Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2025

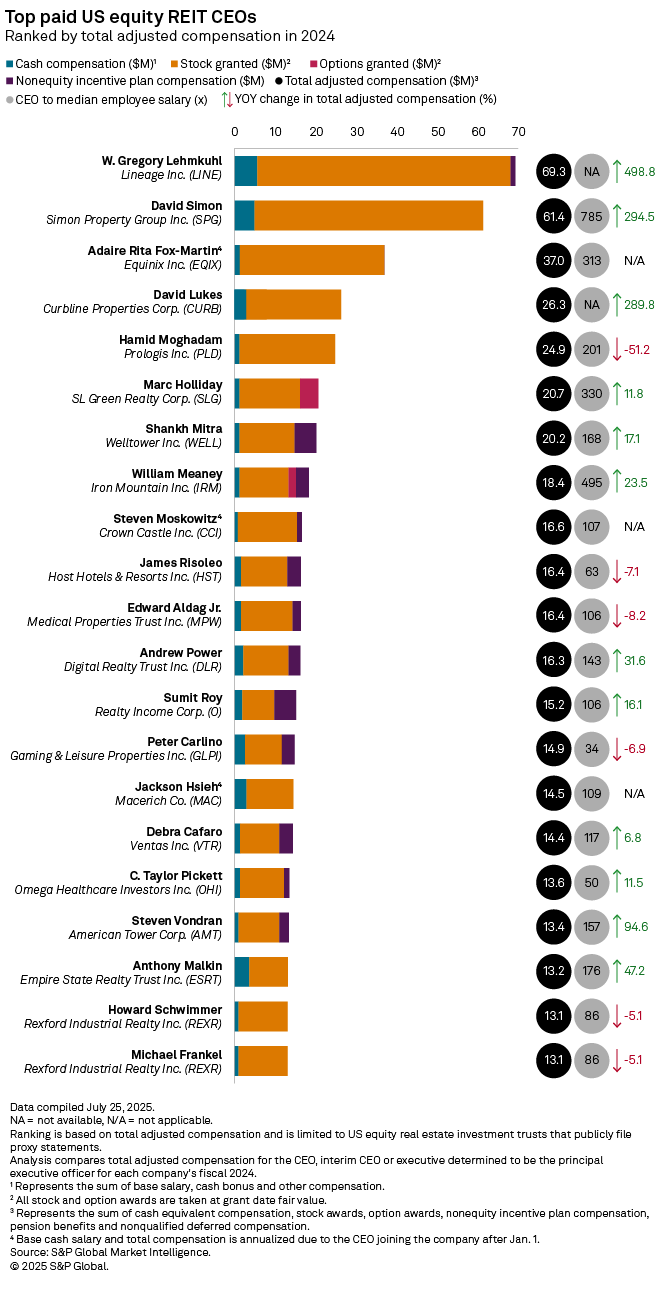

Lineage Inc.'s W. Gregory Lehmkuhl was the highest-paid CEO of a US equity real estate investment trust in 2024, according to an S&P Global Market Intelligence analysis.

The majority of Lehmkuhl's $69.3 million compensation for the year came in the form of stock awards, which were valued at nearly $62.5 million. Besides the stock awards, Lehmkuhl was paid a base salary of $1.2 million, a $4 million cash bonus and $1.2 million in nonequity incentive plan compensation. The CEO also received $441,362 in other compensation, which included a 401(k) match, personal use of the company aircraft, and reimbursement of personal travel, entertainment and legal fees.

Lineage, a temperature-controlled warehouse REIT, completed its IPO in July 2024 at over $5.10 billion, marking the largest REIT IPO ever with gross amount offered, including overallotment.

David Simon, chief executive of regional mall REIT Simon Property Group Inc., took the second spot in the ranking. Simon received $61.4 million in total compensation for 2024, nearly four times his 2023 compensation of $15.6 million.

Equinix Inc.'s Adaire Rita Fox-Martin ranked third, with about $37.0 million in total compensation for 2024, including her annualized base salary for the year. Fox-Martin took over as CEO at the datacenter REIT in June 2024, when Charles Meyers became executive chairman.

David Lukes, CEO at retail REIT Curbline Properties Corp., was the fourth-highest-paid CEO, with total compensation of $26.3 million. Curbline Properties completed its spinoff from SITE Centers Corp. in the second half of 2024.

Industrial REIT Prologis Inc.'s Hamid Moghadam rounded out the top five with total compensation of $24.9 million for 2024.

The rankings are based on total adjusted compensation and are limited to US equity REITs that publicly file proxy statements.

– Download an Excel spreadsheet with a breakdown of total compensation for US REIT CEOs, CFOs and COOs in the 2024.

– Set email alerts for future Data Dispatch articles.

