Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2025

By Yuvraj Singh and Marissa Ramos

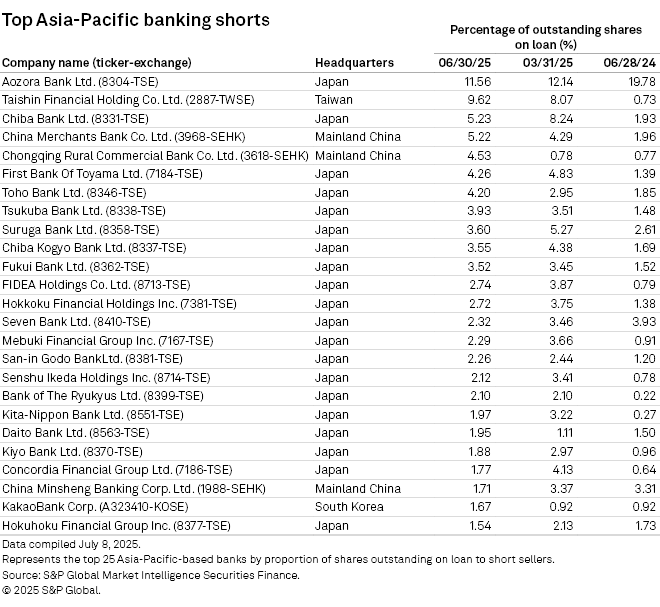

Aozora Bank Ltd. continues to be the most shorted bank in the Asia-Pacific region in the June quarter, holding the spot since 2023.

The midsized Japanese lender had 11.56% of its shares on loan to short sellers as of June 30, a decline of 8.22 percentage points from 19.78% in the same period a year ago, according to S&P Global Market Intelligence data.

Aozora has pursued an aggressive overseas lending strategy, with nearly one-third of its loan book tied to international markets, particularly US commercial real estate.

S&P Global Ratings, in an April 30 report, assigned Aozora a higher economic risk score than banks that operate primarily in Japan "because a high portion of its lending is in economies considered as having higher economic risk."

Aozora's share price has trended downward since early 2024, weighed down by its sluggish performance. Shares have fallen nearly 30% to ¥2,162 since January 2024. In contrast, Japan's Nikkei 225 benchmark index gained 17.8% to reach 40,487 points over the same period.

The bank expects net income of ¥22 billion in the current fiscal year that began on April 1, an increase of 7% from the year that ended on March 31, according to a May 16 statement. In the previous fiscal year that ended in March 2024, Aozora posted a ¥49.9 billion loss.

Most shorted

Short-selling activity in the Asia-Pacific banking sector remains high, particularly in Japan, where it accounts for 20 of the 25 most-shorted stocks in the region, the data show.

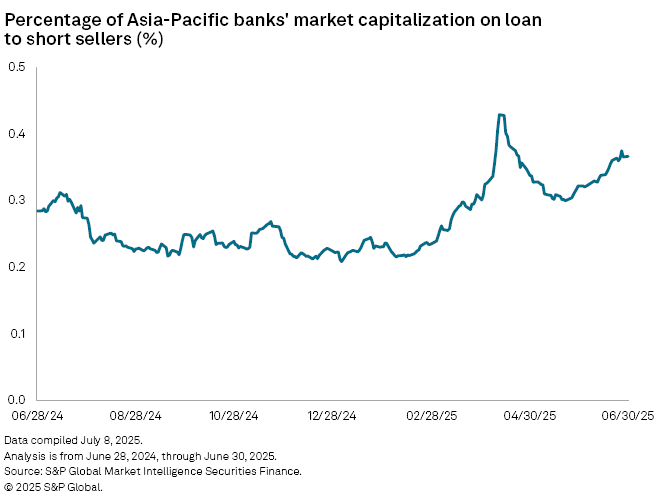

Investors targeting Japanese regional banks "likely had a short position" after US President Donald Trump announced sweeping tariffs on April 2, said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management, in a call with Market Intelligence.

The uncertain macroeconomic environment is likely to affect regional lenders more than megabanks. Rural lenders have been grappling with declining populations in rural areas, leading some to merge to survive the challenging market.

Further, banks across the region faced pressure on net interest margins, as central banks such as the Reserve Bank of India and the People's Bank of China cut interest rates to boost economic growth.

Yuzo Yamaguchi contributed to this article.

As of July 14, US$1 was equivalent to ¥147.53.