Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jul, 2025

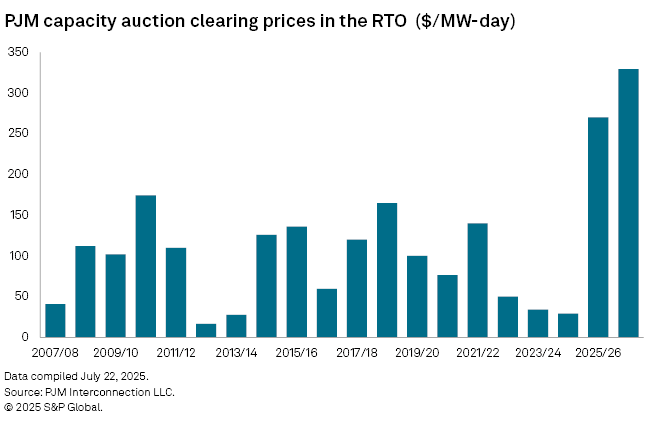

PJM Interconnection LLC's capacity market auction for the 2026/2027 delivery year cleared at record-high prices for a second year, reaching $329.17/MW-day for the entire PJM footprint, due to tighter supply, higher demand and market rule changes.

This year's price, compared with $269.92/MW-day for the 2025/2026 auction, came in at the Federal Energy Regulatory Commission-approved cap, the grid operator said July 22.

"The clearing price in this auction was at the cap value that was the result of the [Federal Power Act Section] 205 filing stemming from a complaint from the Pennsylvania governor's office," Stu Bresler, PJM's executive vice president of market services and strategy, said during a conference call with reporters.

FERC approved an agreement between PJM and Pennsylvania Gov. Josh Shapiro in April that sets a price cap of $325/MW-day and a price floor of $175/MW-day for the 2026/2027 and 2027/2028 auctions.

This was the most closely watched PJM capacity auction in many years, given the record-high clearing prices last year and the attention the higher prices garnered from politicians and consumer advocates concerned about the impact of higher capacity prices on retail customers' electricity bills. PJM said the results of this auction would lead to bill increases of 1.5% to 5% for customers, depending on how wholesale power costs are passed through.

"Even with the short, one-year lead time, auction results and other indicators show supply is responding to the investment signal from the 2025/2026 capacity auction," PJM said in a statement. The capacity auctions are supposed to secure power supplies for needs three years ahead, but due to rule change proceedings, PJM is currently running a compressed auction schedule.

PJM's forecast peak load for the 2026/2027 delivery year increased by more than 5,400 MW year over year, driven largely by datacenter expansion, electrification and economic growth, the grid operator said.

The total volume of incremental power generation and generation uprates in this auction was 2,669 MW in unforced capacity terms, representing the first increase in new generation and uprates in the last four auctions, PJM said.

"From the standpoint of committed resources, we basically cleared right at the reliability requirement, and there were no areas of the regional transmission organization with higher or lower clearing prices," Bresler said.

This auction's cleared volume was just 139 MW over the projected reliability requirement, "underscoring the region's tightening supply-demand balance," PJM said in the statement.

The biggest drivers of year-over-year changes were market rule changes such as the expanded must-offer requirement for all resources, with no categorical exemptions for intermittent resources. Additionally, reliability must-run units were counted as capacity, Bresler said.

Constellation Energy Corp. said all of its power plants in the PJM market, totaling more than 18,000 MW of mostly nuclear capacity, cleared the auction. Talen Energy Corp. said 6,702 MW in three of PJM's locational deliverability areas cleared, equating to about $805 million in capacity revenues for the upcoming delivery year.

Power mix

PJM's procured capacity for the 2026/2027 commitment period is 45% gas-fired, 21% nuclear, 22% coal-fired, 4% hydropower, 3% wind and 1% solar.

Industry analysts had speculated that capacity prices were likely to clear at the cap, but there was a fair degree of uncertainty heading into the auction. "The cap, in our view, will be reached," S&P Global Commodity Insights energy analyst Tanya Peevey said in a recent interview previewing the auction.

Mizuho Securities USA analysts said, in a recent research note before the auction results were released, that "while we initially expected prices to hit the $325/MW-day cap due to tight supply and limited new build response," updated rule analysis and demand curve modeling now suggest that capacity prices "could land anywhere within the collar, potentially at the floor."

The next base residual auction for the 2027/2028 delivery year is scheduled for December, as the grid operator works toward resuming its three-year-forward planning cycle, PJM said.