Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2025

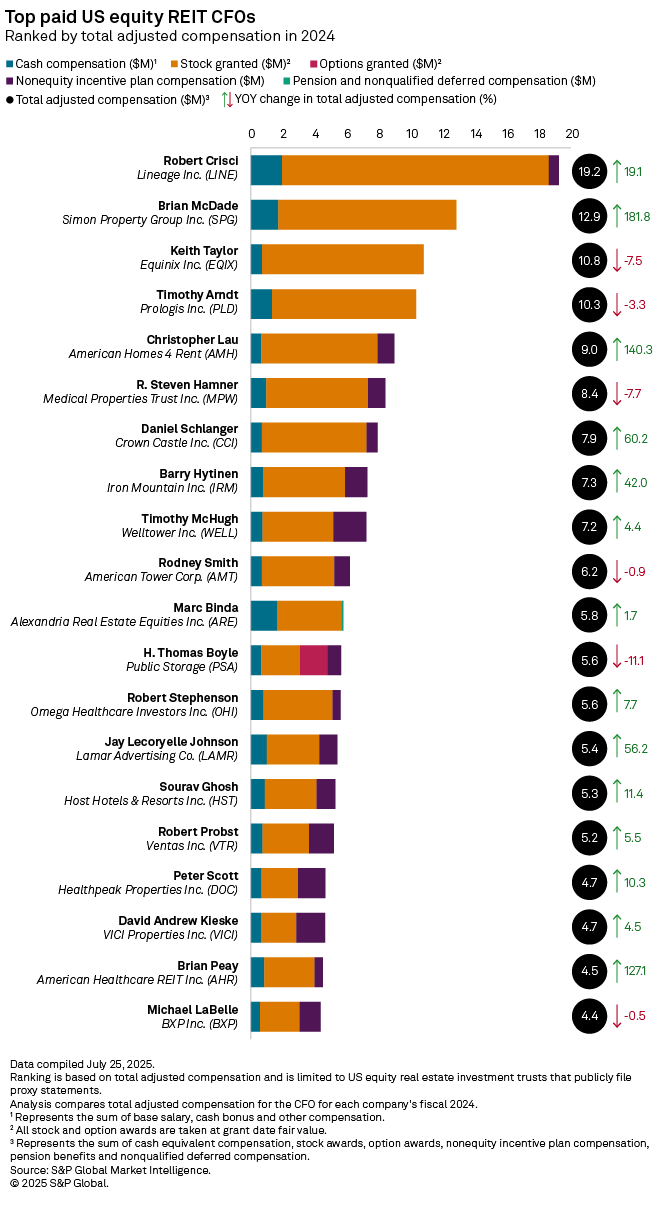

Robert Crisci, CFO of temperature-controlled warehouse real estate investment trust Lineage Inc., was the highest-paid US equity REIT CFO in 2024, according to an S&P Global Market Intelligence analysis.

Crisci received $19.2 million in total compensation for 2024, nearly $16.7 million of which came in the form of stock awards. The rest consisted of a $700,000 base salary, a cash bonus of about $1.3 million, $621,058 of nonequity incentive plan compensation, and $11,346 in the form of the company's 401(k) match, company-paid life insurance premiums and annual executive medical examinations.

Lineage completed its IPO in July 2024 at over $5.10 billion, marking the largest REIT IPO ever with gross amount offered, including overallotment.

Brian McDade of regional mall REIT Simon Property Group Inc. ranked as the second highest-paid CFO with $12.9 million in total compensation, followed by Keith Taylor of datacenter REIT Equinix Inc. with $10.8 million and Timothy Arndt of industrial REIT Prologis Inc. with $10.3 million.

The ranking is based on total adjusted compensation and limited to US equity REITs that publicly file proxy statements.

– Download an Excel spreadsheet with a breakdown of total compensation for US REIT CEOs, CFOs and COOs in the 2024.

– Set email alerts for future Data Dispatch articles.

