Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jul, 2025

By Yuzo Yamaguchi, John Wu, and Marissa Ramos

Global green bond sales declined 9.3% year over year in the second quarter, likely due to investor caution amid economic uncertainties.

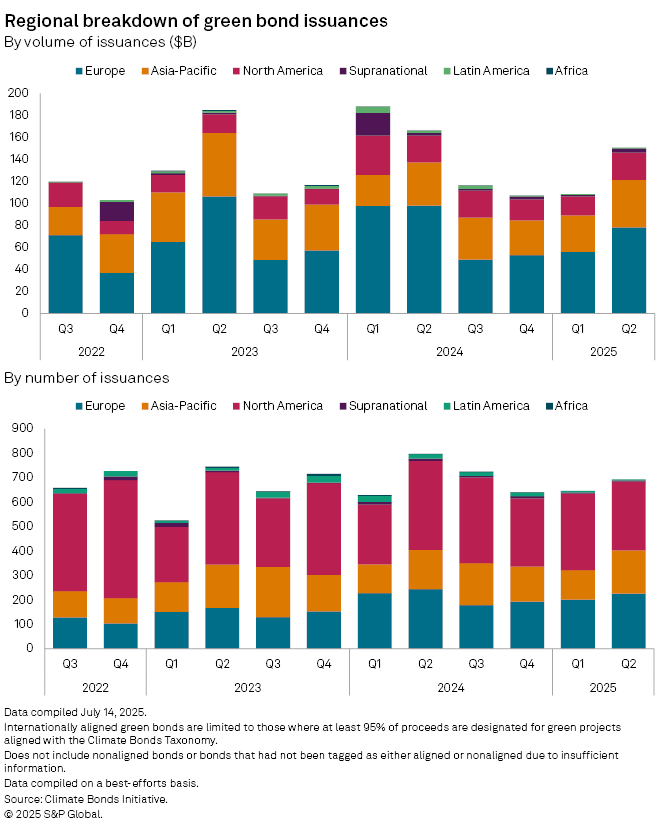

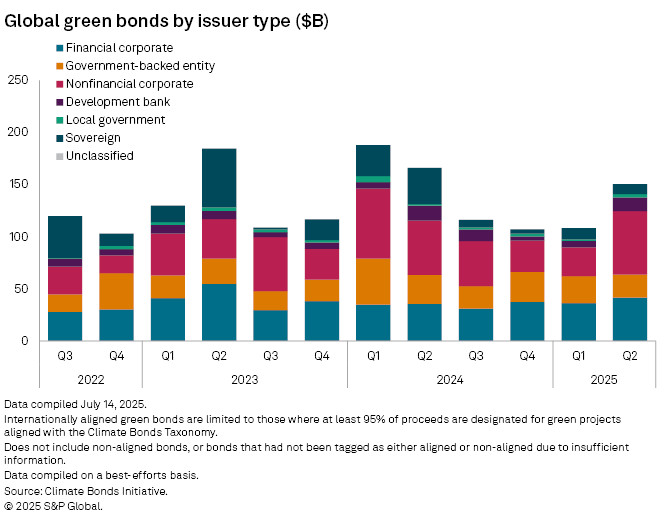

Total global green bond sales from April to June reached $150.65 billion, down from $166.04 billion in the second quarter of 2024 and $184.74 billion in the same period of 2023, according to data from Bonds Initiative, an organization that tracks global capital for climate action.

"The macroeconomy poses headwinds to green bonds," said Takahide Kiuchi, executive economist at Nomura Research Institute. "The US tariffs are expected to ignite inflation in the country and dampen the global economy."

On July 12, US President Donald Trump announced a 30% reciprocal tariff on the EU, the world's biggest issuer of green bonds, following the imposition of high levies on most other US trading partners. The tariffs, combined with rising yields on US Treasurys and German sovereign bonds, are increasing costs for bond issuers and risks for investors. Bond yields and prices move inversely.

"Investors appear to be backing off from ESG [environmental, social and governance] investments due to the aggressive nature of Trump's trade policy," said Mana Nakazora, chief ESG strategist at BNP Paribas Japan, during a July 16 webinar. As a result, green bond issuance "is unlikely to gain momentum," she added.

The implementation of Trump's proposed tariffs remains uncertain. "But if he pushes ahead with it, that could trigger financial turmoil, dampening stocks and bonds, as seen in April," said Eiji Taniguchi, a senior economist at Japan Research Institute.

Europe, the largest regional issuer, sold $78.14 billion in green bonds during the June quarter, representing more than 50% of global sales. But this was a decrease from $98.10 billion in the same period in 2024 and $106.33 billion in 2023, according to CBI data. The Asia-Pacific region followed with $43.34 billion in issuance, while North America issued $24.69 billion in green bonds during the April-to-June quarter.

"The imposition of a 30% tariff on EU goods by the Trump administration has prompted caution among European industrial issuers," Steve Alain Lawrence, chief investment officer at Balfour Capital Group, told S&P Global Market Intelligence. Lawrence noted that some automakers are "reportedly delaying new green bond offerings as they await greater clarity on transatlantic trade conditions."

In the US, elevated Treasury yields have also pressured municipal green bond issuance, Lawrence added.

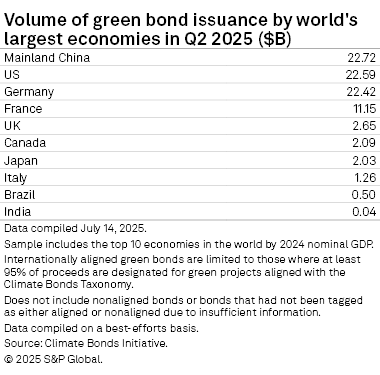

By country, mainland China was the leading issuer with $22.72 billion in internationally aligned green bonds, marking its fifth consecutive quarter of increase. The US followed with $22.59 billion, then Germany with $22.42 billion and France with $11.15 billion.