoming] could be as big as 1.8 GW as early as late 2026, scaling to up to 10 GW, driving [Black Hills] to point to the high end of its EPS guidance in 2026+," Weisel wrote. "Granted [Black Hills] may struggle to finance that capex, but the company seemed poised to grow far faster than 4–6% without a deal."

NorthWestern also has its own datacenter deal opportunities, but management still saw the combination as key to serving this accelerating demand.

"As you might expect, two smaller companies may not have the same resources to compete from a datacenter perspective," Bird said. "As we put these two teams together, we'll have more resources to do that and be more competitive.

"We represent about 20% of the US, and so, if you want to do business in our states, you're going to be talking to us."

KeyBanc Capital Markets said the deal is an "incremental positive" for NorthWestern, which has a five-year, $2.7 billion capital plan.

"The combined company presents an improved earnings profile that is more aligned with the industry average, while also enabling it to deliver within its guidance range on a more consistent basis," KeyBanc analyst Sophie Karp wrote in an Aug. 19 research report. "Additionally, we expect many of those same growth opportunities [NorthWestern Energy Group] has highlighted to remain for the combined company."

KeyBanc also pointed out the challenges of serving the western US, which is "highly fragmented."

"We believe the larger entity will provide opportunity for better optimization and ample generation between the two portfolios to better serve the territory, while also providing a better chance of future load growth opportunities materializing," Karp wrote. "Additionally, the combined company will result in a stronger balance sheet, supporting the capital plan without any equity needs, and alleviating some of the pressure associated with wildfire risks."

BMO Capital Markets analysts said they also view the transaction "favorably," with the larger combined entity providing better access to capital markets.

"With both balance sheets in a position of strength, we see the combined larger entity as better positioned to attract large load development and execute on the associated capital deployment opportunities," BMO analysts wrote.

Regulatory hurdles

The investment community, however, also flagged some potential for regulatory pushback in Montana. That state would represent the largest single share of the combined company's rate base, at 31%, and of customers, at 29%.

"We do believe the [Montana Public Service Commission] presents the largest potential risk to the deal, as it has historically been a challenging commission," Karp wrote.

Management, however, said the merger will present efficiencies and business optimization that will "accrue to customers over time."

"The long-term benefit to customers just has to be compelling, and it is," Evans said.

In addition to Montana, the transaction is subject to approval by state regulators in Nebraska and South Dakota.

"Fortunately, for us, all three of these states are no harm states," Bird said, adding the companies will talk to regulators in advance of filing for approval, likely in October.

The transaction, which is expected to close in 12 to 15 months, also is subject to clearance under the Hart-Scott Rodino Act, approvals from shareholders and the Federal Energy Regulatory Commission. Arkansas state regulators may also need to approve the transaction.