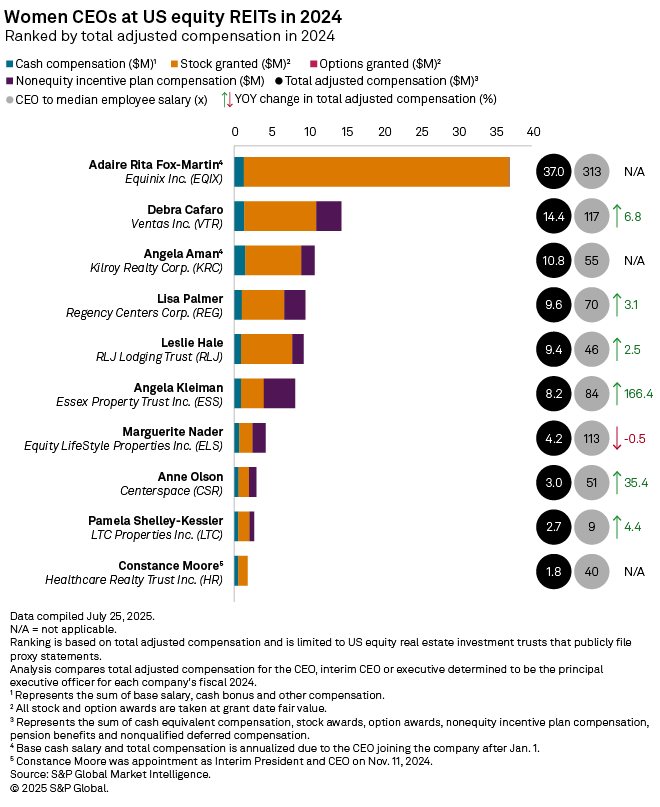

Women CEOs at US equity REITs

Ten US equity REITs had women CEOs in 2024, according to Market Intelligence's analysis of proxy statements filed by companies in the sector.

Fox-Martin of Equinix was the highest-paid executive in this group with total compensation of about $37.0 million. Debra Cafaro of healthcare REIT Ventas Inc. ranked second with $14.4 million in total compensation for 2024.

Angela Aman, the new CEO of office REIT Kilroy Realty Corp., took third place with total compensation of $10.8 million, including her annualized base salary. Aman was appointed CEO of Kilroy effective Jan. 22, 2024, succeeding John Kilroy Jr.

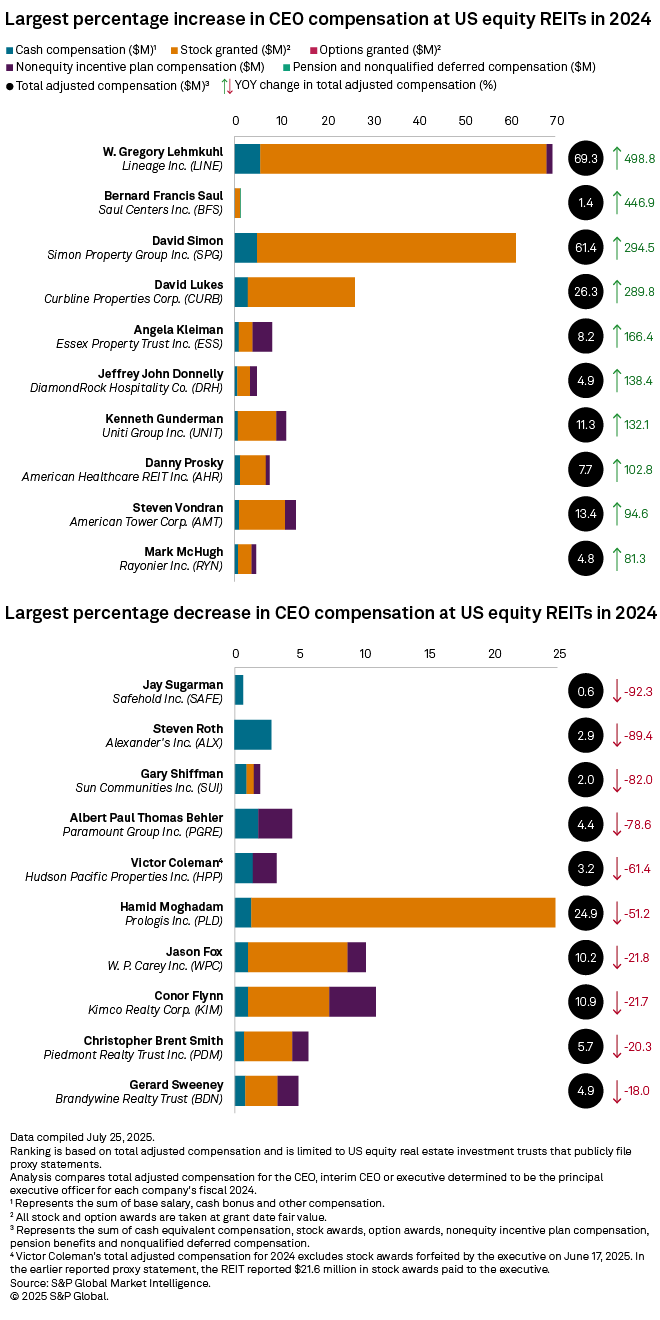

Largest percentage changes in CEO compensation

Lineage CEO Lehmkuhl had the largest percentage year-over-year increase in total compensation, receiving nearly six times his $11.6 million compensation in 2023.

Saul Centers Inc.'s Bernard Francis Saul recorded the second-largest percentage increase with a 446.9% jump in total compensation to $1.4 million, followed by Simon Properties Group CEO David Simon with a 294.5% increase.

Safehold Inc. CEO Jay Sugarman logged the largest year-over-year decrease in total compensation, down 92.3% to $644,601. Sugarman received a base salary of $600,000 and $44,601 in other compensation. Sugarman had the largest year-over-year increase in total compensation in 2023, stemming from $7.8 million of stock awards.

Vornado Realty Trust's Steven Roth ranked next, recording an 89.4% year-over-year drop in total compensation to $2.9 million, followed by Sun Communities Inc. CEO Gary Shiffman with an 82.0% year-over-year decline.