Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Jul, 2025

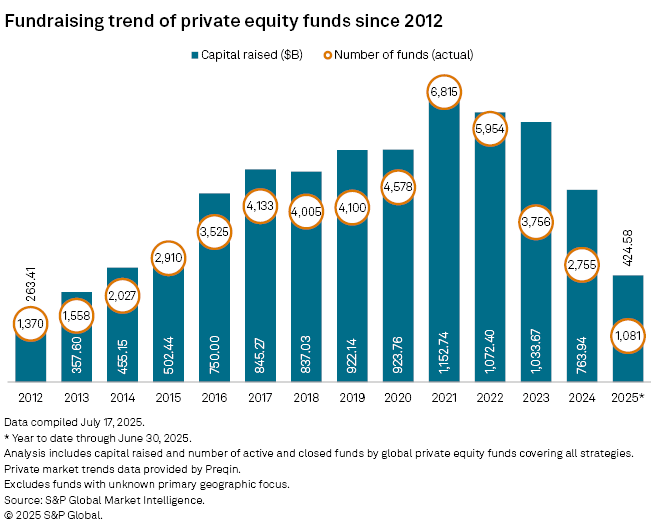

A solid first half of 2025 means global private equity fundraising is on track to exceed the total amount raised in 2024, following three years of declines.

Private equity funds worldwide secured $424.58 billion across 1,081 funds in the first six months of 2025, exceeding 50% of the $763.94 billion that 2,755 funds amassed in full-year 2024, S&P Global Market Intelligence data shows. Private equity fundraising has been on a yearly decline after hitting $1.15 trillion in 2021.

Fundraising could falter in the second half of 2025 should the slow IPO exit market persist, Janet Brooks, partner at placement agent Monument Group Inc. said. "But if a few of the mega funds currently in the market hit their final closes at their targets before the end of the year, the picture changes significantly," said Brooks.

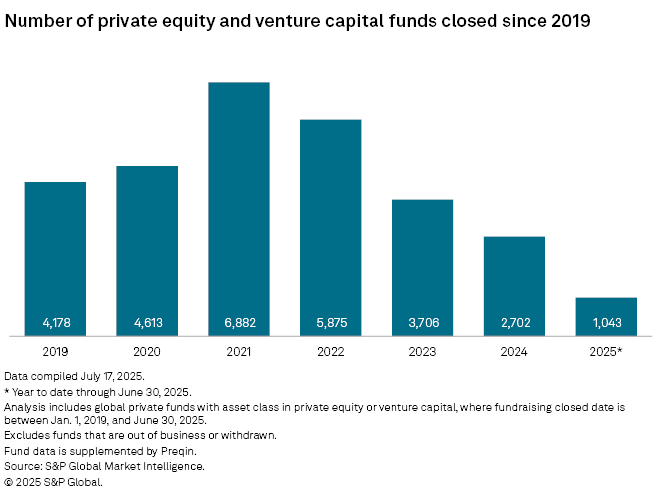

Fewer funds have been raising larger amounts so far this year. From Jan. 1 to June 30, 1,043 funds closed, down from the 1,325 funds closed during the same time period in 2024, Market Intelligence data showed.

Partners Group Holding AG, which has five funds currently seeking capital, confirmed its full-year 2025 fundraising guidance of $22 billion to $27 billion.

"We're on a reasonable trajectory right now," Partners Group CEO David Layton said in a July update call regarding the firm's expectations for fundraising in the second half of the year. "I wouldn't assume it slows down or speeds up at this current point in time," said Layton.

Investors are looking for solutions beyond traditional funds, Layton said, reflecting an industry trend in which traditional standardized funds are giving way to more niche or bespoke funds. "The demand for bespoke solutions continues to grow as clients seek to customize their private markets exposure," Partners Group said in a January statement.

Biggest funds

Ardian SAS closed the largest private equity fund in the first half of 2025, securing $30 billion for its Ardian Secondary Fund IX. Private wealth clients accounted for 22% of capital raised, according to the firm.

Thoma Bravo LP raised $24.30 billion at the final close of its Thoma Bravo Fund XVI LP, the second-largest private equity fund close in the first six months of the year. The fund focuses on investing in IT infrastructure and the software industry.

Insight Venture Management LLC's Insight Partners XIII Growth Buyout Fund LP was third-largest, at $12.50 billion, and the firm's Insight Partners XIII LP fund was fourth-largest, at $11.50 billion.

The second half began with a strong fundraise when, in July, Stone Point Capital LLC closed Trident X, attracted $11.5 billion in capital commitments.

– Download a spreadsheet with data featured in this story.

– Read up on private equity exits in renewable energy.

– Learn about US pension fund private debt allocations.

Fewer funds launched

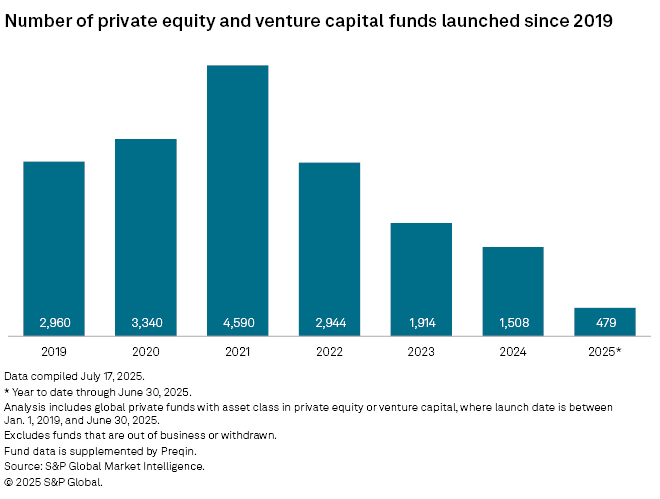

There were 479 global private equity fund launches between January and June, down from the 1,241 launched during the same period in 2024, according to Market Intelligence data.

Institutional investors' demand for more exposure to private equity and the rapidly growing push for retail investors in private markets are drivers for future fundraising, according to Monument Group's Brooks.

"Investors across the board still want to increase their exposure to private equity based on long-term outperformance over quoted markets," Brooks said. "Newer retail type aggregators are growing rapidly and will ultimately prove transformative to private equity fundraising."

Private equity is "increasingly sourcing new funds from noninstitutional investors, such as high-net-worth individuals," according to a McKinsey & Co report in May. "They do this through multiple channels (such as aggregators and wealth managers) and with multiple vehicles (such as open-end and semi-open-end funds) — all of which are more accessible than traditional closed-end vehicles to retail and high-net-worth investors."