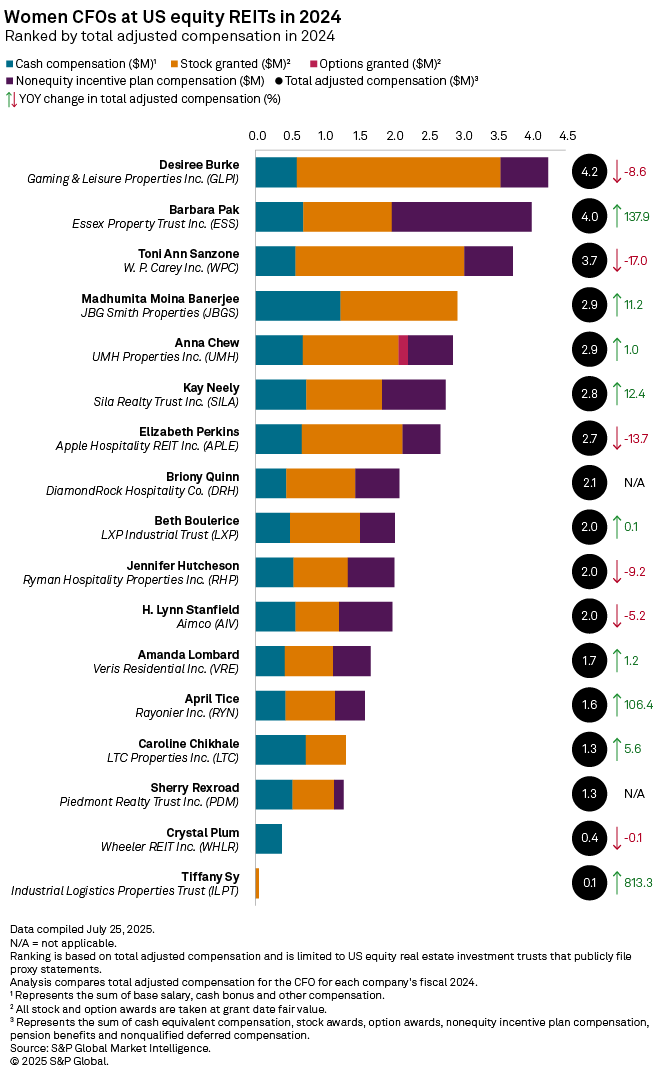

Women CFOs at US equity REITs

Seventeen women held CFO positions at US equity REITs in 2024, according to Market Intelligence's analysis of proxy statements filed by companies in the sector.

Desiree Burke at casino REIT Gaming & Leisure Properties Inc. was the highest-paid woman CFO among all US equity REITs in 2024, with total compensation of $4.2 million.

Barbara Pak of multifamily REIT Essex Property Trust Inc. ranked next with $4.0 million and Toni Ann Sanzone of diversified REIT W. P. Carey Inc. ranked next with $3.7 million.

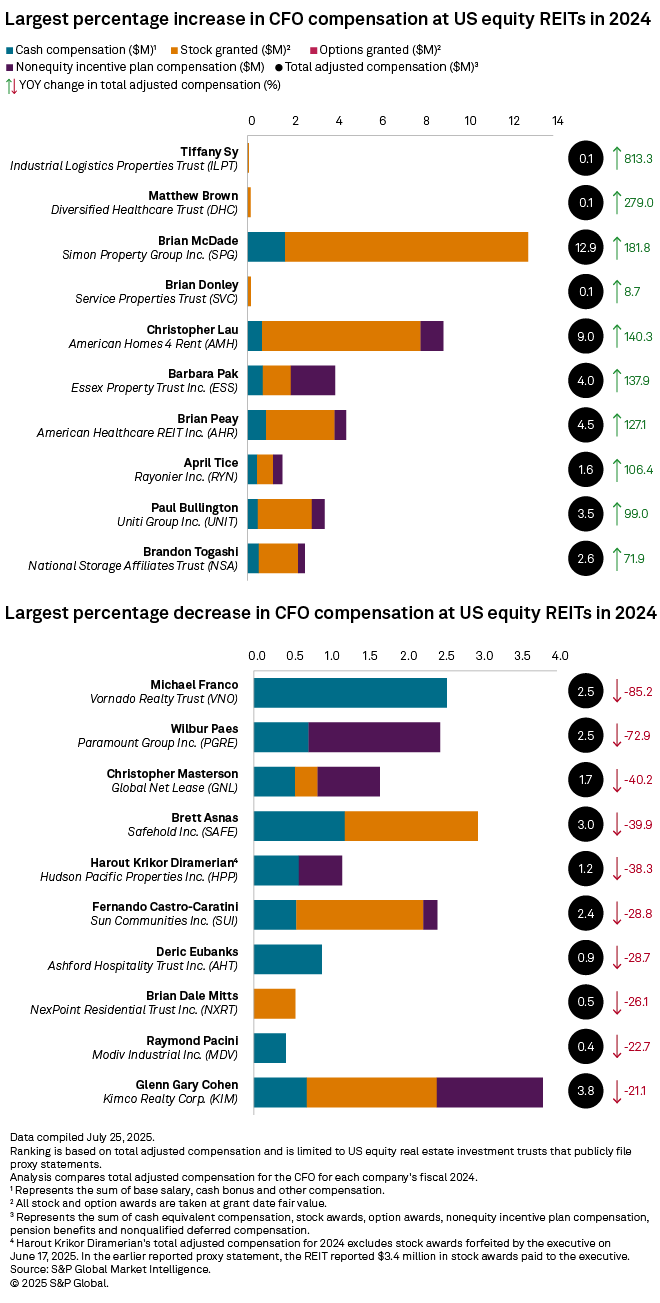

Largest percentage changes in CFO compensation

Industrial Logistics Properties Trust CFO Tiffany Sy recorded the largest year-over-year percentage increase in total compensation. Sy received $50,148 in total compensation for 2024, consisting nearly entirely of stock awards, compared to $5,491 in 2023.

Industrial Logistics Properties Trust's compensation structure is unique because of the REIT's relationship with its manager, The RMR Group Inc. Industrial Logistics Properties Trust's executives are employees of RMR Group, which determines the cash compensation payable to them. While Industrial Logistics Properties Trust does not directly reimburse RMR Group for compensation paid to the executives, the REIT pays the business a management fee based on the lower of the historical cost of its properties and its market capitalization. RMR Group also may earn an incentive management fee based on the three-year total return of Industrial Logistics Properties Trust common stock relative to an index of its peers.

Vornado Realty Trust CFO Michael Franco logged the largest year-over-year percentage decrease in total compensation, receiving $2.5 million for 2024, down 85.2% from 2023.