Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2025

By Beata Fojcik and Cheska Lozano

| OTP's Russian operations are forecast to account for nearly 20% of group profit in 2025. Source: NurPhoto/Getty Images News via Getty Images Europe. |

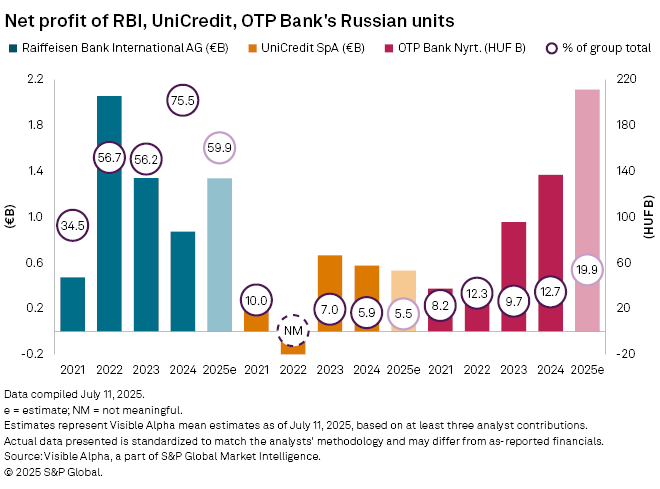

Hungary-based OTP Bank Nyrt. is forecast to report a 54% increase in profit from its Russian business this year, as its closest EU-based competitors face roadblocks to winding down their operations in the country.

The profit growth will be driven by an increase of more than 50% in net interest income, Visible Alpha data shows. OTP continues to grow loans and deposits in the country, in contrast with Raiffeisen Bank International AG and UniCredit SpA, the other EU-based lenders with the highest exposure to Russia.

Following the appointment of new CEO Péter Csányi in May, compliance with regulations and sanctions is a priority for OTP Bank. "We would like to emphasize that OTP remains a minor player in Russia, with a market share of less than 0.3%," its spokesperson said.

Russia is becoming increasingly important to the Hungarian bank's overall performance. The proportion of group profit derived from Russia should grow to 19.9% in 2025 from 8.2% in 2021, according to Visible Alpha.

Full speed ahead

OTP's Russia-related net interest income is forecast to grow to 282.2 billion forints, or €706 million, in 2025. Austria-based Raiffeisen Bank International and Italy's UniCredit are anticipated to reduce their net interest income in the country by 6% and 32%, respectively.

OTP's fee income is also set to jump to 43.7%, compared to a 0.7% increase at UniCredit and a near-10% decline at RBI. RBI should maintain the highest share of Russian net interest and fee income in group-level results for 2025, exceeding 27%, though these figures represent a year-over-year decline.

OTP Bank is projected to achieve a 32% year-over-year growth in gross customer loans and a nearly 30% increase in customer deposits in Russia in 2025. Since the onset of the Ukraine war, the bank has shifted its focus to retail lending while minimizing corporate financing.

Under Russian law, OTP must accept corporate deposits, which continue to flow from Western companies, its spokesperson said. As OTP does not engage in corporate lending, these deposits yield substantial interest income due to the high central bank base rate, the spokesperson said.

In contrast, RBI and UniCredit's Russian loan portfolios are poised to decline by 4% and 21%, respectively, while deposits should fall by 8.8% and over 9%.

UniCredit CEO Andrea Orcel said in June that since 2022, the Italian lender has effectively ceased all lending activities in Russia, reducing the portfolio by roughly 90% to about €900 million of outstanding loans, which are gradually depleting.

Stuck in Russia's grip

Since the invasion of Ukraine in 2022, Russia has introduced hurdles for foreign companies trying to exit their local businesses, including complicated approvals, 60% sale price discounts and 35% budget contributions.

At the same time, European regulators have pushed companies to retreat. Italy's government requested that UniCredit exit Russia as one of several conditions for approving the acquisition of Banco BPM SpA, while the ECB has instructed RBI to reduce its exposure to Russia.

