Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jul, 2025

By Dylan Thomas and Tim Siccion

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

High interest rates and the expected impact of tariffs on the economy and supply chains kept bankruptcy filings by private equity-backed US companies elevated through the first half of 2025.

With 52 bankruptcy filings recorded between Jan. 1 and June 30, US-based private equity and venture capital portfolio companies are on pace to match or exceed the full-year 2024 total of 103 in-court restructurings, according to S&P Global Market Intelligence data. The private equity portfolio companies in Chapter 11 proceedings represented 14% of the 371 bankruptcy processes initiated in US courts by companies this year through June 30.

Financial pressures appear to be squeezing companies in two sectors particularly hard. In the first half, the consumer discretionary and healthcare sectors recorded 11 bankruptcy filings each, leading all other sectors.

There may be more to come. John Sparacino, principal at McKool Smith, told S&P Global Market Intelligence that tariffs were partly to blame in the recent Chapter 11 filings he had reviewed, and the brunt of those tariffs is just beginning to be felt by US businesses and consumers.

Read more about bankruptcy filings by US venture capital- and private equity-backed companies in the first half of the year.

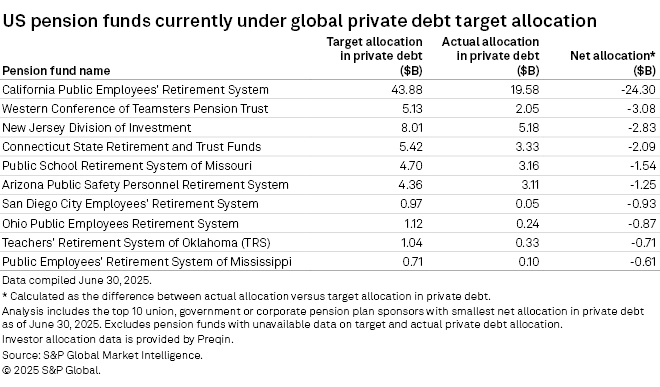

CHART OF THE WEEK: US pensions fall short on private debt allocations

⮞ US pension funds are collectively falling short of the private debt targets in their investment portfolios, with a median aggregate underallocation of $48 million as of June 30, according to Market Intelligence data.

⮞ An analysis of 127 pension fund portfolios found 88, or about 69% of the total, failed to meet their target allocations to private debt.

⮞ California Public Employees' Retirement System was $24.30 billion shy of its $43.88 billion private debt target, representing the largest gap among pension funds in the analysis.

TOP DEALS

– KKR & Co. Inc.-managed Kairos Bidco AB agreed to acquire Perrigo Co. PLC's dermacosmetics business for up to €327 million, including €300 million in up-front cash and up to €27 million in milestone payments. The transaction is expected to close in the first quarter of 2026.

– Partners Group Holding AG, Singapore's GIC Pte. Ltd., TPG Capital LP's TPG Rise Climate LP and Mubadala Investment Co. PJSC, agreed to invest in Techem GmbH, a Germany-based provider of digitally enabled real estate industry solutions, at an enterprise value of about €6.7 billion. The deal is likely to close in the second half of 2025.

– Bain Capital LP and Kohlberg & Co. LLC led a multibillion-dollar investment in Philadelphia-based PCI Pharma Services, a contract development and manufacturing organization specializing in biotherapies.

TOP FUNDRAISING

– Stone Point Capital LLC closed its Trident X fund with $11.5 billion in total commitments, surpassing its original target and hard cap of $9 billion. Debevoise & Plimpton LLP was legal counsel for Stone Point in the fund's formation.

– Pontem Energy Capital held the first close for its second fund, Pontem Energy NonOp Fund I. The fund aims for a final close at $250 million and will invest in upstream oil and gas assets across North America.

– The Riverside Co. closed Riverside Value Fund II at its hard cap of $750 million. The oversubscribed fund closed at more than double the size of its predecessor fund.

MIDDLE-MARKET HIGHLIGHTS

– Core Industrial Partners LLC's portfolio company, PrecisionX Group, acquired Florida-based metal parts manufacturer Hudson Technologies Inc.

– Hammond Kennedy Whitney & Co. Inc., which does business as HKW, acquired Gonzales, Louisiana-based wastewater treatment company Sepratech Liquid Solutions. Taft Stettinius & Hollister LLP was HKW's legal adviser. Brookside Capital Partners and LongWater Capital Solutions provided financing for the deal.

– Unity Partners LP added Canadian unit turnover services provider The Byng Group Ltd. to its portfolio. Kirkland & Ellis LLP was legal adviser and PricewaterhouseCoopers LLP was financial adviser to Unity on the deal.

FOCUS ON: HEAD COUNT DATA AND DEAL VALUE

The significance of team size in determining deal value has diminished in AI-related transactions, according to S&P Global Market Intelligence research paper "When Headcount Counts How Investors are Pricing Scale and Story." In 2019, a 100-fold increase in head count typically led to a 100-fold increase in deal size. By early 2025, this relationship weakened, with a 100-fold increase in head count only resulting in a 25-fold increase in deal size.

Amid this trend, overall deal values for AI companies have surged, benefiting firms of all sizes, particularly smaller ones. Unique strengths of certain firms, such as firm-specific intellectual property, product differentiation or strategic positioning, can lead to higher deal values than expected. These firms are more likely to secure future funding and grow rapidly, regardless of team size.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter