Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2025

By Brian Scheid

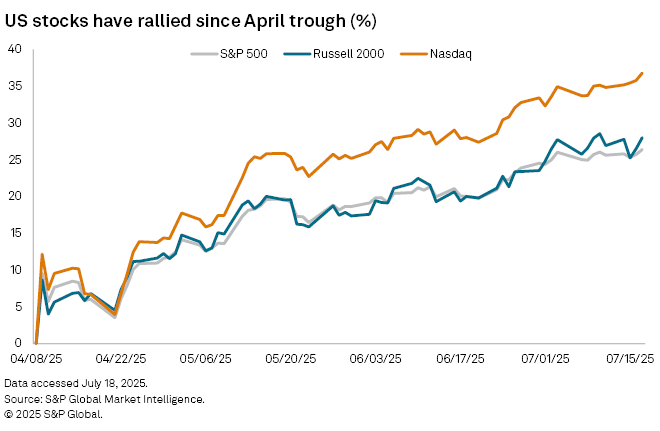

After weeks of threats, investors last week seemed to suddenly realize President Donald Trump may really try to fire Federal Reserve Chairman Jerome Powell, triggering an almost immediate decline in stocks, short-term bond yields and the US dollar.

Shortly after reports of Trump's push to fire Powell broke, the president said he had no immediate plans to oust the chairman, easing market worries. Yet the brief market turmoil provided a preview of what may be to come for investors as Trump continues to chip away at decades of central bank independence with his pressure campaign for lower interest rates.

"It feels like a slow boiling of the frog to me, where Trump is testing the boundaries of what is acceptable to the market," said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

Testing the limits

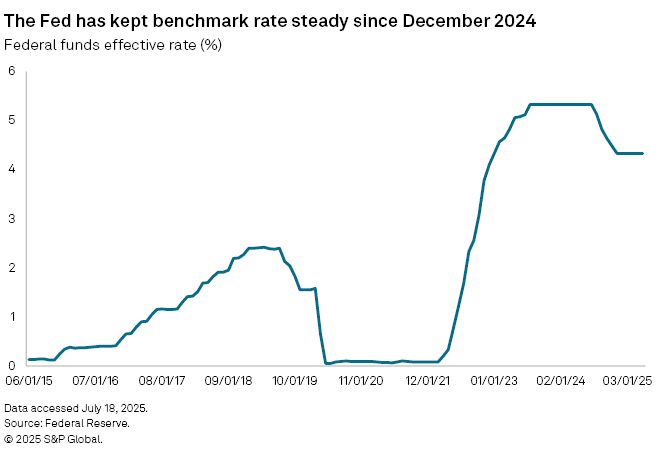

The reliability of US monetary policy and economic stability rests in large part on the Federal Reserve's ability to remain independent, accountable to Congress, and largely free from political pressure and interference. Through public pressure on Powell to cut rates and gauging support among political allies for his possible removal, Trump could cut short the ongoing rally in equities, further weaken the dollar, and push shorter-term bond rates lower and longer rates much higher, according to economists and market strategists.

"It would be very damaging," said Derek Halpenny, managing director and head of research with MUFG Bank. "This is a scenario commonly discussed in emerging market economies run by autocrats not strong solid democracies with solid frameworks governing financial markets."

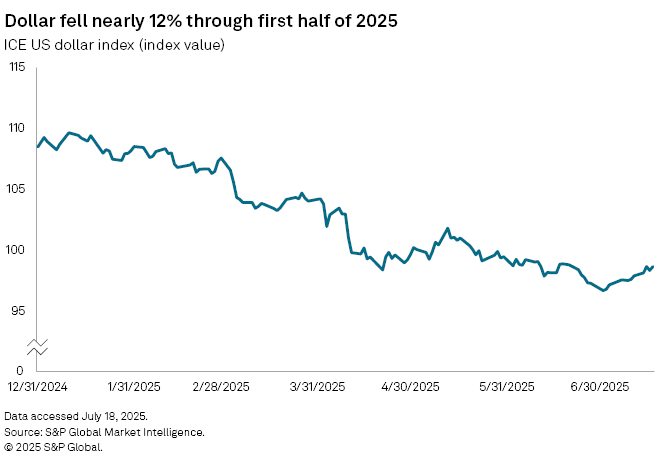

If Fed independence is further tested, it could end up raising the risk premium on US assets, including term premiums for bonds, and could raise the cost of capital for companies, said Sonu Varghese, a global macro strategist with Carson Wealth. The dollar would likely continue to fall, boosting import prices and inflation, and triggering a reduction in foreign investment.

