Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

US beauty retailer, Ulta Beauty Inc. (NASDAQ: ULTA) is set to report fiscal second-quarter 2026 results on Thursday, August 28, offering an update on its recovery momentum following a softer end to 2025.

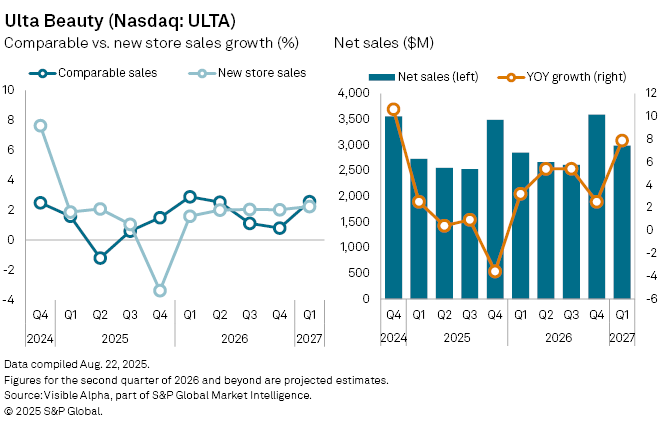

Analysts expect a modest pick-up in momentum. Visible Alpha consensus estimates point to a +4.3% year-on-year rise in Q2 net sales to $2.7 billion, following a +4.5% gain in Q1. That compares with a -1.9% contraction in the Q4 of 2025, when slowing discretionary spending weighed on results.

Comparable-store sales, a key retail metric, are forecast to increase by +2.3% in the quarter, slightly below the +2.9% pace in Q1, reflecting a more tempered performance in established locations. Growth is expected to be offset by expansion: new store sales are projected to rise +2% as Ulta adds 17 outlets in Q2, up from six in the last quarter.

Retail sales are set to climb +5.2% year-on-year to $2.2 billion, with e-commerce revenue forecast to edge up +2.6% to $460 million.

For the full year, analysts expect net sales to rise +3.6%, a modest improvement on the +0.8% growth in 2025. Retail sales are forecast to recover by +4%, compared with a -0.3% decline last year.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Ulta Beauty.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.