Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Jul, 2025

By Samantha Lipana and Marissa Ramos

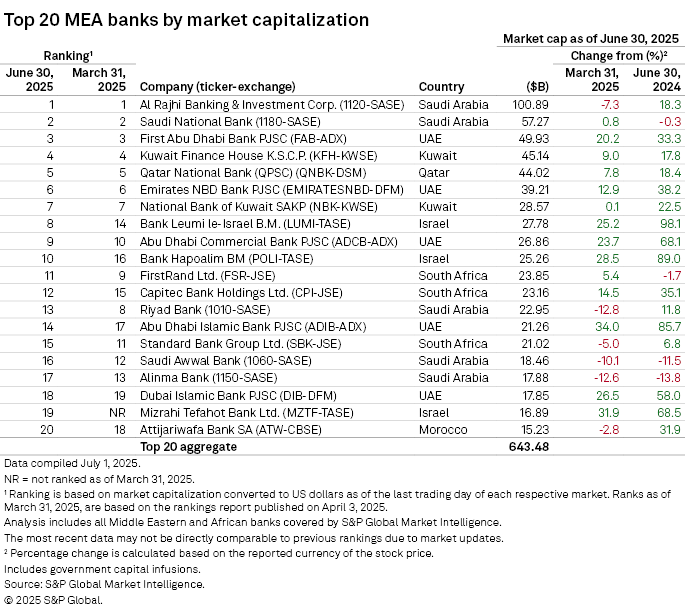

Banks in the United Arab Emirates and Israel recorded the highest quarter-over-quarter increase in market capitalization among peers in the Middle East and Africa in the second quarter, S&P Global Market Intelligence data shows.

Abu Dhabi Islamic Bank PJSC moved three places up in a sample of 20 banks, improving its market cap to $21.26 billion by the end of the second quarter, up 34% from three months prior.

During this period, the Abu Dhabi-based lender partnered with real estate developer Binghatti Holding Ltd. to offer Sharia-compliant financing solutions to home buyers. The bank also launched the first-ever platform for sukuk— Sharia-compliant bond-like instruments—that allows fractional sukuk investments. The tool enables participation with as little as $1,000, significantly lower than the traditional $200,000 threshold.

The lender booked 18% year-over-year growth in first-quarter net profit to 1.9 billion dirhams, thanks to a strong balance sheet, increased business momentum and sustained customer growth. It was also the second top-performing bank in 2024 with a return on average equity of 23.5%, a net interest margin of 3.88% and an efficiency ratio of 29.58%.

The rest of the UAE lenders in the list — First Abu Dhabi Bank PJSC, Emirates NBD Bank PJSC, Abu Dhabi Commercial Bank PJSC and Dubai Islamic Bank PJSC — also showed double-digit growth in their respective market caps. They benefited from the government's economic and social reforms through a reduction in credit risks, S&P Global Ratings said.

However, Emirati banks are still susceptible to unexpected spikes in geopolitical tensions and oil price volatility, Ratings added.

Israeli banks' stocks remained attractive despite the country's recent conflict with Iran. Mizrahi Tefahot Bank Ltd. made its first entry into the list, logging the second-highest market value growth of 31.9% in the second quarter. The bank's market cap stood at $16.89 billion as of the end of the second quarter.

Domestic peers Bank Leumi le-Israel BM and Bank Hapoalim BM experienced a respective 25.2% and 28.5% rise in their market caps as well.

All three lenders reported yearly increases in their first-quarter net profits. The Israeli government's continued support allowed its banking sector to achieve a near-historical high return on equity of about 15%, low nonperforming loans and contained asset quality deterioration in the first quarter, Ratings said.

Al Rajhi Banking & Investment Corp. and Saudi National Bank retained their positions as the first and second most valuable lenders with market caps of $100.89 billion and $57.27 billion, respectively.

However, Saudi Arabia-based banks were also the worst performers in the quarterly ranking. Riyad Bank fell five places to the 13th spot after logging a market cap decline of 12.8%, the largest among the sampled banks in the second quarter.

Alinma Bank had a 12.6% quarterly reduction in its market value, and Saudi Awwal Bank's value fell 10.1% to $18.46 billion. Both dropped four places in the ranking from the previous quarter.

The sampled banks recorded an aggregate market cap of $643.48 billion as of June-end.