Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2025

By Iuri Struta

| Bankers and other market watchers are expecting the tech IPO market to pick up in the second half of 2025. Source: Witthaya Prasongsin/Moment via Getty Images. |

Tech IPOs are rebounding from last year's lows as global markets recover from tariff-driven declines earlier this year.

At 2024-end there was optimism that technology IPOs would start the new year with strong momentum, given the expected pro-business stance of US President Donald Trump's second administration. However, uncertainty around the administration's tariff policies drove a stock market sell-off, cooling IPO activity again. As the administration moderated tariff changes and extended some implementation deadlines, markets recovered, and technology firms have once again begun to consider public offerings.

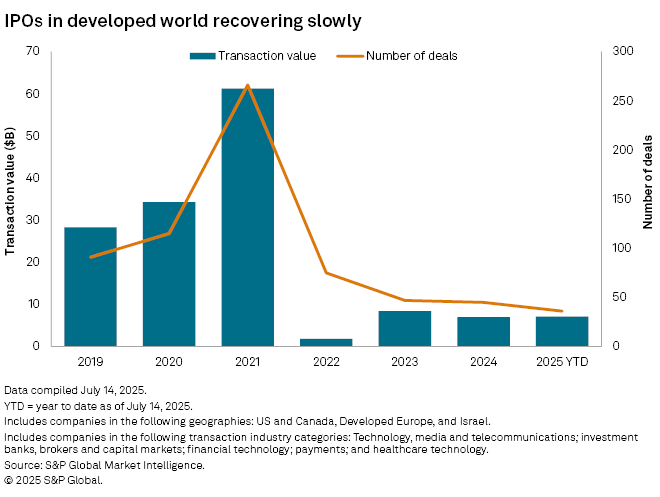

A little more than halfway into the year, developed markets have seen about 36 deals and raised more than $7.1 billion, according to data from S&P Global Market Intelligence. Already, that beats last year's $6.9 billion run.

"We have seen a meaningful uptick in activity in the last four weeks or so," West Riggs, head of equity capital markets at investment bank Truist Securities Inc., told Market Intelligence. "If we have a second half that's busier than the first half, we get back to a pre-COVID norm to IPO issuance."

Uneven recovery

Notably, the recovery in the IPO market is concentrated around key segments of the technology sector.

Strong interest in going public has been seen in the AI, fintech and cryptocurrency spaces, largely due to the strong performance in public markets of these types of stocks and asset classes. AI faces secular tailwinds and investors are eager to pay high multiples for such companies. Meanwhile, the cryptocurrency space has been boosted by expected friendly regulation from the Trump administration in the US, and cryptocurrencies such as Bitcoin are trading at record levels.

In terms of companies that have benefited from these trends, CoreWeave Inc., an AI cloud services provider, has seen its stock price nearly quadruple since going public earlier in 2025 despite questions about its business model amid large losses and customer concentration. Circle Internet Group Inc., the issuer of USDC stablecoins, is up more than threefold since its IPO.

"We expect a lot of customers are going to test the waters, particularly AI-driven and cryptocurrency firms," Ross Carmel, a partner at law firm Sichenzia Ross Ference Carmel, said in an interview.

Excluding these bright spots, however, most tech companies remain cautious about going public, for now. Buy-now, pay-later giant Klarna Group PLC and ticket reseller StubHub Inc. both postponed their IPOs earlier this year. The software-as-a-service space has underwhelmed as performance has been impacted by fears of AI disruption, while IPOs backed by private equity performed abysmally.

