Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jul, 2025

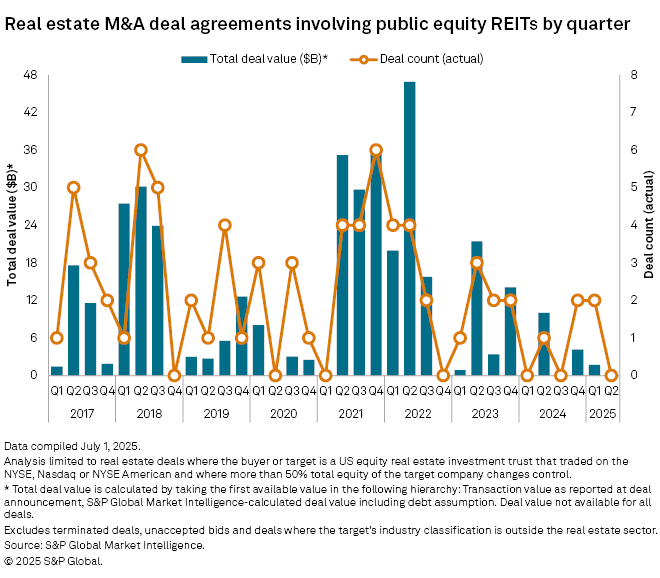

Real estate M&A activity involving publicly traded equity real estate investment trusts remained low in the first half of 2025 with only two announced deals.

Increased interest rates and associated higher costs of debt have largely slowed transactions in the REIT sector.

The analysis included real estate deals where either the buyer or target is an equity REIT that trades on the Nasdaq, NYSE or NYSE American.

2 healthcare deals

Both M&A deals during the first half came from the healthcare sector.

Welltower Inc. announced its definitive merger agreement to acquire nontraded REIT NorthStar Healthcare Income Inc. on Jan. 29 in an all-cash deal with an approximate enterprise value of about $900 million.

Under the deal terms, NorthStar Healthcare's shareholders will receive $3.03 per share in cash, about 2.4% above the company's $2.96 net asset value per share as determined by its board as of June 30, 2024.

On March 11, CareTrust REIT Inc. agreed to acquire London-based Care REIT PLC for £1.08 per share in cash. The per-share price represented a 32.8% premium to Care REIT's March 10 closing price and a 28.1% premium to its volume-weighted average share price for the 12 months ended March 10, according to the press release announcing the deal. The total purchase price for the deal, which closed in May, was approximately $817 million after accounting for $240 million of assumed net debt.

For comparison, three deals were announced in 2024, totaling roughly $14.16 billion in transaction value: Blackstone Inc.'s privatizations of Apartment Income REIT Corp. and Retail Opportunity Investments Corp. and NexPoint Diversified Real Estate Trust's acquisition of NexPoint Hospitality Trust.

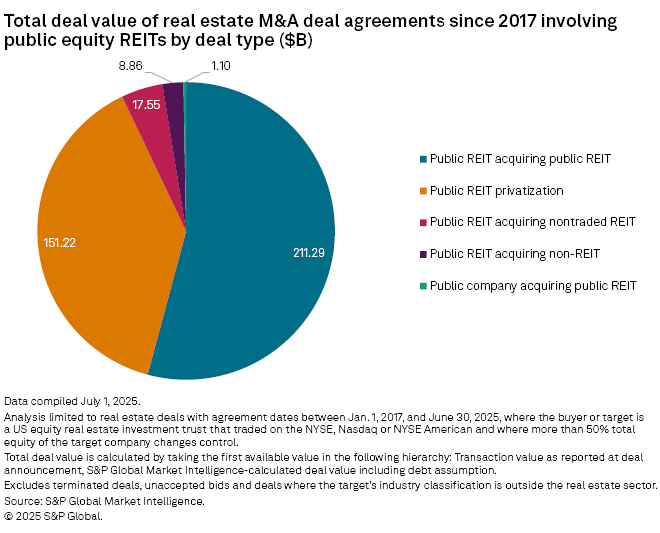

Public REITs merging or acquiring other public REITs remained the most common transaction type, accounting for $211.29 billion in deal value since 2017. This equates to 54.2% of the total transaction value of real estate deals involving public REITs.

Private equity firms have also been active acquirers of REITs over the years. Over the same time period, privatizations of public REITs totaled $151.22 billion in transaction value, roughly 38.8% of the analyzed deals.

Public REITs acquiring nontraded REITs accounted for $17.55 billion in deal value since 2017, while public REITs acquiring non-REIT companies operating in the real estate sector totaled $8.86 billion over the analyzed period.

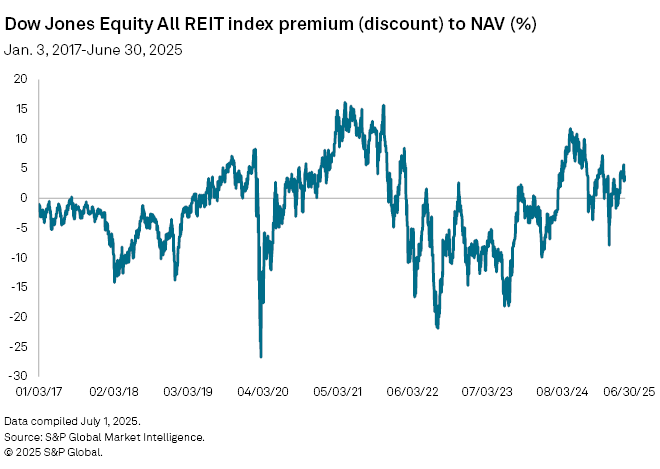

While the majority of REITs continue to trade at a discount to net asset value estimates, the market-cap-weighted Dow Jones Equity All REIT index trades at a small premium to net asset value, at 3.7% as of the end of the second quarter.