Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jul, 2025

By Yuzo Yamaguchi and Cheska Lozano

Japan's traditional banks are spending billions of dollars to accelerate their digital transformation, seeking to compete better with new-age lenders for deposits amid Japan's shift to higher interest rates.

Lenders, especially Japan's three megabanks, plan to invest more than ¥1 trillion in digitization in the fiscal year beginning April 1, according to a survey in April by the Bank of Japan. The investments include launching digital banking units or developing digital platforms to prevent customers from shifting to other emerging digital banks.

The traditional banks "are hitting the gas pedal [on digitization] as digital banks and brokerages are making a strong push into the market," said Hideo Oshima, a senior economist at Japan Research Institute. "Digitization will be an irreversible trend as they shore up their retail businesses."

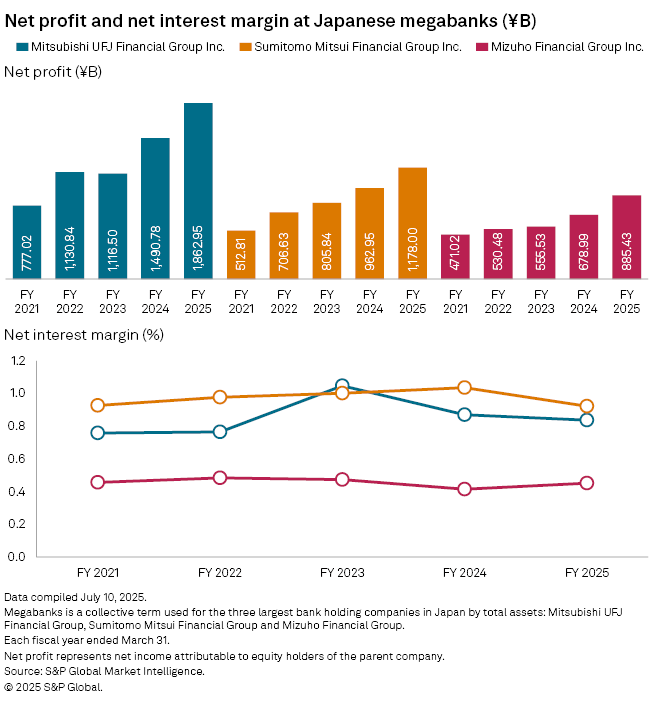

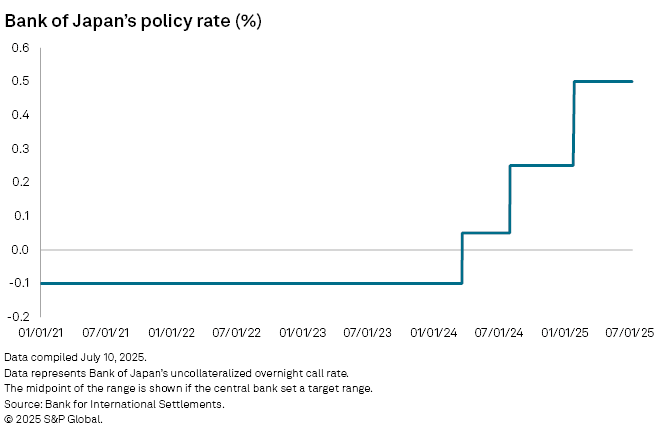

Japan's banks face an unfamiliar environment after the central bank reversed its longtime policy of negative interest rates in 2024. With the Bank of Japan looking to hike rates further while other major global central banks slash rates, Japanese banks are keen to ride the digital wave to secure deposits, often a source of cheaper funds, to protect their net interest margins.

