Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jul, 2025

By Dylan Thomas and Tim Siccion

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity fund managers are under growing pressure to cash out investments and return profits to investors. Corporate acquirers took notice.

Trade sales exits held relatively steady in the first half of 2025 as corporate acquirers turned private equity fund managers' urgent liquidity needs to their advantage. Even with US tariff policy temporarily disrupting M&A activity, private equity exits via trade sales were down just 3% from the year-ago period, according to S&P Global Market Intelligence data.

Additionally, six of the 10 largest private equity exits by value during the first half were sales to corporate acquirers.

Resilient public markets mean corporate acquirers have ample acquisition capital, said Jason Strife, head of junior capital and private equity solutions for Churchill Asset Management LLC. Strife said corporate acquirers are less likely to be outbid by private equity firms, whose nimbleness and dealmaking prowess are being tested by an uncertain macroeconomic outlook.

Read more about private equity exit activity in the first half of 2025.

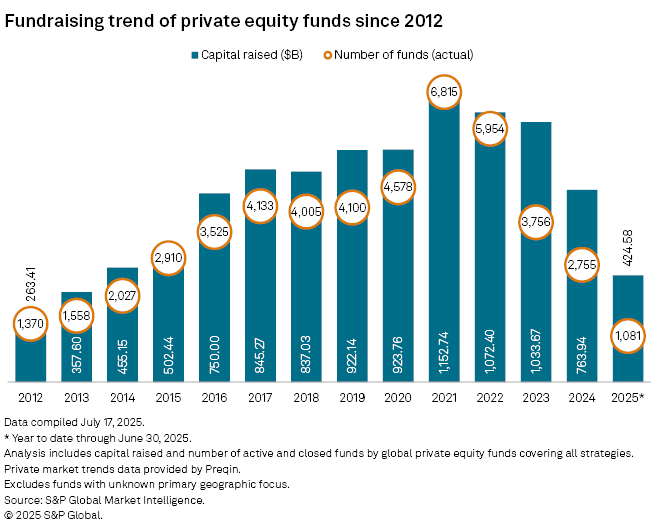

CHART OF THE WEEK: Private equity fundraising poised for a turnaround

⮞ Private equity funds raised $424.58 billion globally in the first half of 2025 and are on track to exceed the full-year 2024 fundraising total of $763.94 billion, according to Market Intelligence data.

⮞ The private equity sector is poised to end a three-year streak of declining fundraising totals linked to a weak exit environment that has slowed the return of capital to investors.

⮞ Ardian SAS held the largest fund closing in the first half, garnering $30 billion in capital commitments for Ardian Secondary Fund IX.

TOP DEALS

– Blackstone Inc., through fund affiliates, agreed to make a majority growth investment in NetBrain Technologies Inc., valuing the network automation and AI platform at $750 million. McDermott Will & Emery was legal counsel to NetBrain, while Simpson Thacher & Bartlett LLP was legal adviser to Blackstone.

– Brookfield Asset Management Ltd. participated in an $835 million round of funding for Canadian AI digital infrastructure provider 5C Group Inc. Simpson Thacher & Bartlett was Brookfield's legal adviser. Moelis & Co. LLC was financial adviser and placement agent to 5C and Osler Hoskin & Harcourt LLP was 5C's legal counsel. Milbank LLP was legal counsel to Deutsche Bank, which provided debt financing.

– The Carlyle Group Inc. agreed to sell London-headquartered global funds network Calastone Ltd. to SS&C Technologies Holdings Inc. for approximately £766 million, subject to adjustments. Barclays was Calastone's financial adviser, and Linklaters and Mishcon De Reya were its legal advisers. Davis Polk & Wardwell LLP was SS&C's legal adviser.

– CC Capital Management LLC and One Investment Management Ltd. agreed to acquire Australia's Insignia Financial Ltd. for A$4.80 per share via a scheme of arrangement, representing a 56.9% premium to Insignia's last undisturbed close, with an implied enterprise value of A$3.9 billion. Insignia's board unanimously recommended the transaction.

TOP FUNDRAISING

– IK Partners closed its fourth small-cap fund, IK Small Cap IV Fund, at €2.0 billion. IK Partners will invest in companies across the business service, healthcare, consumer and industrial sectors.

– Omega Funds closed its eighth fund, Omega Fund VIII LP with $647 million in capital commitments, surpassing its $600 million target. The venture capital firm invests in life sciences companies in the US and Europe.

– Croatia's AYMO Ventures held the first close for two funds — AYMO Fund and AYMO Accelerator Fund — with combined assets under management of €52 million, The Recursive reported. AYMO Accelerator Fund will target early-phase startups, while the AYMO Growth Fund will focus on mature startups with proven business models and significant traction.

– Emerald Technology Ventures AG secured a €20 million commitment for Global Water Fund II from Veralto Corp., a provider of water analytics and water treatment technologies.

MIDDLE-MARKET HIGHLIGHTS

– An ArchiMed SAS affiliate agreed to acquire dental instrument supplier ZimVie Inc. at an enterprise value of about $730 million. The agreement allows ZimVie to solicit proposals from third parties for 40 days. Prior to the deal's closing, ZimVie will operate as usual, and separately from ArchiMed. Centerview Partners LLC is financial adviser for ZimVie, and Cravath Swaine & Moore LLP is its legal adviser. UBS Investment Bank is the financial adviser for ArchiMed, and Latham & Watkins LLP is its legal adviser.

– TSG Consumer Partners LP agreed to buy Phlur Inc. in a deal that will see Prelude Growth Partners Management Co. LLC exit the US perfume producer.

– Sullivan Street Partners Ltd. signed an agreement to purchase Senior Aerospace (Thailand) Co. Ltd., the aerostructures business of Senior PLC, for £200 million. The deal is expected to be completed by year-end. Lazard Freres & Co. Ltd. was financial adviser to Senior, and Slaughter and May was its legal adviser.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our