Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2025

By John Wu and Beenish Bashir

Hong Kong will likely fortify its position as one of the world's top destinations for equity fundraising, driven by secondary listings by companies based in mainland China.

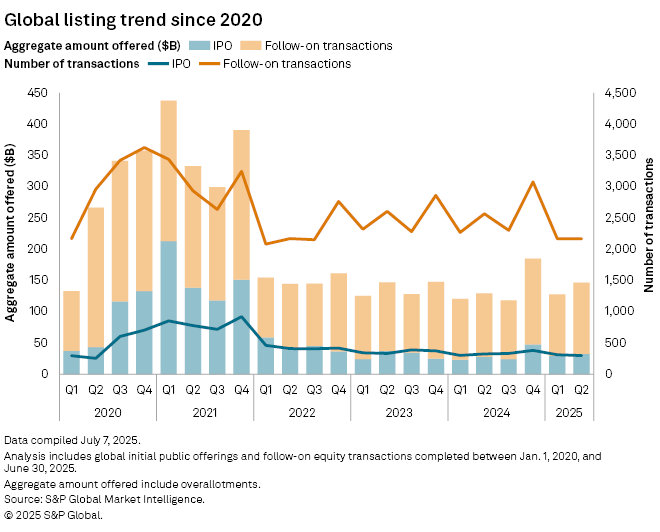

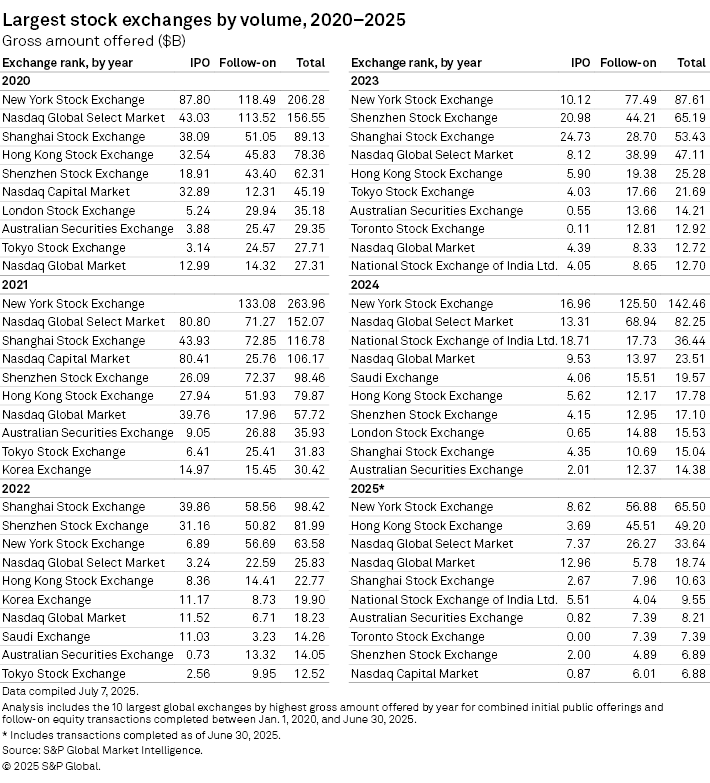

The amount raised on the main stock exchange jumped more than eightfold to $49.2 billion in the first half of 2025, driven mainly by follow-on offers from companies already listed on other exchanges, according to S&P Global Market Intelligence data.

Hong Kong Exchanges and Clearing Ltd. (HKEX) hosted 210 IPOs and follow-on offerings in the January to June period, the data shows. That compares with 182 deals to raise $5.26 billion in the same period in 2024.

Follow-on share sales include companies that are already listed on mainland exchanges, such as Shanghai and Shenzhen, seeking dual listing in Hong Kong to raise fresh funds. On May 20, Shenzhen A-listed Contemporary Amperex Technology Co. Ltd., the world's largest battery maker, debuted on HKEX, selling 155.9 million H shares to raise $5.25 billion, the world's biggest equity transaction so far this year.

