Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jul, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity and venture capital exits of companies focused on renewable energy have plunged as downward pressure on valuations delays divestments.

Private equity exit value in the renewable energy industry amounted to $2.25 billion across seven deals in the year to July 9, less than a quarter of the $11.64 billion that 11 deals amassed in the first half of 2024, according to S&P Global Market Intelligence data.

The trend runs in contrast to private equity exits of fossil fuel companies, which are already on track to surpass the transaction value recorded in full year 2024.

"Companies that were bought quite expensively didn't have the growth that they were supposed to have, or at least not as fast as they were supposed to," Tioopo Capital's founding partner, Cyril Aboujaoude, told Market Intelligence.

Aboujaoude cited the current US administration's pivot away from renewable energy initiatives as a major factor affecting valuations in the industry. "Today, to be able to exit, investors will have to accept a discount on their purchase price."

Private equity exits in renewables are likely to remain subdued for the rest of the year given current interest rates, Aboujaoude said.

High interest rates can cause potential buyers to adjust their offers based on the cost of capital, which can lead to lower exit valuations for private equity firms. Interest rates can also make a portfolio company less attractive to buyers if the company relies on debt for operations or growth.

"As long as interest rates are at these levels, I'm not that positive," Aboujaoude said.

– Download a spreadsheet with data featured in this story.

– Learn more about trends in private equity dry powder.

– Read up on UK private equity fundraising.

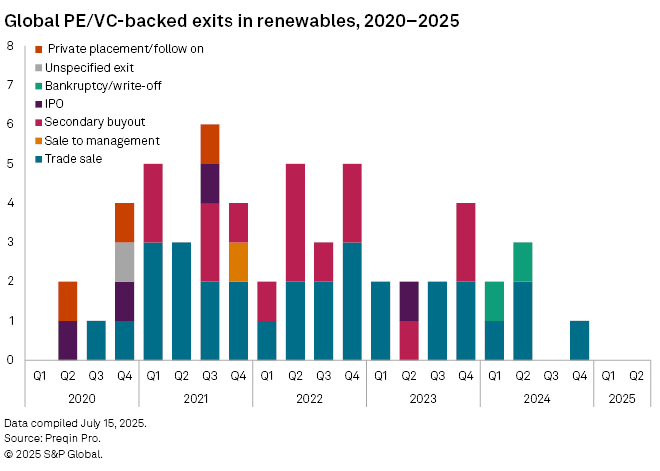

Private equity sales of renewables companies to corporate strategics have recorded the largest number of exits, followed by secondary buyouts, according to Preqin Pro data.

Energy-focused institutional investors are looking to offload their stakes in the secondaries market, according to an Akin Gump Strauss Hauer & Feld LLP report. Investors on the sell side have been forced to hold assets longer than intended, and there is pent-up demand for sales, the report added.

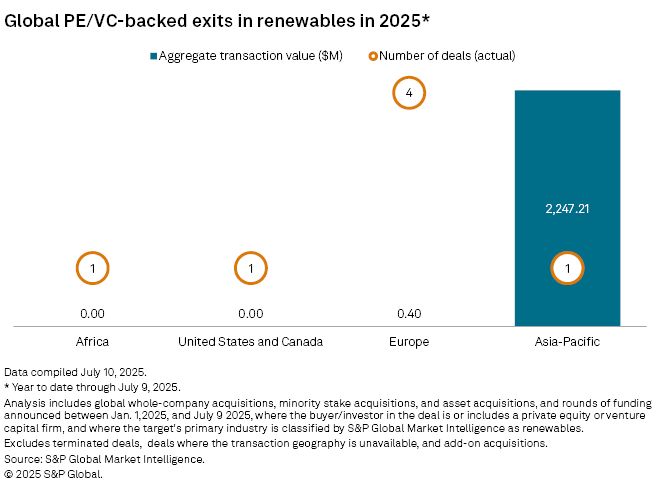

Asia-Pacific has the highest exit value for renewables so far in 2025, at $2.25 billion, Market Intelligence data shows. Europe is a far second with four deals totaling less than $500,000. The US and Canada had only one deal.

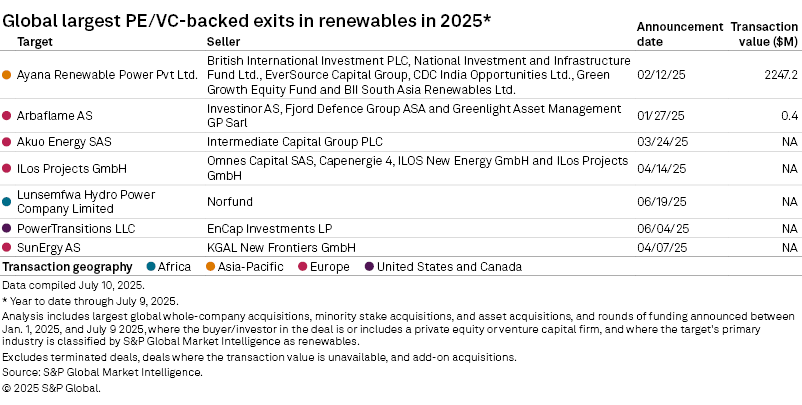

Largest exits in renewables

The largest private equity-backed exit in renewables between Jan. 1 and July 9 was the $2.25 billion sale of Indian renewable energy producer Ayana Renewable Power Pvt. Ltd. to ONGC NTPC Green Pvt. Ltd. The selling investor group includes private equity firms British International Investment PLC, EverSource Capital Group and National Investment and Infrastructure Fund Ltd.

The second largest was the sale of Norwegian renewable electricity producer Arbaflame AS for about $400,000. The seller is an investor group including Investinor AS and Greenlight Asset Management GP SARL.