Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jul, 2025

By Karin Rives and Susan Dlin

| A rendering of a 4.5-GW natural gas-fired power plant and datacenter campus that Homer City Redevelopment LLC is developing in Pennsylvania. The gas plant is expected to be the largest built in the US. Source: Kiewit Corp. |

The US power industry plans to add more than 106 GW of fossil fuel-fired generation to the grid over the next several years, although supply chain bottlenecks make some timelines uncertain.

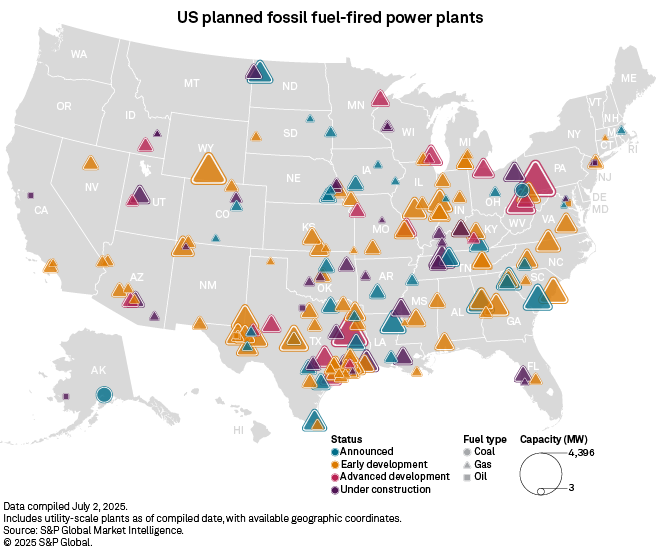

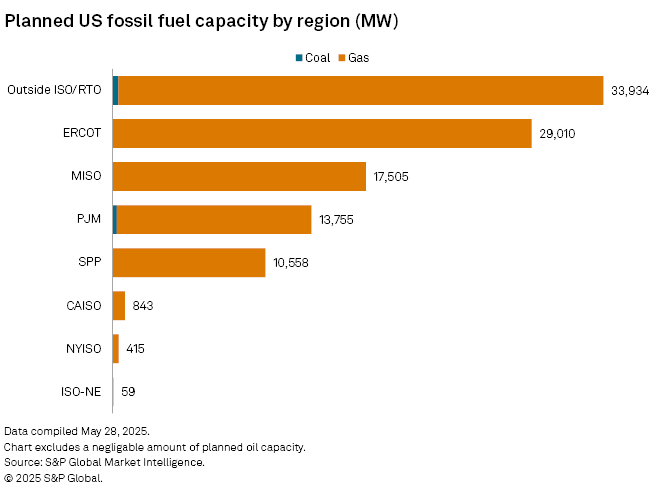

Companies announced or are in the process of developing 197 new carbon-emitting power plants, 188 of which would be fueled by natural gas, data from S&P Global Market Intelligence showed. More than a quarter of the new capacity would be built in the Electric Reliability Council of Texas Inc. region, with projects planned for 39 other states.

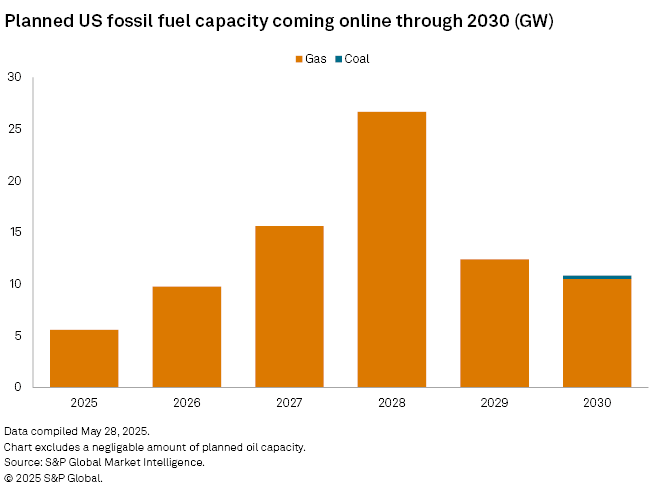

The power sector continued to ramp up plans for new natural gas-fired generation during the second quarter of 2025, raising the capacity target to 106 GW from 80 GW since early this year. All plants are expected to come online by 2030, but a turbine shortage that has led to yearslong delivery delays and other hurdles could affect operational dates, industry analysts said.

Engie SA and Howard Midstream Energy Partners LLC cited such equipment constraints when canceling plant projects in Texas early this year. Three other plants backed by low-interest loans from the Texas Energy Fund pulled out in subsequent months, citing costs.

About 7 GW of planned natural gas capacity was canceled between the first and second quarters of 2025, but the overall growth trend and most project plans hold steady, the Market Intelligence data showed.

US greenhouse gas emissions set to rise

The strategy to add more natural gas-fired capacity to the grid leaves the US power sector with a significant carbon footprint for the foreseeable future. Plants that go into operation in the next decade could produce electricity until the latter half of the century.

Duke Energy Corp., for example, expects to propose a new 1.4-GW natural gas-fired plant to regulators this year. It would begin serving South Carolina customers in early 2031. Duke Energy spokesperson Ryan Mosier said in an email that such a plant would have a 35-year life expectancy, meaning it could operate well into the 2060s.

Scientists have urged nations to halve greenhouse gas emissions by 2030 to avoid the worst impacts of climate change, a goal that the US is unable to meet. Researchers in Europe published data on July 7 showing that the catastrophic flooding in Texas three days earlier was intensified by human-driven climate change.

The Trump administration's rapid unwinding of US climate policies is expected to boost US greenhouse gas emissions by 470 million metric tons by 2035, according to initial estimates by Princeton researchers, representing a 7% increase from 2005 levels.

The continued build-out of natural gas generation will release additional climate-warming emissions into the atmosphere. The power sector's greenhouse gases dropped nearly 23% between 1990 and 2023, but it still accounts for 31% of emissions from fossil fuel combustion, the latest data from the US Environmental Protection Agency showed.

"A big driver for emission reductions in the near term continues to be coal plant retirements," said Patrick Luckow, power and renewables director for the Americas at S&P Global Commodity Insights. "At the same time, we expect natural gas emissions to continue to increase, despite a lot of renewables getting added to the grid."

Rising demand, higher power costs

Duke Energy's South Carolina plant would help the state's growing economy meet its "tremendous electricity generation needs," the utility said when announcing the project in June. The utility was echoing an industrywide push to keep pace with growing power demand and service reliability concerns, although analyses vary on how much power will be needed in coming years.

"In general, companies will meet the moment however they can, and I think the answer is going to be a mix of things," said Alex Bond, legal and clean energy policy executive director for the Edison Electric Institute. "For some, it will be a lot of renewables. For others, it will be a gas plant. For some, it will be both, and some will invest in nuclear."

Critics of the surge in natural gas investments worry the trend will also increase costs for households and businesses.

"The price of natural gas is going nowhere but up because of LNG exports," said John Quigley, a senior fellow with the University of Pennsylvania's Kleinman Center for Energy Policy. "We're looking at a 40% increase in energy prices in the coming decades."

The US Energy Department's Biden-era estimates of how LNG exports could raise US energy prices — coupled with impacts from a sweeping budget bill — suggest the nation is in for "price shocks," Quigley said in an interview.

"It's an issue of misaligned incentives," said Michael Thomas, founder and CEO of platform Cleanview, which tracks clean energy investments.

"A utility makes money when they build a really big piece of infrastructure, no matter whether it's used or not, whether it gets mothballed, or whether it's a stranded asset in 10 years or 15 years," Thomas said in an interview. "Just like a lot of coal plants right now are costing ratepayers and electricity consumers like me, you and businesses in America."

'Got to be ready to move as fast'

The largest natural gas plant project in the pipeline at this time, the 4.5-GW Homer City Combined Cycle Plant in Pennsylvania, also promises to be the largest plant of its kind ever built in the US. The project led by hedge fund-backed Homer City Redevelopment LLC will be developed at the site of a former coal plant and primarily serve a 3,200-acre campus of hyperscale datacenters.

The first natural gas turbines Homer City Redevelopment ordered from GE Vernova Inc. are in production and should be delivered in 2026, a company spokesperson said in an email, adding that while no project is immune from delays, the plant is expecting to get the equipment on time. Operations are expected to begin in 2027.

Speed is of the essence, Homer City Redevelopment CEO Corey Hessen told a Sunday morning Pittsburgh business show in June. The plant is going through permitting with the state and expects to begin construction in fall 2025, Hessen said.

"We are going to have a datacenter customer who is moving faster than any other customer we have ever experienced in this industry," Hessen said. "So we've got to be ready to move as fast as they do as an industry, as a community."

The $10 billion project will bring thousands of new construction jobs and about 1,000 indirect and direct jobs to Indiana County, northwest of Pittsburgh, in what the company says will be the largest capital investment in the state's history. Pennsylvania lawmakers who tried to keep the old coal plant alive to save jobs have now embraced the redevelopment project as a new beginning for the region.

At 4.5 GW, the Homer City plant will emit about 60% less carbon dioxide than the coal plant did for each megawatt of power it produces, the company notes on its website. Even so, the new natural gas-fired plant will push nearly 18 million short tons of CO2 equivalent into the atmosphere annually, according to its air permit application with the state.

These carbon emissions are equivalent to what 3.7 million cars emit on the road for a year, federal data shows.