Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jul, 2025

By Garrett Hering and Susan Dlin

| Power lines serve Meta's Facebook datacenter in Eagle Mountain, Utah, completed in 2024. US datacenter demand is on pace to double by 2028, 451 Research said in a recent outlook. Source: George Frey/AFP via Getty Images. |

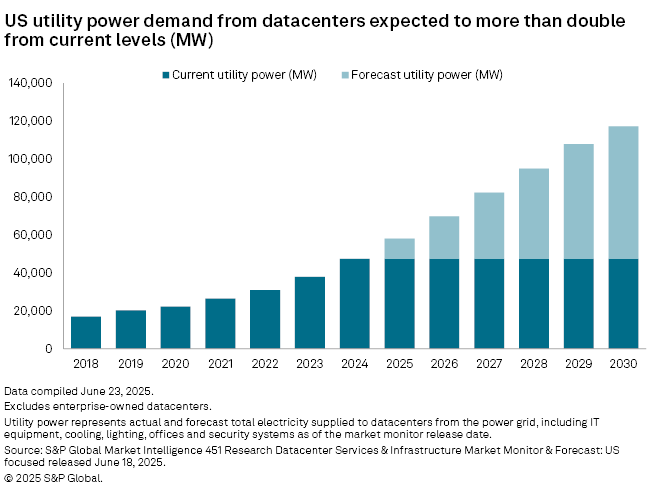

US datacenters will need twice as much grid power in 2028 as at the end of last year, according to the latest forecast from 451 Research, part of S&P Global Market Intelligence.

Utility power provided to hyperscale, leased and crypto-mining datacenters will hit roughly 58 GW in 2025, up 23% from 47.4 GW in 2024, and double 2024 levels to nearly 95 GW in 2028, 451 Research said in its updated Datacenter Services & Infrastructure Market Monitor & Forecast, released in June.

The outlook anticipates that datacenters will require 117.1 GW for IT equipment, cooling, lighting and other uses in 2030, up 147% from last year and more than quintupling since the start of the decade. That does not include enterprise-owned datacenters outside of hyperscale tech giants such as Amazon.com Inc., Apple Inc., Google LLC, Meta Platforms Inc. and Microsoft Corp.

Driven largely by the emergence of artificial intelligence, the datacenter boom is helping to reverse decades of relatively stagnant load growth for electric utilities, combined with rising power demand in transportation and building sectors. It comes as states scramble to shield households and other utility customers from related infrastructure costs and prevent a potential capacity crunch.

This year, state legislatures in several top US datacenter markets have created or considered new laws aimed at preventing power-hungry server farms from inducing electric rate shocks, power supply shortages or environmental degradation.

Governors in Texas and Oregon in June both enacted laws aimed at addressing cost and reliability concerns. California's state Senate in May advanced a measure to contain cost and climate impacts, partly in response to a surge in datacenter interconnection requests in the San Francisco Bay Area served by PG&E Corp. operating arm Pacific Gas and Electric Co.

Also in May, Virginia Gov. Glen Youngkin vetoed a bill that would have required datacenter applicants and electric utilities to disclose the noise and environmental impact of their proposed large-load projects.

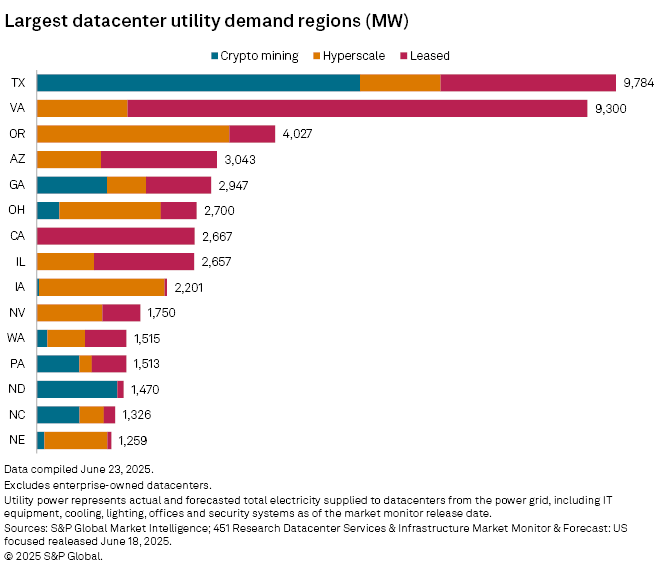

In Texas, the largest state datacenter market in the US according to 451 Research, Gov. Greg Abbott on June 20 signed Senate Bill 6, which seeks to ensure fair allocation of transmission costs, improve forecasting of large loads and support grid stability. Touted as one of the most important bills in this year's Texas legislative session, it also aims to reduce the risk of blackouts for residential customers by requiring new large industrial customers to share load shed obligations during grid emergencies, including by relying on backup power.

It tasks the Public Utility Commission of Texas and the Electric Reliability Council of Texas Inc. with establishing rules and standards to implement the new law.

"Datacenter challenges were a main focus of the 2025 session," said Lillian Federico, energy research director at Regulatory Research Associates, a group within S&P Global Commodity Insights, in a June 26 analysis. S.B. 6 defines large-load customers as those requesting new or expanded interconnection, with total load at a single site exceeding a certain demand threshold to be created by the commission.

"The law specifies a minimum demand threshold of 75 MW but grants the PUC authority to establish a lower threshold if necessary to achieve the goals of the statute," Federico said.

Datacenter grid power demand in Texas is fueled primarily by crypto-mining, 451 Research data shows. Texas is followed by Virginia, which is by far the biggest US state market for leased facilities. Oregon, the third-largest market overall, hosts the largest utility power demand from hyperscalers, and California is second only to Virginia for leased datacenter grid power demand.

'A legislative model'

Signed by Gov. Tina Kotek on June 16, the measure directs the Oregon Public Utility Commission to create a new customer class for large, power-hungry operations using at least 20 MW, with their own tariff schedule. It also mandates minimum 10-year contracts between utilities and datacenters, with datacenters required to pay for a certain amount of energy even if they use less than anticipated and fees if they use more.

"If a datacenter coming online needs a new substation to connect to the grid, datacenters as a customer class should pay for that," Bob Jenks, executive director of consumer advocacy group Oregon Citizens' Utility Board, said in an email. "If a utility needs to upgrade its transmission because of datacenter load growth, datacenters should pay for that."

The Oregon Citizens' Utility Board backed the bill, along with other ratepayer advocacy, environmental and renewable energy groups.

Datacenter industry and union groups opposed the measure, in written testimony calling it "misaligned" for "unfairly" targeting one industry. Requiring datacenters to pay costs beyond their actual usage "could drive investments and businesses away from Oregon," the Data Center Coalition and other opponents said.

Since the law passed, consumer advocates in other states have reached out to the Oregon Citizens' Utility Board.

"We are starting to be in talks with other states that are curious about this solution, so we know there is interest in using the POWER Act as a legislative model," Jenks said.

Although rising residential rates have been the group's primary issue to address this year, Jenks is also concerned about strains on the power system and delays in meeting the state's requirement for utilities to nullify their greenhouse gas emissions by 2040, as outlined in a 2021 state law.

"The massive amount of energy datacenters require is creating emerging challenges for utilities in Oregon," he said. "Utilities are starting to struggle with meeting clean energy requirements because of the rapid load growth on the system ... And as load continues to grow, our energy grid is reaching its limits on how much electricity it can deliver."