Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jul, 2025

A shortfall of generation during an accelerated period of power demand is expected to provide a "near-term crunch" that will drive historically high PJM Interconnection LLC capacity prices to a record high.

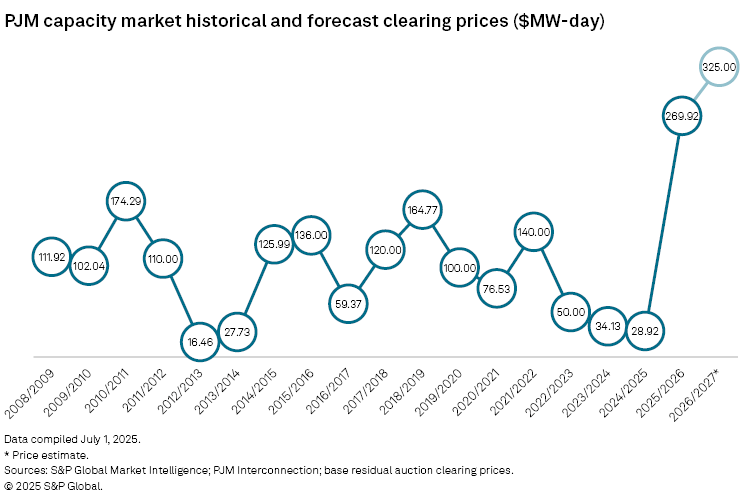

Following years of depressed prices, the auction for PJM's 2025/2026 delivery year cleared at $269.92/MW-day for much of the grid operator's 13-state footprint, a nearly tenfold increase from the $28.92/MW-day clearing price in the 2024/2025 auction. The capacity prices for the 2026/2027 delivery year could close even higher.

"There is still this near-term need for generation that is going to be hard to meet," S&P Global Commodity Insights energy analyst Tanya Peevey said in a recent interview.

"There are some resources that can come online quicker than others," Peevey said. "But there is definitely going to be a near-term crunch that I think a lot of people understandably are concerned for in terms of the consumers and the ratepayers, the ones that are going to be paying the cost of this tighter market."

Results for the 2026/2027 baseload residual auction are scheduled to be posted July 22. The bidding window opened July 9 and closes July 15.

There is a limit, however, on how high prices can go.

The Federal Energy Regulatory Commission approved an agreement between PJM and Pennsylvania Gov. Josh Shapiro in April that sets a price cap of $325/MW-day and a price floor of $175/MW-day for the 2026/2027 and 2027/2028 auctions.

"The cap, in our view, will be reached," Peevey said.

'Not nearly enough'

PJM, which serves all or parts of 13 states and Washington, DC, has warned about the need for more dispatchable capacity to serve surging load, primarily driven by power-hungry datacenters.

"There is a lot of activity in that space, and it does not seem like it is going to relent," Peevey said. "There is not nearly enough [capacity] to meet the demand that is coming next year."

Virginia, for example, is home to the largest concentration of datacenters in the US, and by many accounts, the world.

"An interesting aspect of this is that even though PJM may not want more datacenters in Virginia, they do not really have any control over where they set up shop," Peevey said. "They are going to go where the power is."

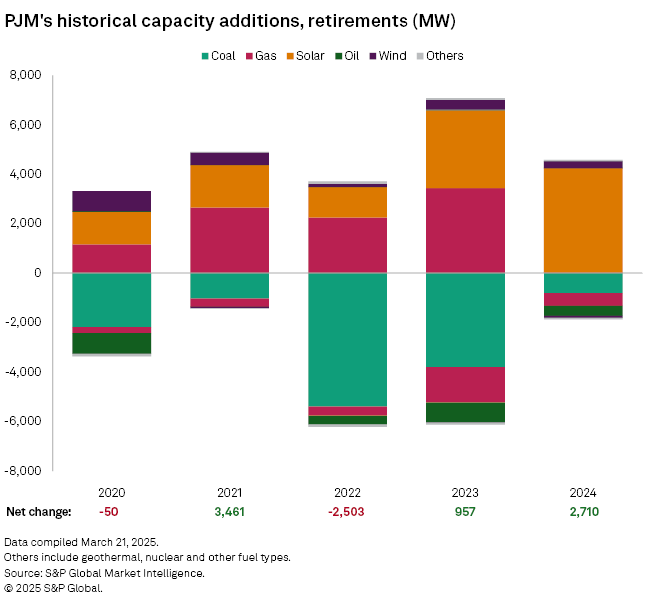

The nation's largest grid operator is also balancing an overabundance of intermittent generation with the rising retirement of fossil fuel generation.

In response, FERC approved PJM's proposal in February to enable 50 "shovel-ready, high-reliability" generation projects to move ahead in the interconnection queue as part of its Reliability Resource Initiative.

"PJM really is trying to move projects through the queues as quickly as they can," said Steve Piper, director of energy research at S&P Global Commodity Insights. "But what we seem to be seeing are the developers themselves, with those approvals in hand, are still needing time to bring this capacity to market."

Elevated prices to continue

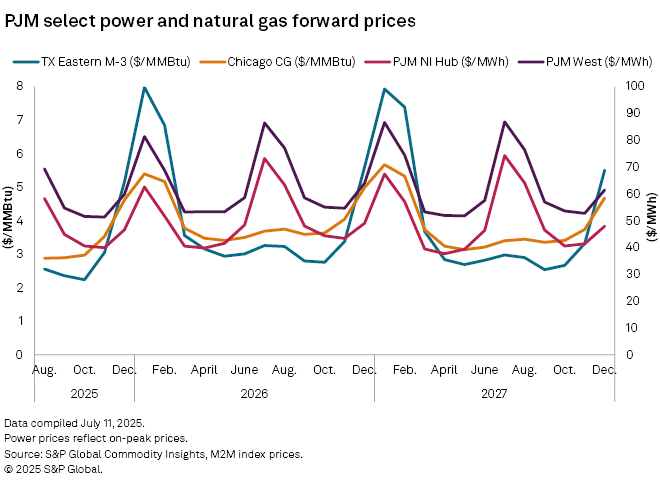

If certain resources can come online quickly, that will drive capacity prices down for the next auction, experts said.

PJM officials have defended the market as sending the appropriate signals to encourage the generation needed to meet skyrocketing demand and maintain reliability.

"One would hope that those elevated capacity prices would send the market signal that they are intended to send," Peevey said, "which would then incentivize builds of whatever type that would then come online and provide generation in 2027 that would bring down those prices."

The lower results "would be some slight relief to the consumer," but the prices would still be elevated, according to analysts.

"There is so much demand that is forecast into the future that there are many years of playing catch-up," Peevey said. "It is hard to get ahead of it."

PJM's 2025 long-term load forecast anticipates a significant increase in electricity demand over the next 20 years. Summer peak demand is projected to rise by about 70 GW to 220 GW in the next 15 years, according to the forecast.

The current generating capacity in the market is about 183 GW, PJM noted.

The Trump administration has pushed to keep some existing baseload resources online longer to help meet demand, including a 50-year-old gas-fired plant in the PJM region. In addition, PJM said it received 94 applications representing 26.6 GW of nameplate capacity as part of its Reliability Resource Initiative, evenly split between uprates of existing generation and proposed new builds.

While power producers move to add new gas generation, market observers noted that such projects have a long lead time and are facing supply chain challenges.

"These projects are just seemingly getting started," Piper said.

Hyperscalers, meanwhile, are pursuing several different avenues and resources to fulfill capacity needs as the market tries to catch up.

"It is pretty unclear if any one is going to be the answer," Piper said.