Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jul, 2025

By Brian Scheid

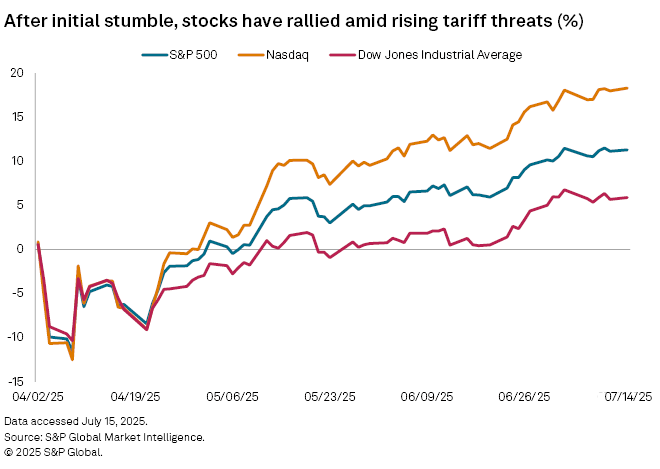

US tariff threats are escalating by the day, but the US stock market continues to rally, emboldening further threats and setting up a potential clash between President Donald Trump's trade policy and an emerging group of stock market vigilantes, market strategists believe.

Stocks continue to rally with the S&P 500 up about 26% from its April 8 trough, when equities initially declined on the White House announcement placing higher tariffs on nearly the entire world. Even though tariffs, if ultimately enacted as proposed, are expected to boost inflation, slow job and overall economic growth, stocks continue to climb.

Should the threats of harsher tariffs become reality, so-called stock market vigilantes may emerge and begin to sell equities, potentially reversing the market's record-breaking climb.

Stock vigilantes would be similar to the bond vigilantes who came to prominence in the 1970s by selling US government bonds and boosting rates in an attempt to counter what they saw as reckless government spending and rising debt and deficits.

"Essentially, the bond vigilantes kept the government in line on spending by exacting market pain on the government if its fiscal situation deteriorated too much," said Tom Essaye, founder of Sevens Report Research, in an interview. "So, it's possible that stock vigilantes could appear and do the same thing with the administration on tariffs."

Still, investors appear to either not believe the tariffs will have a significant economic impact or that they will be substantially pared back from what has thus far been outlined by the White House.

"That's the strangest dynamic: despite the fact that every day there's another tariff threat that's very, very high, the market is completely ignoring it," Essaye said. "In many ways, it's almost as if the market has just put Trump on mute."

Investors believe that since the Trump administration delayed reciprocal tariffs, de-escalated a series of trade disputes with China and granted some tariff exemptions when stocks plunged in early April that it likely would not significantly shift trade policy, Essaye said.

"The market claims to be very worried about tariffs, but they don't always lead to the projected disasters," said Gary Brode, managing partner at Deep Knowledge Investing. "The first Trump Administration announced tariffs that also scared the market. The reality was so mild that the following administration kept them in place and most people didn't even notice."

However, Trump now appears emboldened by the ongoing rally in stocks, pointing to all-time highs in equities as he ramps up tariff threats that could pose serious risks to the worldwide economy, Essaye said.

"I think the tariffs have been very well received," Trump said in a July 10 interview with NBC. "The stock market hit a new high today."

Vigilantes poised to sell?

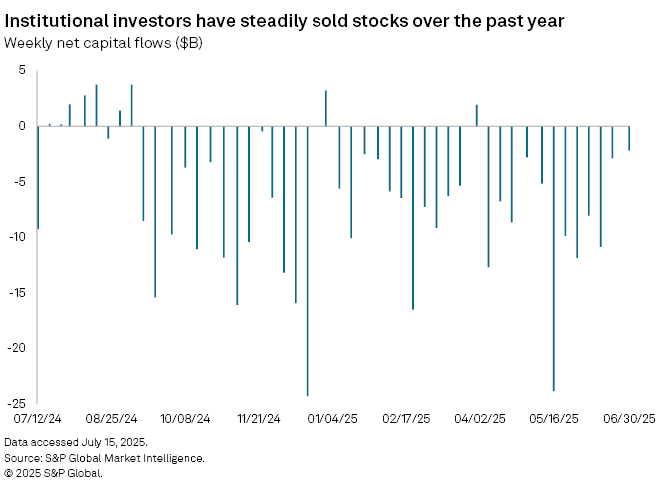

Stock vigilantes would likely be large, institutional investors, which have an outsized impact on the market and they would not appear until there was a real sense that Trump's steepest tariffs will actually occur, a belief that is not common at the moment, Essaye said.

"We'd have to see these larger investors looking around and saying 'Oh my god, he's actually going to go through with it and it's a terrible idea,'" Essaye said. "It requires a belief that this is actually going to become a policy and a policy that these investors view as demonstrably negative for the economy. By dumping stock it would then affect some sort of change."

Institutional investors have been steadily selling throughout the ongoing rally in US equities, according to S&P Global Market Intelligence data. That selling would significantly increase if the tariffs move from threat to reality, Essaye said.

Yet the chances of vigilantism in stocks are remote since there likely are not sufficiently large market participants who would look to sell as a way to manage White House trade policy, said George Pearkes, a macro strategist at Bespoke Investment Group.

"I won't go as far as to say that's impossible, but there isn't an obvious category among domestic holders of equities while international holders aren't cohesive enough to coordinate that kind of behavior," Pearkes said.

If Trump's latest tariff threats are actually applied, however, neither current stock market estimates nor valuations are sustainable and most investors are unprepared for that, Pearkes said. Based on earnings estimates and valuations, Pearkes estimates the market is pricing just a 5% chance that Trump's steepest tariffs will actually get implemented.

"That is just ludicrously low," Pearkes said.