Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jul, 2025

By Brian Scheid

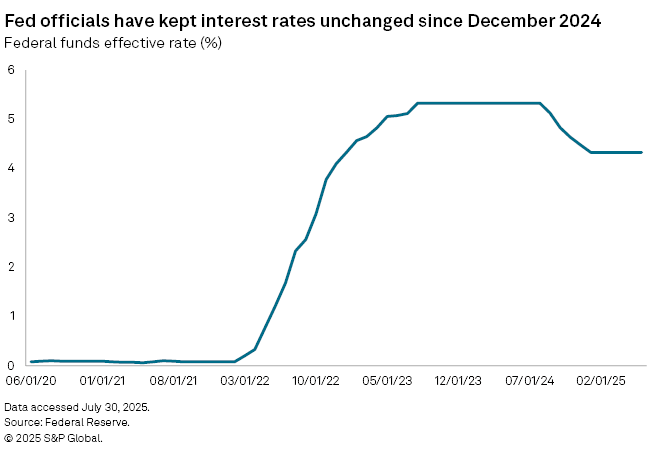

After Federal Reserve officials cut interest rates by 25 basis points in December 2024, it was not a question of when the central bank would cut again, but just how many cuts would take place throughout 2025.

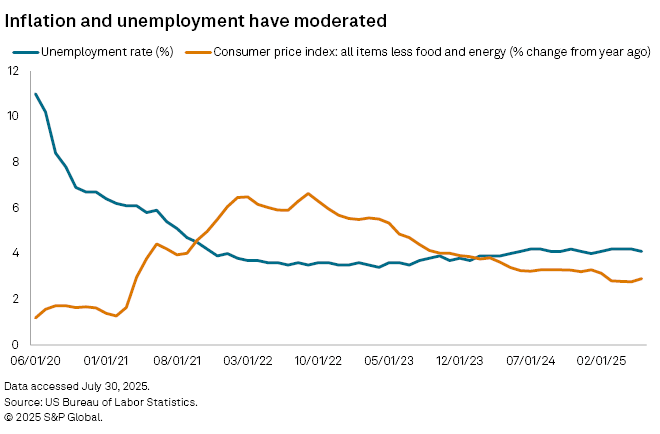

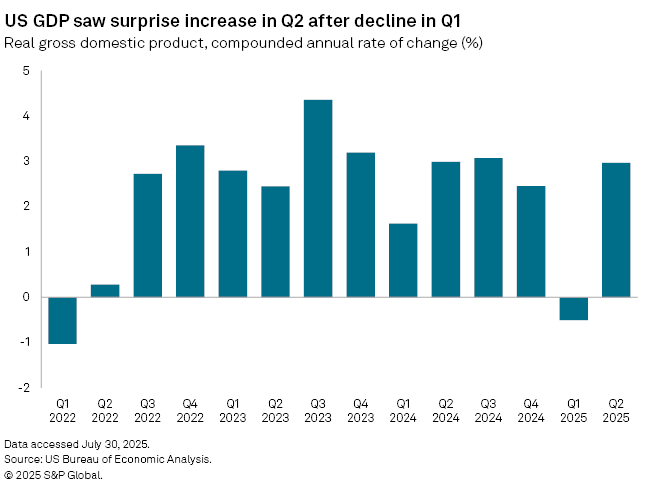

Stubborn inflation, a domestic labor market that continues to show more signs of strength than weakness, and a wave of policy uncertainty over the economic impacts of higher tariffs and stricter immigration enforcement, have led economists and market strategists to pare back their expectations for monetary policy easing.

Rather than multiple rate cuts in 2025, Fed officials may not cut at all.

"While the base case remains for some degree of policy easing later this year, the possibility of no rate cuts in 2025 cannot be ruled out," said Dan Siluk, head of global short duration and liquidity and portfolio manager at Janus Henderson Investors.

The Fed's rate-setting Federal Open Market Committee on July 30 voted, as expected, to hold its benchmark federal funds rate unchanged, its fifth straight meeting this year of leaving rates in their current range of 4.25% to 4.5%, where it has been since December 2024.

"We haven't made any decisions about September," Fed Chairman Jerome Powell said during his July 30 press conference. "We'll be monitoring all the incoming data and asking ourselves whether the federal funds rate is in the right place."

The futures market odds of a 25-basis-point cut at the Fed's next meeting in September fell to about 40% hours after the Fed's July 30 decision, down from over 60% a day earlier and 75% a month earlier, according to CME FedWatch. The odds of no cuts before the end of 2025 remained low, at about 13% on June 30, but up from essentially zero a month earlier.

Higher risk

With just three FOMC meetings before the end of the year and inflation still moving away from the central bank's 2% target, the likelihood of 2025 without a rate cut is increasing.

"I'd view it as a materially higher risk than what the market is pricing," said George Pearkes, a macro strategist at Bespoke Investment Group.

Pearkes believes the Fed's rate moves will likely hinge on the state of the labor market. If the jobs picture strengthens, the Fed is unlikely to cut, Pearkes said. With unemployment remaining in a range between 4% and 4.2% since May 2024 and initial weekly claims for unemployment insurance in the US actually decreasing since the first week of June, job market strengthening may already be underway.

In order for the Fed to keep rates unchanged, Janus Henderson's Siluk said unemployment needs to hold at current levels close to 4% and show no material signs of slack. In addition, Siluk said, inflation would need to remain sticky, showing limited progress toward the Fed's 2% target, and financial conditions need to remain stable.

"If financial conditions remain accommodative — for example, equity markets remain firm, credit spreads tight and volatility measured — the Fed may see little need to stimulate further," Siluk said.

A no-cut 2025 is "certainly plausible," and may have grown more likely after the Fed's July 30 meeting, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"All it would take is a sustained step up in monthly inflation that doesn't go away," Tang said. "Who wants to cut while inflation is rising? The FOMC can't afford another hit to their inflation credibility."

If there is no turn in economic data, then no cuts in 2025 is "definitely a possibility," but employment, rather than inflation, will likely dictate the ultimate decision, said Jack McIntyre, portfolio manager for Brandywine Global.

"There is no pressure for the Fed to cut now, in fact, I suspect that what happened during [the fourth quarter] of last year scared them, as the long-end of the curve rose as much as they reduced policy rates," McIntyre said. "They don't want a repeat of this development."

For now, the Fed can remain in "wait-and-see" mode, but this stance could be altered quickly if employment data softens, McIntyre said.