Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jul, 2025

By Tom Jacobs and Malik Ozair Zafar

|

Community members and crews clean up debris from a tornado that struck London, Kentucky, on May 16. The twister was part of an outbreak that caused 19 deaths and damaged more than 6,200 structures in the Bluegrass State with a reconstruction cost value of $1.15 billion. |

A changing pricing environment and renewed social inflation worries will be among the focal points for US property and casualty insurers when they release second-quarter results.

Executives are expected to talk about the pace of pricing increases slowing after enjoying a historic year of underwriting profitability in 2024 Both the personal auto and homeowners segments booked year-over-year double-digit increases in direct premiums written last year as combined ratios eased.

Pricing and demand trends against the backdrop of tariff-driven inflationary pressures will be elements of the "big picture" for earnings calls, according to CFRA Research analyst Cathy Seifert.

"I think after a strong 2024, a lot of the tailwinds have gone," Seifert said in an interview. "We've got some headwinds and uncertainty, but we've also got a stable to acceptable pricing environment. We just don't have a whole lot of really strong tailwinds right now coming off a strong 2024."

An "overarching" issue is how tariffs and the possible "mass deportation" of migrants in the US impact the demand for insurance, as well as "input costs, [such as] lumber, construction and auto parts," she added.

Earnings season kicks off in the morning of July 17 with The Travelers Cos. Inc.

Ratios recover

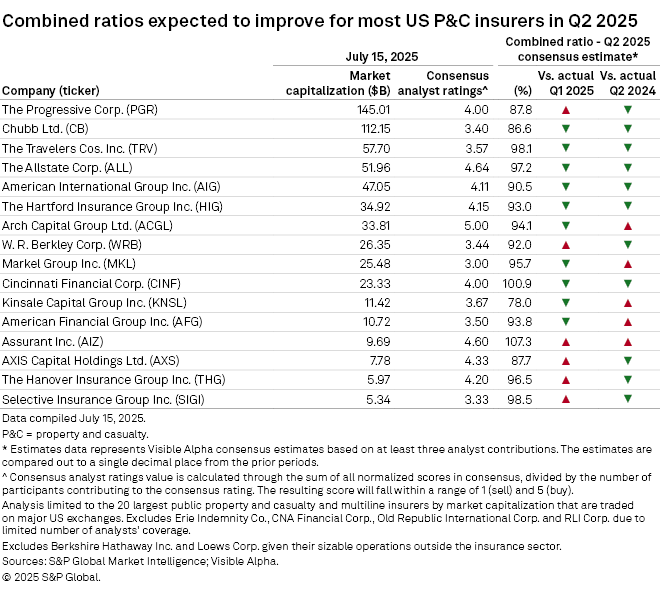

An S&P Global Market Intelligence analysis found that sell-side analysts expect combined ratios to improve both sequentially and year over year for a majority of the 16 largest publicly traded US property and casualty and multiline insurers. Analysts predict that 10 companies will show improvement from the first quarter, which was overshadowed by the January wildfires in the Los Angeles area, while 11 are expected to show year-over-year improvement.

Four companies are expected to book ratios below 90%: Kinsale Capital Group Inc., Chubb, AXIS Capital Holdings Ltd. and The Progressive Corp.

Assurant Inc. and Cincinnati Financial Corp. are the only companies expected to post ratios above 100%, which would indicate underwriting losses. Assurant is the lone company in this analysis expected to see deterioration in its ratio both sequentially and year over year.

Catastrophe losses for the quarter appear to be "normal" based on April and May results published by Progressive and The Allstate Corp., according to Piper Sandler analyst Paul Newsome. Progressive reported catastrophe losses of $206 million in April and $275 million in May, while Allstate reported $594 million and $777 million in losses, respectively.

Earnings bounce back

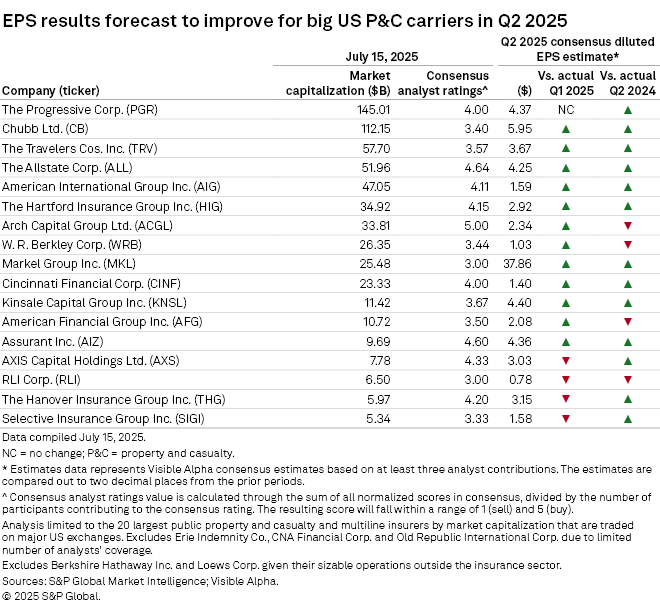

Sell-side analysts expect EPS to increase sequentially for 12 of the 17 companies in the analysis, while 13 will report higher earnings compared to the second quarter of 2024.