"If anything, we may see higher stock-bond correlations, which means traditional portfolio diversification, using bonds, may not work as well," Varghese said.

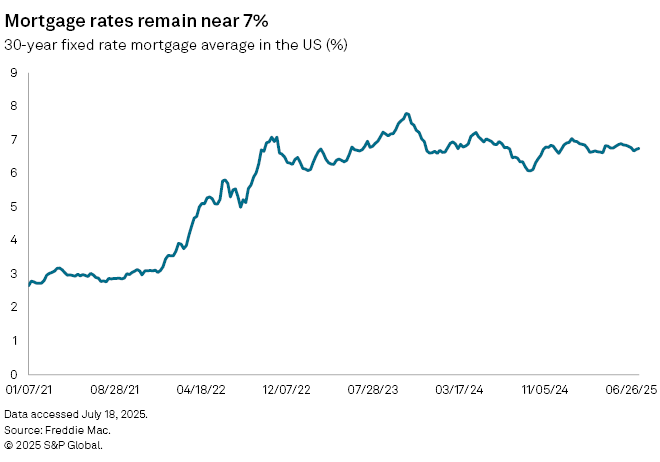

Rate-sensitive areas would likely be hit hardest, particularly if longer-term rates rise, likely pushing mortgage rates higher, leading to declines in housing stocks within the consumer discretionary and real estate sectors, Varghese said.

Not priced in

The immediate response from capital markets on last week's reports show that market participants have yet to really price in any credible threat to the central bank's independence, said Michael Arone, chief investment strategist at State Street Investment Management.

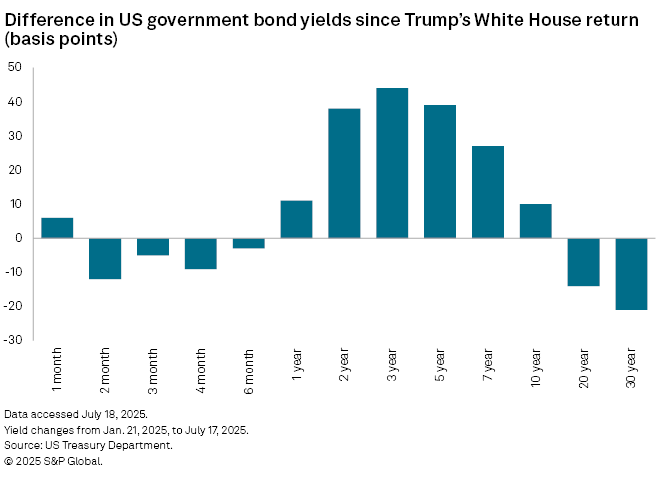

"The market volatility suggests investors aren't prepared for a non-independent Federal Reserve," Arone said. "Moves that threaten the Fed's independence would likely result in plummeting stock prices, rising yields particularly for longer maturity bonds, and a falling US dollar. Long-term bond yields and the US dollar would suffer the most if the Fed's independence is threatened."

The US dollar index has fallen as much as 12% since January, but only a small degree of this decline is due to Trump's push against Fed independence, with much of it likely caused by other policies, particularly Trump's tariffs and signs of slowing economic growth, Halpenny with MUFG said.

Whenever speculation has popped up that Trump could fire Powell, the dollar has immediately fallen and then quickly recovered as that speculation has been assuaged.

"The sharp initial moves suggest to me that not much is priced in relation to this specific risk," Halpenny said.

If that risk becomes more real, such as Trump claiming he has found cause to fire Powell, the dollar would see a rapid, sharp decline against other currency peers, Halpenny said. The US dollar per euro rate, for example, would quickly move to 1.20, a level not seen since June 2021.

"It would be a long-term negative and would strengthen the trend already in place of diversifying further away from the dollar to other currencies," Halpenny said.

While the probability of Powell leaving before his term expires in May 2026 remains low, an early departure would cause long-end rates to rise as the risk of higher inflation increase and market confidence in the Fed collapses, said Padhraic Garvey, regional head of research with ING.

"I'd suspect we'd see really big moves within the first days, dominated by risk off," Garvey said. "But over subsequent weeks we'd likely see a steeper curve from both ends and equities could even rally on a rate cut expectation theory."

Overall, the potential loss of Fed independence would undermine attempts to achieve price stability, Arone said.

"History has shown that countries without an independent central bank can suffer wild price swings that result in significant capital market volatility," Arone said. "The worst possible outcome is the Trump administration fires Chairman Powell, undermines the Fed's independence and inflation expectations skyrocket."