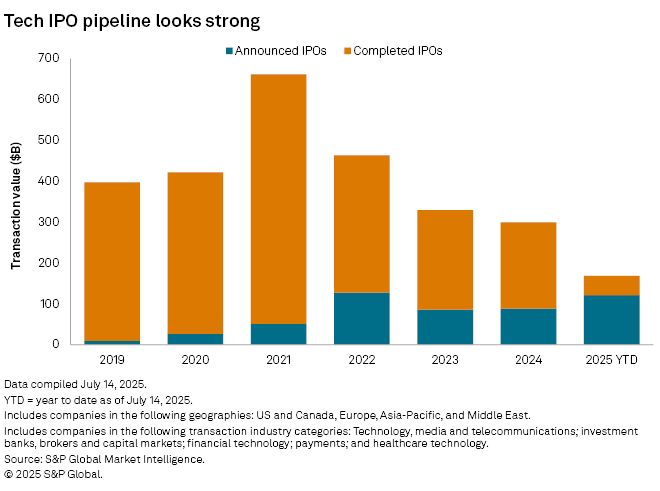

Still, there are hopes that Klarna and others will have their IPOs in the second half of 2025. Other companies that have filed registration statements to go public sometime this year are design tool provider Figma Inc., whose sale to Adobe Inc. for $20 billion was blocked by regulators a few years ago, and AI chipmaker Cerebras Systems Inc.

RELATED CONTENT:

Mainland China heavyweights lift Hong Kong to top IPO destination

Indian IPOs to get lift from healthy pipeline and favorable market

Exit strategy

One obstacle that remains for the IPO market is the relative absence of tech-focused private equity firms. Private equity firms have been active in buying tech companies in recent years, with the average annual dollars deployed to acquire tech companies doubling in the last half decade compared to the previous one, according to data from 451 Research, a technology research group within Market Intelligence.

Many of these private equity firms are seeking exit opportunities, but the IPO market has been closed to them as current valuations do not match those seen in the post-pandemic highs of 2021 and 2022.

"Valuation expectations are a lot greater for [private equity]-backed companies and that is narrowing the field for IPO candidates," Kevin Friedmann, Chicago head of corporate at law firm Norton Rose Fulbright LLP, told Market Intelligence.

The private equity-backed companies that did go public in the past two years have largely underwhelmed.

SailPoint Inc., a cybersecurity company owned by Thoma Bravo LP, has seen its stock decline since going public earlier this year. OneStream Inc., which is backed by KKR & Co. Inc., has moved sideways since it listed its equity in 2024.

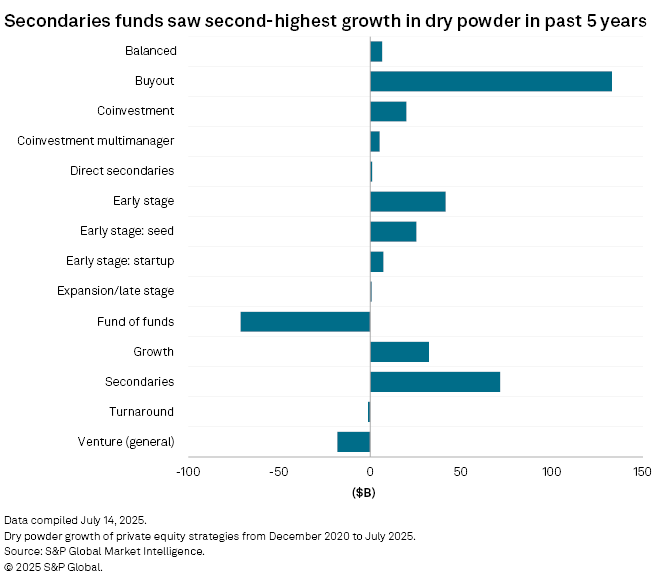

Private equity firms are looking at alternative ways to exit their investments, including continuation funds and minority stake sales to secondaries funds. This allows them to get some level of liquidity while waiting for public markets to improve.

"The private secondaries market continues to have a lot of activity, but it does not solve all your liquidity and shareholder dynamic problems," Truist Securities' Riggs said.

"We have a very robust secondaries market, which has evolved over the last 15 years, and that can provide liquidity to investors, early employees," Carmel of Sichenzia Ross Ference Carmel said. "That delays some companies from going public."