"It is really a big year for Hong Kong and I don't see any sort of pushback from this kind of trend," Frank Bi, a Hong Kong-based partner and Asia head of corporate transactions at law firm Ashurst, told Market Intelligence on the sidelines of a June 12 conference.

Bi said nearly 100 new applications were submitted this year, including at least 20 A-share listed mainland China companies. These companies hope to gain overseas profiles by listing in Hong Kong, where they could take advantage of HKEX's shorter vetting process.

The combined IPOs and follow-ons on the Shanghai Stock Exchange raised $10.63 billion in the first six months of 2025, a year-over-year increase of 51.4%. The numbers at the Shenzhen Stock Exchange added to $6.89 billion, a decline of 17.7%, according to Market Intelligence data. Globally, aggregate fundraising through IPO and follow-on offerings was $274.2 billion in the first half, an increase of 9.9% year over year.

Starting in early 2024, the China Securities Regulatory Commission and the State Council, the top administrative body in mainland China, announced new rules to improve the quality of new listings by enhancing the responsibilities of sponsors and exchanges. Simultaneously, mainland China companies are being encouraged to seek fundraising opportunities in financial centers outside mainland China, especially Hong Kong, under the National Nine Articles program.

The HKEX and Hong Kong's Securities and Futures Commission jointly announced in October 2024, enhanced rules aimed at shortening the IPO process and "to further elevate Hong Kong's attractiveness as the leading international listing venue in the region."

The Hang Seng Index, Hong Kong's equity benchmark, is up 20.7% to 24,203 so far this year, while the CSI 300, its mainland China counterpart, is up 2.1% to 4,017.

"The recent inflow of capital into Hong Kong has demonstrated that our fundamentals are robust and trusted by investors. We serve as a safe harbor for international capital," Hong Kong's Financial Secretary Paul Chan Mo-po said at a June 5 S&P Global Market Intelligence event.

For Contemporary Amperex Technology Co. Ltd., it took only four months to complete its Hong Kong listing, Ashurst's Bi noted. Hong Kong stands out as the most attractive market for investors compared to regional jurisdictions such as India, which has capital controls, and Singapore, which lacks liquidity and scale, according to Ashurst.

According to a June 11 EY report, with Chinese corporations internationalizing strategies and outbound trends, more high-quality A-share listed companies are expected to expand their global foothold through HKEX's accelerated time frame for eligible A-share listed companies.

"The Hong Kong IPO boom in 2025 was the aggregated result of multiple driving factors such as policy changes, market dynamics and increased corporate supply," Jacky Lai, EY Hong Kong capital market services spokesperson, said in the report.

"Chinese mainland corporates are expanding their international footholds through A+H dual listing, unlocking a new growth curve," Lai said, adding that consumption and technology firms emerged as a key catalyst for the Hong Kong IPO market.

Under Hong Kong's accelerated time frame for eligible A-share listed companies, the regulatory assessment time is reduced to a maximum of 30 business days per regulator, provided the application is deemed to fully meet requirements, according to the Securities and Futures Commission of Hong Kong.

The trend among companies seeking to list A and H shares is expected to continue.

KPMG said in a July 3 report that 47 such listing applications were received in the first six months of 2025, compared to only five in 2024. A-shares represent mainland Chinese companies listed on mainland exchanges. H-shares represent mainland Chinese companies listed in Hong Kong.

At least 43 applicants are sizable A-share companies with market capitalization exceeding 10 billion Chinese yuan, providing a significant boost to Hong Kong's efforts to maintain its leadership in the global IPO markets by year-end, according to the report.

"While other global IPO markets have slowed, Hong Kong is showing significant growth driven by A+H and high-tech listings," said Louis Lau, partner and head of Hong Kong Capital Markets Group at KPMG China. "We remain highly optimistic about the outlook for Hong Kong's IPO market for this year and beyond."

Hong Kong ranked second after NYSE on the first half global IPO league table by bourses, followed by Nasdaq Global Select Market and Nasdaq Global Market, data shows.

As of July 14, US$1 was equivalent to 7.17 Chinese yuan.