Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jul, 2025

By Sean Longoria and Annie Sabater

Corporate bankruptcy filings have leaned toward reorganization over liquidation so far in 2025, while a greater share of 2024 filings also had sought to restructure.

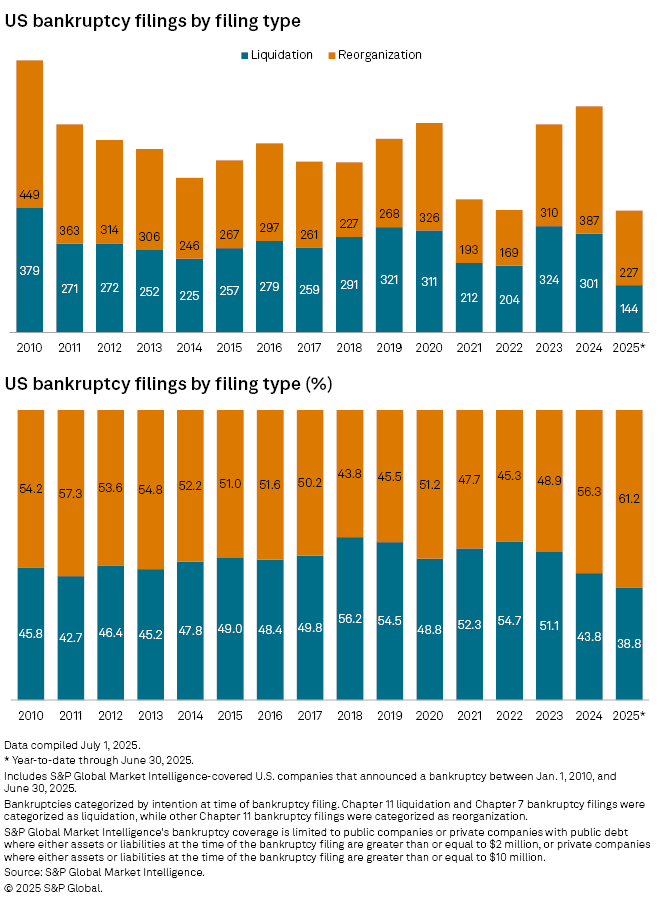

Of the 371 filings in the first six months of 2025, 227 have sought to restructure businesses, or about 61.2%, according to the latest S&P Global Market Intelligence data. Additionally, 2024 bankruptcies continued to favor reorganization, though revised data collected by Market Intelligence showed a decrease in the share to 56.3% of 688 total filings, compared with the initially reported share of 62.7% of 695 filings. Market Intelligence continuously revises its bankruptcy database.

Bankruptcies in 2025 are on track to outpace most years since 2010. The recent data extends a trend of companies seeking to reorganize in their initial bankruptcy petitions rather than sell their assets and cease operations. Still, the balance has previously shifted to favoring liquidation following the onset of COVID-19 in the West and previously during 2018–2019.

Strong run of reorganization

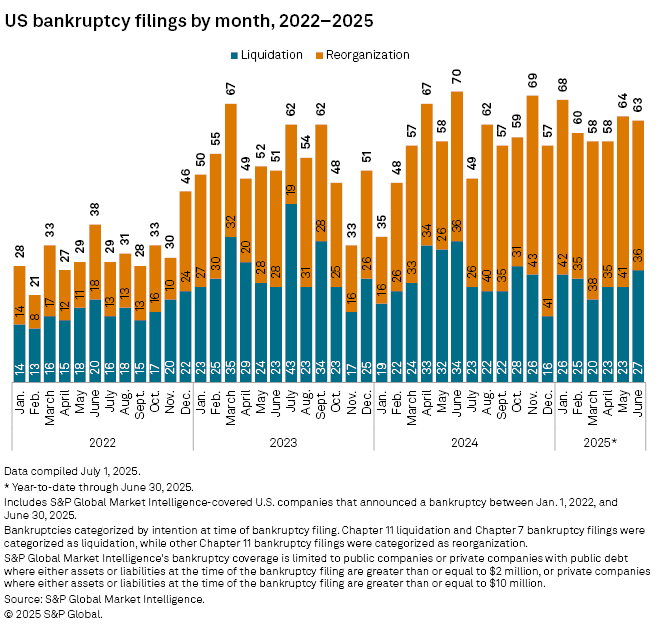

Since mid-2024, bankruptcy petitions seeking reorganization have dominated monthly filings.

While the balance between filings seeking reorganizations versus liquidations fluctuates, a greater share of restructuring petitions tends to coincide with a higher number of bankruptcy petitions filed overall in a given year.

Sector breakdown

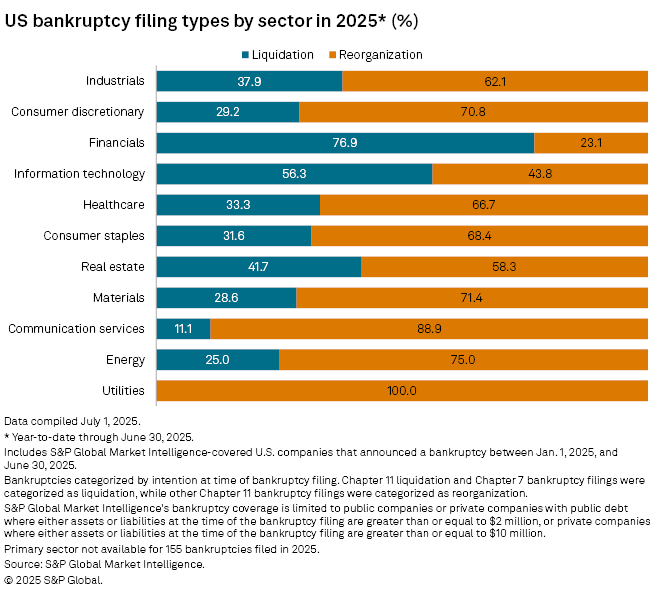

Every utility company that filed for bankruptcy in the first six months of 2025 sought to reorganize, the highest share of any sector, according to Market Intelligence. Still, just three utility companies have sought bankruptcy protection during the year: Sunnova Energy International Inc., ESG Clean Energy LLC and Water Energy Services LLC.

ESG Clean Energy's case, however, was dismissed in early June — just over a month after the case was filed — over what a judge said was the company's failure to file certain documents with the court.

Meanwhile, just three of the 13 bankruptcies involving financial companies sought reorganization — Charter School Capital Inc., GreenFi and Caymus Funding Inc. — the lowest share of any sector at just over 23%. Several of the bankruptcy cases involving financial companies, however, were filed on an involuntary basis, meaning creditors sought court intervention on the repayment of debts.

Sector information was not available for 155 of the bankruptcy filings recorded in 2025.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.