Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Aug, 2025

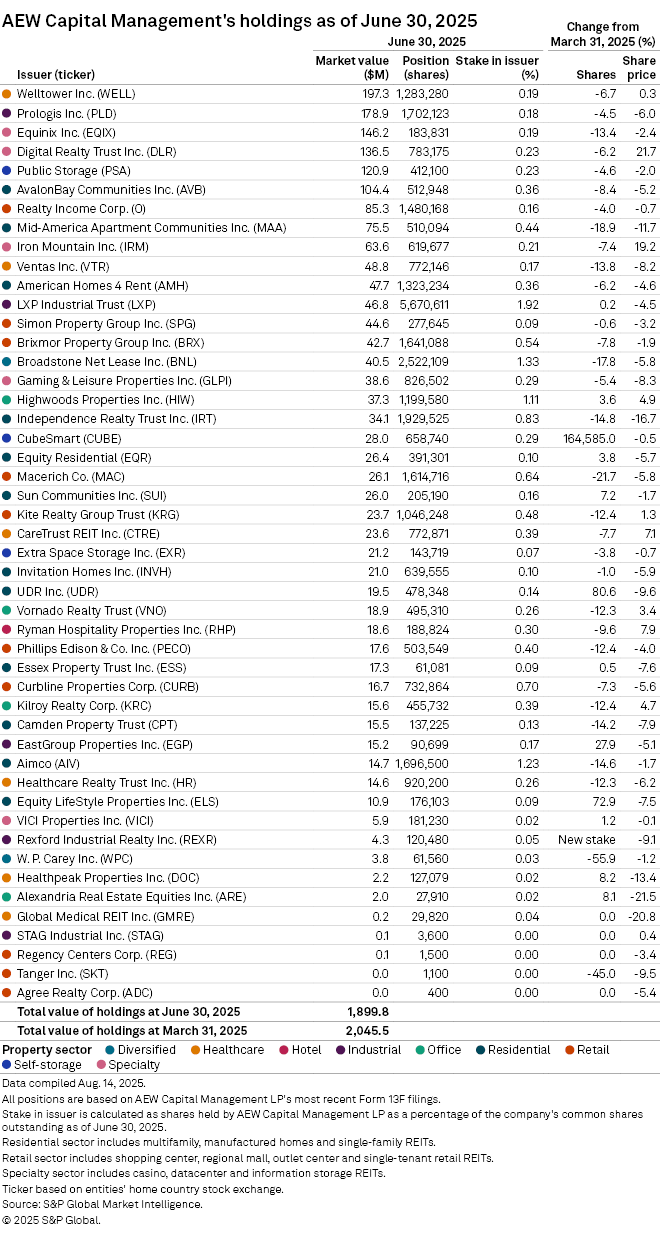

AEW Capital Management LP slashed share count in 31 of its US real estate investment trust holdings during the second quarter, equivalent to around 65% of its holdings.

Coupled with an overall dip in REIT share prices, the cuts led to the investor's total REIT holdings declining 7.1% to almost $1.90 billion as of June 30, according to AEW's latest Form 13F filing.

Sells more than half its stake in WP Carey, exits Lineage

Fifteen of the 31 share count reductions were double-digit cuts. The largest relative cut was to holdings in diversified REIT W. P. Carey Inc. The Boston-based money manager sold 55.9% of its stake, retaining 61,560 shares as of quarter-end valued at around $3.8 million, the firm's eighth-smallest holding by market value.

AEW also sold 45.0% of shares in outlet center-focused Tanger Inc., and slashed over 15% of its stake in regional mall landlord Macerich Co., multifamily-focused Mid-America Apartment Communities Inc. and diversified REIT Broadstone Net Lease Inc.

The investor also sold its stake in industrial REIT Lineage Inc. during the second quarter, a position valued at $17,589 at the end of the first quarter.

– Set email alerts for future Data Dispatch articles.

– For further institutional investor research, try the Investor Targeting tool.

– View AEW Capital's holdings history here.

AEW adds Rexford; massive stake hike in Cubesmart

AEW's added one position to its REIT portfolio during the second quarter, buying 120,480 common shares in the industrial REIT Rexford Industrial Realty Inc. The position was valued at $4.3 million as of June 30.

The firm also raised the share count in 12 existing REIT positions during the second quarter, including a massive stake bump to over 600,000 shares in self-storage-focused CubeSmart, from only 400 shares in the previous quarter. The self-storage REIT, valued at $28.0 million at quarter-end, jumped from being AEW's smallest holding by market value in the first quarter to being the 19th largest holding in the second quarter.

AEW upped its share count in three other REITs by more than 20%: multifamily-focused UDR Inc. at 80.6%, manufactured home REIT Equity LifeStyle Properties Inc. at 72.9% and industrial-focused EastGroup Properties Inc. at 27.9%.

Top holdings

At $197.3 million, AEW's largest holding was Healthcare REIT Welltower Inc. as of June 30, even as the asset manager sold off 6.7% of its shares. Industrial-focused Prologis Inc. ranked second, valued at $178.9 million. Datacenter REIT Equinix Inc. came in third, valued at $146.2 million as of June 30.

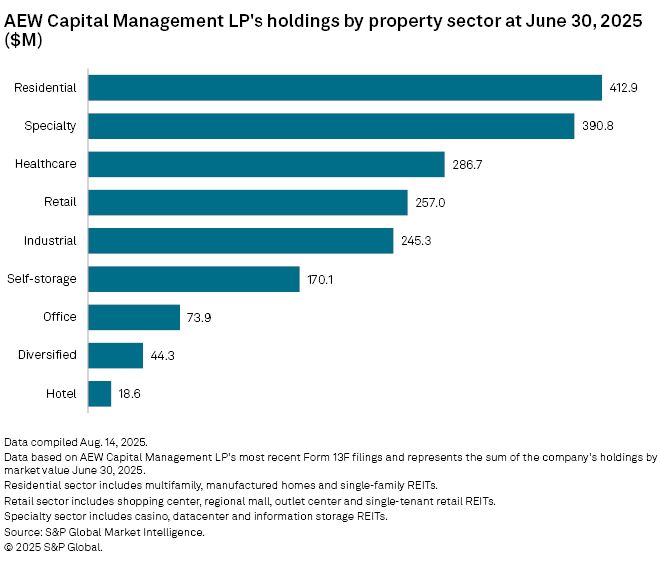

AEW's holdings in residential REITs totaled $412.9 million, or about 21.7% of the asset manager's total REIT holdings, the largest of any property sector.

Specialty REITs — which include casino, datacenter and information storage REITs — were collectively valued at $390.8 million, while the firm's holdings in healthcare REITs totaled $286.7 million.