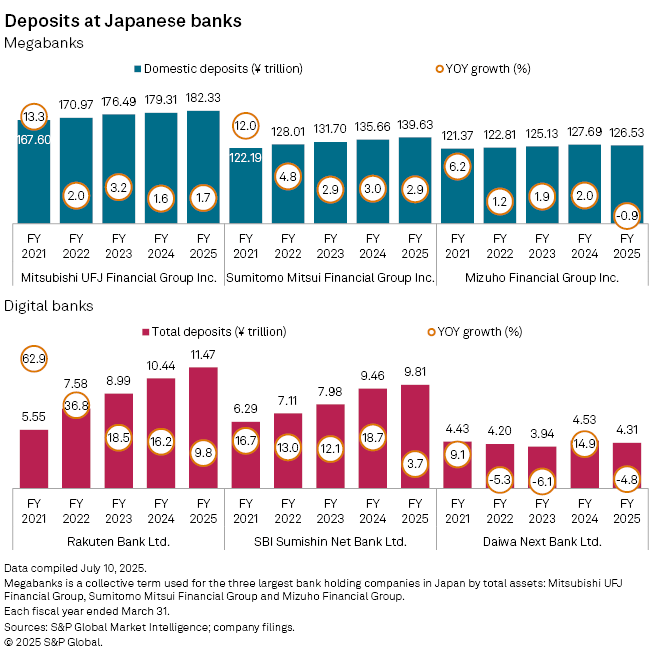

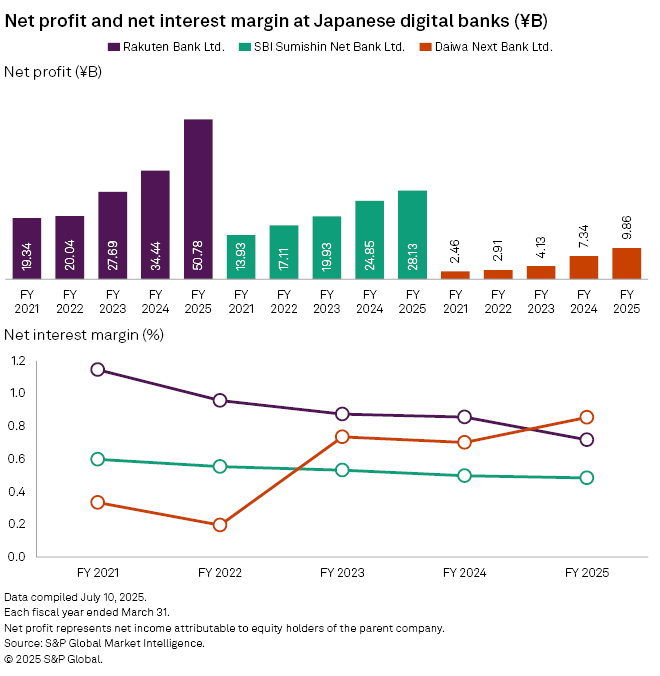

Digital banks have so far outpaced the megabanks in deposit growth. The three major digital banks — Rakuten Bank Ltd., SBI Sumishin Net Bank Ltd. and Daiwa Next Bank Ltd. — boosted their combined deposits by 16.5% on average over the past five years, data from S&P Global Market Intelligence show. Aggregate deposits at Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. increased at a slower rate of 3.8% over the same period, although the megabanks have a much bigger base.

"For now, the megabanks have more overall deposits than digital banks, but they may lose clout in the coming decades as the generation shifts to younger customers," Oshima said.

Traditional Japanese banks' digitization investments would exceed ¥1 trillion for the first time this fiscal year, according to the Bank of Japan survey. This amount is nearly double the ¥549.1 billion recorded five years ago, and would reverse a five-year decline of 12%, Bank of Japan said.

Mitsubishi UFJ Financial Group plans to launch a digital banking unit in the second half of the fiscal year starting April 2026. The lender, Japan's biggest by assets, has not elaborated on the plan. However, it plans to invest ¥900 billion in a digital system over three years, ending March 2027, including ¥280 billion spent in the fiscal year ended March 31, according to a May 19 earnings statement for the year ended March 31, 2025.

"Our main concern is whether we can maintain our position as the leader in accounts and deposits as various services such as digital banking are rapidly expanding," Mitsubishi UFJ CEO Hironori Kamezawa said at a press conference after the results. "We have to push into this [digital] field."

Some analysts are skeptical about Mitsubishi UFJ's digital initiatives. "They [Mitsubishi UFJ] must proceed, but they are behind," said Toyoki Sameshima, a senior analyst at SBI Securities Co.

Sumitomo Mitsui Financial Group, the second-biggest Japanese bank by assets, announced a partnership with Japanese mobile services provider SoftBank Corp. in May to enhance digital banking. Through this partnership, the bank's digital banking platform, Olive, was integrated with SoftBank's PayPay cashless payment platform, a leading digital payment service in Japan with 69 million users.

Olive caters to 5.7 million Sumitomo Mitsui account holders now. The partnership aims to enable Olive and PayPay to attract each other's users, while leveraging mutual capabilities to expand user bases.

"Sumitomo Mitsui Financial Group appears to be leading other megabanks in the digital competition," Japan Research Institute's Oshima said. "Convenience is crucial for attracting customers."

Mizuho, which raised its stake in Rakuten Securities Co., a web-based brokerage arm of the Rakuten Group, to 49% in 2023, acquired a stake of nearly 15% in 2024 in Rakuten Card, one of the most popular credit cards in Japan. The megabank expects the alliance to enable Mizuho to provide wealth management services to Rakuten customers and draw them to open Mizuho accounts.

The megabanks' digital investment "could allow them to enhance their relations with fintech partners for retail banking and help differentiate themselves [from the new-era digital lenders]," said Eiji Taniguchi, a senior economist at Japan Research Institute.

Japanese regional banks too are seeking to improve operational efficiency through digital transformation. However, their scale is limited by declining local populations and fewer opportunities to partner with fintech companies to offer digitized services to customers. As an example, Shizuoka Financial Group Inc. plans to invest over ¥40 billion in digitization over the next three years, according to a bank statement.

As of July 16, US$1 was equivalent to ¥147.39.