Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jul, 2025

By Brian Scheid and Annie Sabater

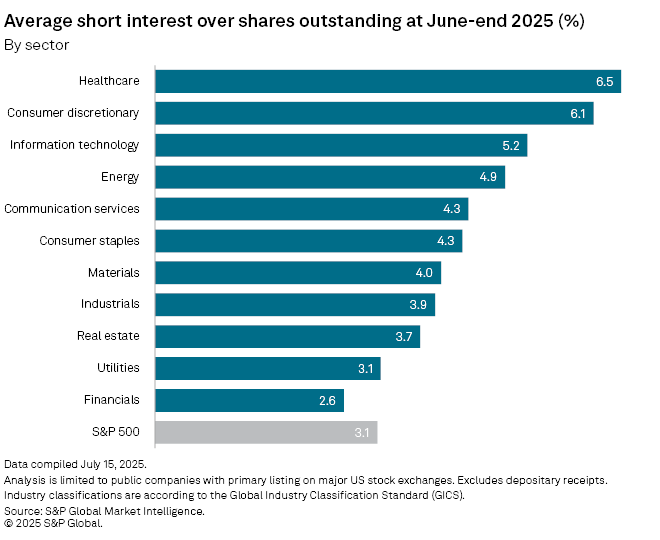

Short sellers again increased their positions against healthcare and consumer discretionary stocks through the first half of the year, making them the most shorted sectors in US equity markets by a wide margin.

Short interest in healthcare reached 6.5% at the end of June, up from 5.3% at the end of 2024, while short interest in the consumer discretionary sector stood at 6.1%, up from 5.0% at the close of last year, according to S&P Global Market Intelligence data.

Information technology, the third-most shorted sector, had short interest of 5.2% at the end of June, up from 4.3% in December 2024.

Investors boosted their short positions across the board in the US equity market during the second quarter, according to the analysis. Short interest in the S&P 500 averaged 3.1% at the end of second quarter, up from 2.8% at the end of the first quarter.

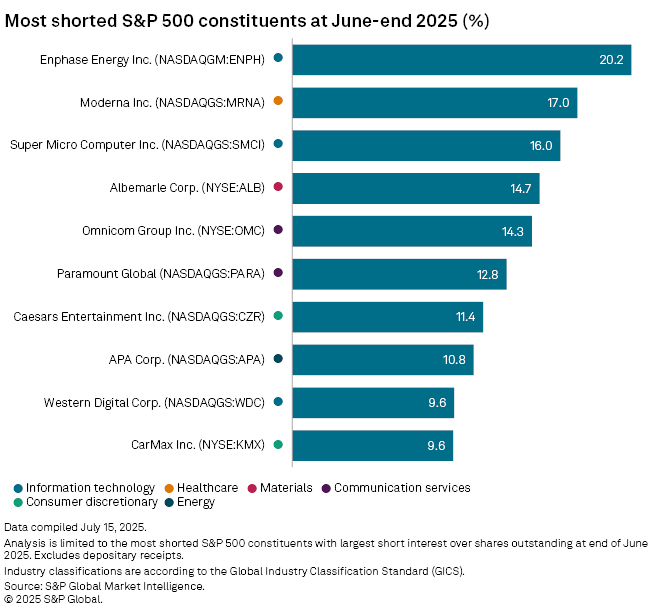

At the end of June, Enphase Energy Inc. was the most shorted stock on the S&P 500 with short interest of 20.2%, followed by Moderna Inc. with short interest of 17%.

Short interest in seven of the S&P 500's largest stocks, a group widely known as the Magnificent Seven, grew modestly by the end of the second quarter. However, short interest in all these megacap stocks remains well below average.

Tesla Inc. was the most shorted Magnificent Seven stock, with short interest of 2.5% at the end of June. Four of the seven stocks, Amazon.com Inc., Apple Inc., Microsoft Corp. and NVIDIA Corp., all had short interest of 1% or less at the end of June.