Media outlets recently reported that three UAE-based companies are interested in acquiring UniCredit's Russian business. This could be appealing to Russian regulators as the buyers are not under Western sanctions and have prior experience in the country, according to Yaroslav Kabakov, strategy director at Russian brokerage company Finam.

UniCredit has not confirmed reports regarding the potential sale of its Russian subsidiary. The Russian exit condition could be a deal breaker for the BPM takeover because UniCredit does not intend to exit the country by the end of the year at a loss, Alessandro Boratti, associate director, Financial Institutions at Scope Ratings, told Market Intelligence.

RBI's efforts to exit Russia have also faced setbacks, as a Russian court recently upheld an existing ban on selling its Russian unit.

"Our plans regarding our Russian subsidiaries, reducing the business in line with the ECB request and the intention to sell, have not changed," RBI's spokesperson said. "We will continue with our legal efforts to lift the transfer ban."

While the latest verdict complicates the sale of a controlling stake in the Russian unit, RBI maintains a CET1 ratio that comfortably meets regulatory requirements even in a full write-down scenario of the Russian business, Julian Zimmerman, director, Financial Institutions at Scope Ratings told Market Intelligence.

RBI's net profit in Russia is estimated to grow more than 50% year over year to €1.2 billion in 2025, following a significant drop in 2024 due to a provision for legal proceedings in Russia, but will be largely flat compared with 2023. The 2025 figure could make up almost 60% of RBI's 2025 net profit reported at the group level, the highest among the three banks.

OTP Group said it attempted to exit Russia after the outbreak of the war, but, similarly to other Western banks, has been unable to do so due to the changed regulatory environment. Since September 2023, it has withdrawn 41.8 billion rubles in dividends from Russia, with an additional payout of 18.4 billion rubles scheduled for the second quarter.

The bank remains open to all strategic options regarding its Russian subsidiary, but selling the local unit for just 5% of its value would be "unreasonable" and would effectively inject 95% of the value into the Russian economy, raising serious business and moral concerns, the bank's spokesperson said.

OTP, which has been an active M&A player across central and Eastern Europe, is not concerned that its Russia exposure could impact its acquisition plans elsewhere, the spokesperson said.

Emerging risks

Several systemically important Russian banks have explored recapitalizations amid concerns of a looming banking crisis in the country due to deteriorating loan quality, Bloomberg News reported in July.

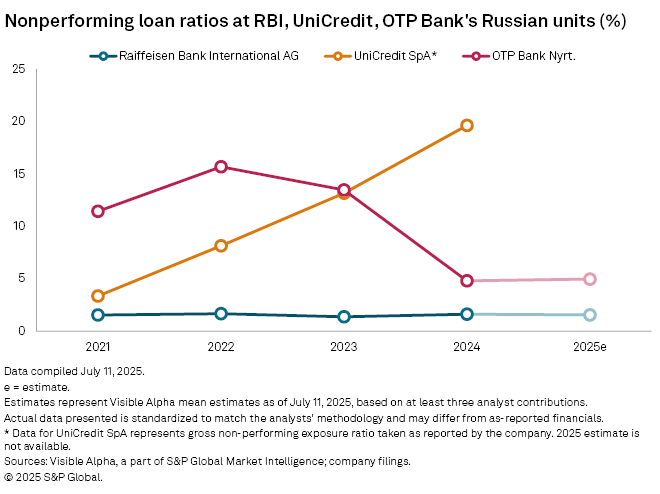

Given their relatively low market share, the EU-based banks appear less exposed to these risks. OTP Bank Russia does not have a corporate portfolio and is not experiencing the deterioration in the retail segment, its spokesperson said. RBI's spokesperson also pointed to a "very stable and very low NPE ratio" of the Russian unit over the past quarters.

UniCredit's nonperforming exposure ratio in Russia has been growing in recent years and exceeded 13% in 2024. The bank did not respond to questions on its asset quality.

As of July 22, US$1 was equivalent to 341.19 Hungarian forints.

Visible Alpha is an S&P Global Market Intelligence company.