Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jul, 2025

By Ranina Sanglap and Cheska Lozano

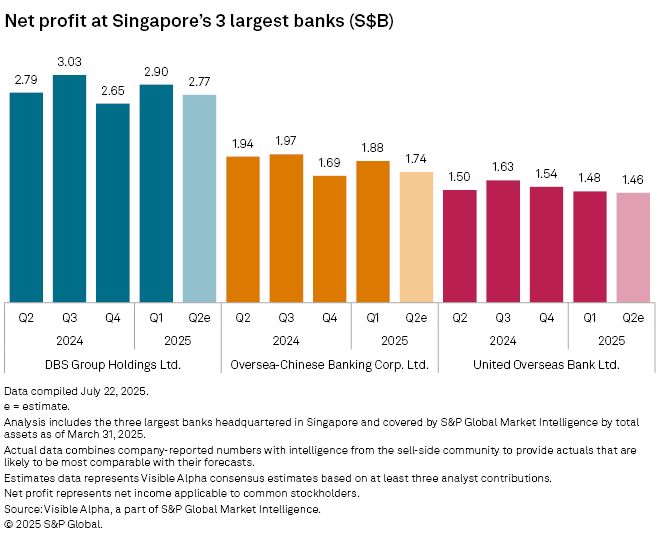

Singapore's three biggest lenders are expected to post declines in their net profits for the April-June quarter amid falling interest rates and slower loan growth.

DBS Group Holdings Ltd.'s net profit for the second quarter is expected to be S$2.77 billion, down from S$2.79 billion in the same period in 2024, according to analyst estimates compiled by S&P Global Market Intelligence. Oversea-Chinese Banking Corp. Ltd.'s net profit for the quarter will likely fall to S$1.74 billion from S$1.94 billion in the prior-year period, while United Overseas Bank Ltd.'s net profit could fall to S$1.46 billion from S$1.50 billion.

Growth slowdown

Singaporean banks posted record profits in 2024, fueled by the rising stature of the city-state as a global financial hub. Singapore's GDP grew faster than expected at 4.4% in 2024, compared to 1.8% in 2023. With global interest rates trending lower and trade uncertainties weighing on global supply chains, Singapore's economy, a bellwether for global trade, is expected to slow in 2025 between 0% and 2.0%, according to government estimates in May. The tepid growth outlook will likely weigh on bank earnings in 2025.

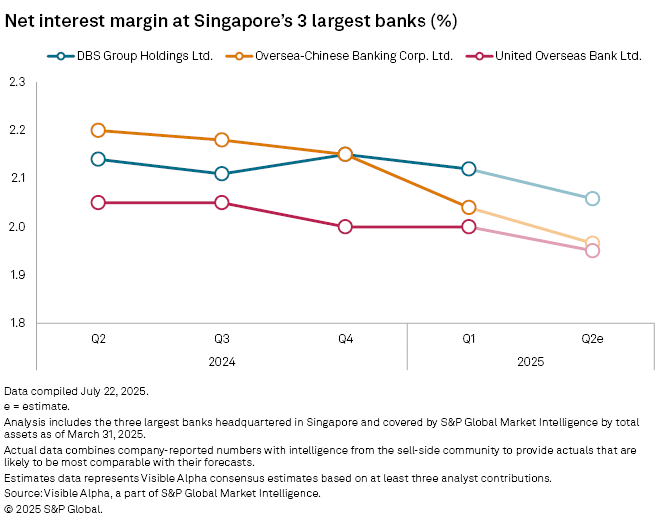

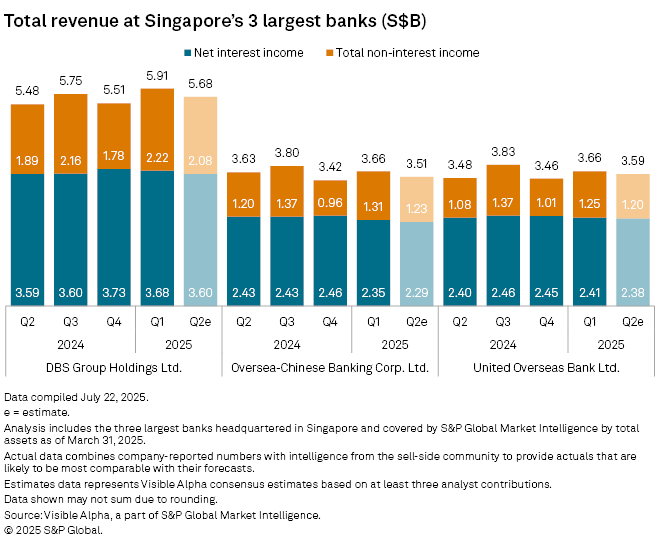

Falling interest rates could push lenders' net interest income lower "as a result of [net interest margins] compression following lower interest rates, as well as softening loan growth," CGS International said in a July 15 note. Non-interest income, especially for wealth management fees and trading income, would have been affected by a risk-off sentiment since April, CGS International said.

"While equity market sentiment has slowly recovered with equity indices across the US and Singapore reaching all-time highs, we believe uncertain macroeconomic conditions could continue to dampen fee income" in the second half of 2025. Still, CGS expects new money to keep flowing into Singapore's strong and stable economy and support the longer-term growth of wealth management franchises of banks.

The Singapore Overnight Rate Average, the volume-weighted average borrowing rate in Singapore's interbank cash market, dropped to 1.92%, as of July 25, from 3.55% in 2024. By comparison, the Hong Kong interbank offered rate decreased to 1.75% on July 25 from 4.64% on July 26, 2024.

Market Intelligence expects DBS' net interest margin to fall to 2.06% from 2.14% in the prior-year period and from 2.12% in the prior quarter. Oversea-Chinese Banking Corp. Ltd.'s margins are expected to come in at 1.97%, down year over year from 2.20% and from 2.04% in the previous quarter. United Overseas Bank's net interest margin will fall to 1.95% in the second quarter from 2% in the first quarter and from 2.05% in the prior-year period.

DBS, the biggest bank in Southeast Asia by assets, and the United Overseas Bank are due to report their second-quarter earnings on Aug. 7. Oversea-Chinese Banking Corp. Ltd. will report earnings for the quarter on Aug. 1.

As of July 29, US$1 was equivalent to S$1.29.