Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — AUGUST 14, 2025

By Ashish Negi

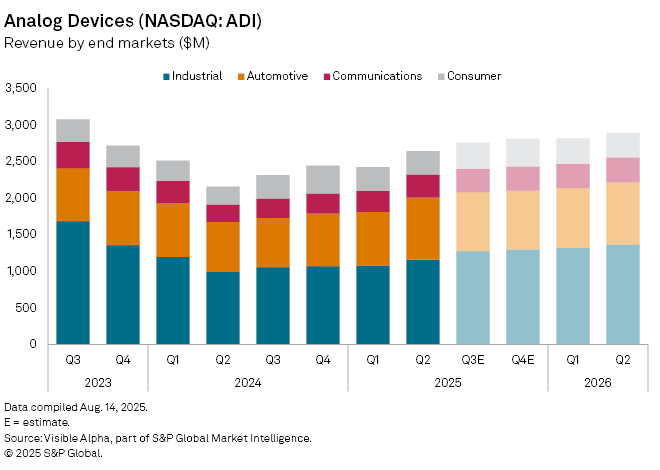

Analog Devices Inc. (NASDAQ: ADI) should deliver another quarter of double-digit revenue growth, signaling an end to the downturn that has weighed on the US chipmaker over the past two years.

Visible Alpha consensus estimates point to a 19% year-on-year rise in third-quarter revenue to $2.8 billion, extending the 22% gain reported in the last quarter. The recovery follows seven consecutive quarters of contraction, triggered by excess customer inventories and a weaker macroeconomic backdrop.

Analysts see broad-based momentum across the group’s core business-to-business end markets, including industrial, automotive and communications, alongside renewed strength in consumer demand. For the full fiscal year, revenue is forecast to climb 13% to $10.6 billion, rebounding from a 23% decline in 2024.

Profitability should also improve. Net income is projected to rise to $2.2 billion, from $1.6 billion a year ago, while diluted earnings per share are forecast at $4.35, reflecting both higher sales and margin recovery. That compares with EPS of $3.16 in 2024 and $6.48 in 2023.

It is unclear whether Analog Devices can sustain this pace of recovery into 2026 as cyclical tailwinds ease and competition in analogue semiconductors intensifies. The company reports third-quarter earnings on Wednesday, August 20.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment