Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Jul, 2025

By Sean Longoria and Annie Sabater

The share of Americans actively in the workforce hit a new low in June, extending a stretch of workers increasingly exiting employment or the job search.

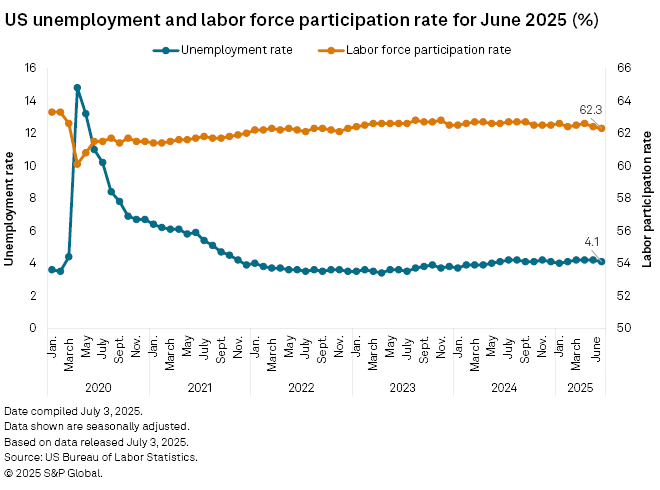

In June, 62.3% of Americans aged 16 or older were working or actively looking for work, the lowest share since December 2022, according to the latest US Bureau of Labor Statistics data. Before the COVID-19 pandemic upended the US labor market in 2020, the labor force participation rate had not dipped to its latest low since 1977.

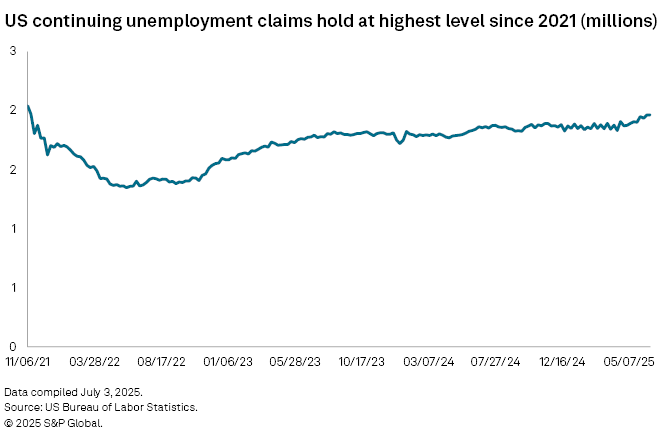

Meanwhile, continued unemployment claims — which count workers that already filed for initial unemployment benefits and are still seeking them — held at 1.96 million for the week ending June 21, the highest level since 2021, according to the US Labor Department. Taken together, the claims and labor force participation data may signal that some are becoming discouraged over finding work and withdrawing from the labor force, said James Knightley, chief international economist with ING.

"If it continues, it can become a constraint on future growth as it would limit the supply side capacity of the economy to meet the needs of any pick up in demand," Knightley said in an email to S&P Global Market Intelligence. "There is also a sense that it can lead to more personal hardship and more strain on government social services, with fewer people feeling the benefits of economic growth."

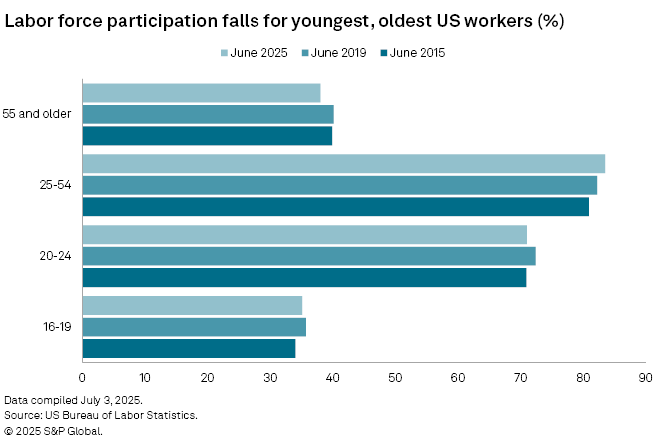

Much of the drop in labor force participation comes from the youngest and oldest workers in the workforce — those between 16 and 19 years old and those who are 55 or older. Labor force participation for both groups lags its pre-pandemic levels, while the rate for so-called "prime-age" workers between 25 and 54 has risen.

Economists have pointed to retirements, generous severance after a layoff, younger workers' focus on higher education and general disillusionment with the labor market as possible reasons for the declining share of workers in the labor force in the youngest and oldest groups.

Unemployment falls, hiring rises

Lower labor force participation likely contributed to a slight decline in the unemployment rate to 4.1% from 4.2% in May. The rate has hovered near 4% for more than a year.

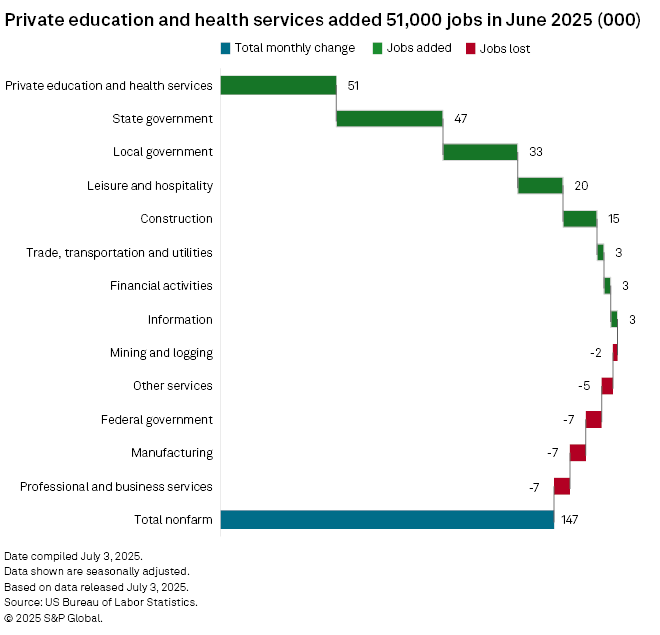

Additionally, employers added 147,000 jobs in June, a faster clip than the 110,000 expected, according to estimates compiled by Econoday.

Still, job gains in June were concentrated mainly in healthcare, private education and state and local government.

"Employment growth outside of those marquee industries has been anemic at best, and the duration of unemployment for the typical unemployed worker seeking a job continues to creep up," said Cory Stahle, an economist at the Indeed Hiring Lab, in a July 3 report. "There are real weaknesses in the market — including concentrated job gains, slowing wage growth, and falling participation — that have persisted for months, and there are scant signs of those concerns fading anytime soon."

Investors largely viewed the latest labor market data as justification for the US Federal Reserve to extend its pause on lowering benchmark interest rates.

The odds of no change in the benchmark federal funds rate at the July 29–30 meeting of the rate-setting Federal Open Market Committee shot above 93% shortly after the labor market report, according to the CME FedWatch Tool.