Companies expected to show both sequential and year-over-year improvements in EPS include Chubb, Travelers, Allstate, AIG, The Hartford Insurance Group Inc., Kinsale Capital, Markel Group Inc., Cincinnati Financial and Assurant. RLI Corp. is the lone carrier expected to report annual and sequential decreases in EPS.

Progressive's revenues jump

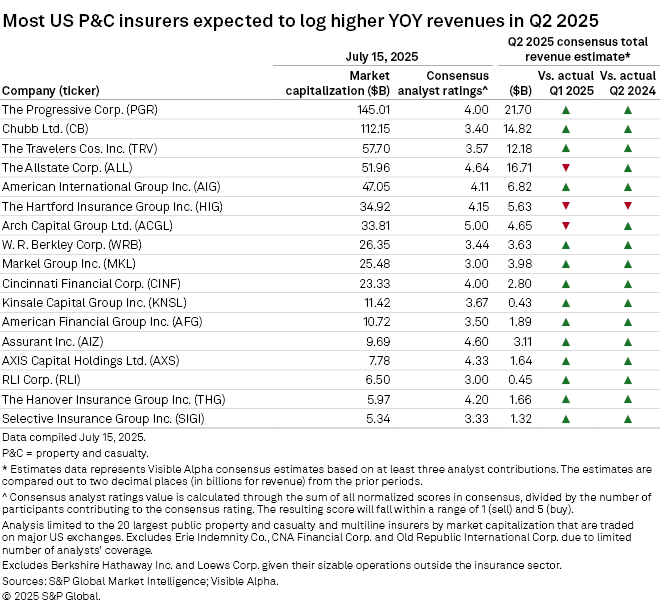

Sell-siders anticipate revenues improving, with 14 of 17 expected to see higher revenues compared to the last quarter and 16 of 17 projected to see increases over the prior-year quarter.

Progressive should top the analysis in total revenues for the ninth-straight quarter, with a consensus estimate of $21.70 billion. That would be a 19.70% year-over-year increase and a 6.32% improvement a quarter earlier.

Arch Capital Group Ltd. and Allstate are expected to report sequential decreases in revenue, while The Hartford is set to log decreases both sequentially and year over year.

Litigation worries back on radar

Social inflation, a topic that had faded into the background in the aftermath of the COVID-19 pandemic, is front and center once again as litigation that was delayed by pandemic-related court closings is making its way back to the judicial system.

Chubb Ltd. CEO Evan Greenberg, one of the most vocal executives on the topic, sounded the alarm once again in a July 7 op-ed he co-wrote with John Doyle, CEO of Marsh McLennan Cos. Inc., for The Wall Street Journal, referring to litigation costs as "a hidden tax."

"The volume of litigation is growing rapidly," Greenberg and Doyle wrote. "Cases are becoming more expensive to resolve, and people and businesses everywhere are footing the bill. As the leaders of Chubb and Marsh McLennan, we see the real costs of this hidden tax every day through our customers."

Piper Sandler's Newsome said social inflation makes it imperative insurers keep a close eye on their casualty reserves.

"Companies differ greatly in their view of which products are most affected, which geographies are the most affected, the actual rate of social inflation, and the accident years most affected," Newsome wrote in a note to clients. "This suggests to us that, other than raising rates, the insurers have no long-term fix for the problem."

Investors shrugging off tariffs

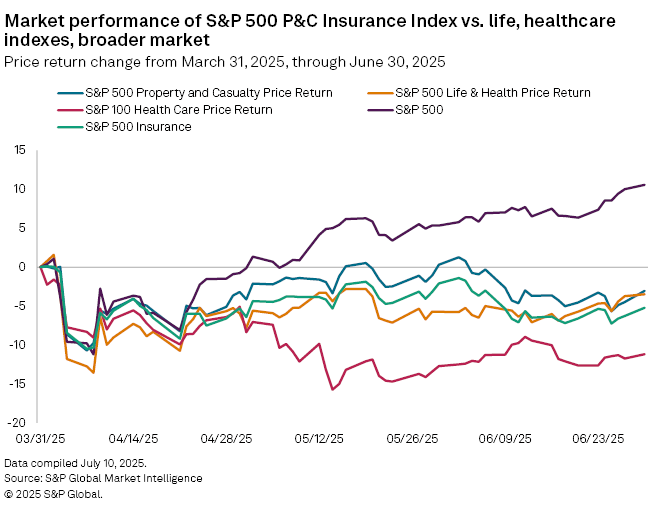

Equity investors are moving away from defensive characteristics provided by P&C carriers' stocks in favor of those that are "more economically sensitive," according to UBS Global Research analyst Brian Meredith. The S&P Composite 1500 Property & Casualty Insurance Index, which fell 3.35% during the second quarter, has fallen an additional 4% since the start of the third quarter.

"Everything melted down when it looked like tariffs would disrupt the economy," Shields said in an interview. "Broader investors have said, 'We don't think tariffs are going to be that disruptive,' and I think that's why a lot of things have recovered and the defensive appeal of property casualty insurance has faded in that context."