Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2025

By Harry Terris and Hussain Shah

Investors are looking for banks to fill in capital outlooks in upcoming earnings reports after stress test results surpassed high expectations and as regulators move to ease requirements.

US-headquartered banks in this year's test announced anticipated stress capital buffers (SCBs) that would lower their common equity Tier 1 (CET1) requirements by a median 50 basis points, and none of them expect increases, according to data compiled by S&P Global Market Intelligence. SCBs mostly reflect Federal Reserve estimates of potential losses under a severe economic shock.

For the global systemically important banks in particular, "investors are hyper-focused on unpacking the latest regulatory/capital developments, specifically 'what's next' in the deregulation narrative following better-than-anticipated [stress test] results," Wolfe Research analyst Steven Chubak said in a July 6 note. Combined with proposed changes to the supplementary leverage ratio, the test results "should meaningfully reduce capital requirements for the largest US banks."

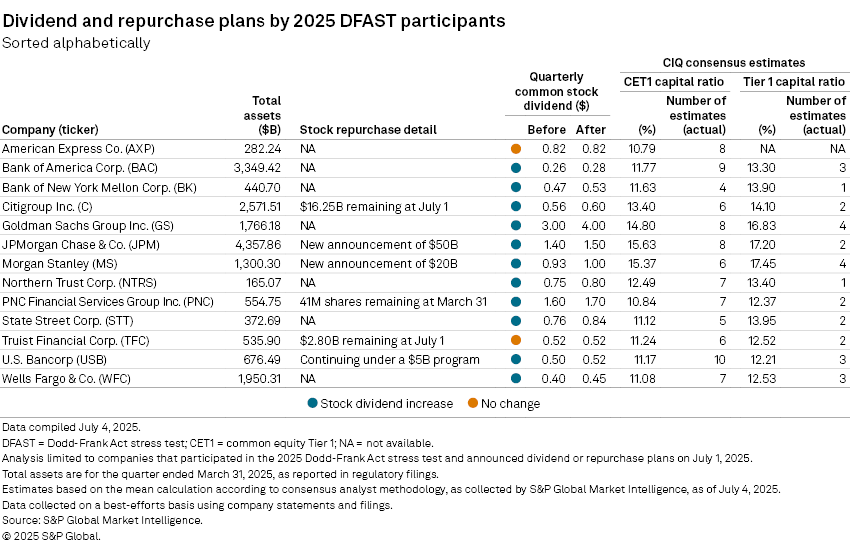

Along with anticipated SCBs, the banks announced a slew of dividend increases that analysts said also exceeded forecasts and support projections for increased payouts to shareholders. Almost all the US-headquartered banks announced dividend increases, led by a one-third increase at Goldman Sachs Group Inc., according to data compiled by Market Intelligence.

|

– For a spreadsheet with data in this article, click here.

– Set email alerts for future Data Dispatch articles.

– Download a template to generate a bank's regulatory profile.

Bigger excess

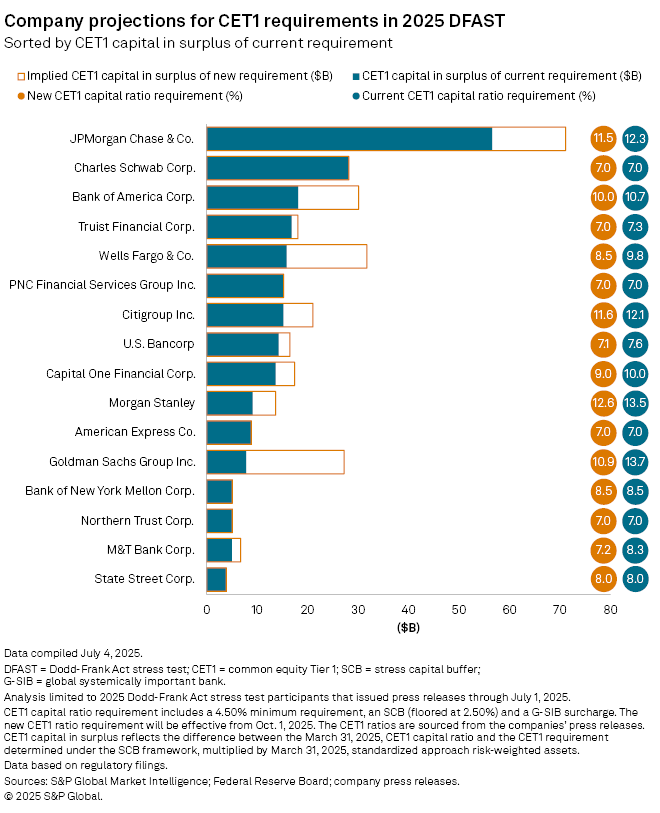

Each of the big US-headquartered banks entered the stress test with CET1 in excess of existing requirements, and declines in SCBs would increase the aggregate excess by about one-third to $319.83 billion, according to Market Intelligence data.

Aggregate CET1 deterioration across the banks in the test — including subsidiaries of foreign companies — fell to the lowest level in more than six years, at 1.8% in 2025, from 2.8% in 2024. Better revenue before credit provisions, reflecting strong recent performance at the banks, was the biggest factor behind the year-over-year improvement, according to the Fed. An easier macroeconomic scenario and more favorable treatment of private equity losses also had large impacts.

The new SCBs go into effect in the fourth quarter, and the Fed has proposed averaging estimated losses over two years, a change that would go into effect next year. Averaging results would generally lead to higher SCBs, though estimated losses at many of the banks are substantially below a 2.5% floor for the SCB, muting the impact.

Wells Fargo & Co.'s hypothetical capital deterioration narrowed to 1.0% from 3.3% in the results published in June 2024, for an average of 2.2%. The bank said it expects its SCB to decrease to the 2.5% floor and that its SCB would be 2.6% under the proposed changes.

Bank of America Corp., Goldman Sachs and Morgan Stanley "may revise their CET1 targets 'at least' 50 basis points lower given the favorable outcome, though SCB averaging could impact timing for some," Chubak said in a note June 29. "Most importantly, the meaningful SCB gains recorded this year suggest that the regulatory pendulum is swinging in favor the large-cap banks."

"Given lower capital requirements, investor attention is focused on how quickly banks can optimize their balance sheets and identify opportunities for capital deployment," Morgan Stanley analysts said in a July 3 note. "Expect earnings calls this quarter to include discussions on capital priorities, pace of capital return and any updates on management buffer levels above regulatory minimums."

|

Movers

Goldman Sachs' dividend hike was supported by the largest decrease in estimated capital deterioration compared with the stress test among the US-headquartered banks in 2024. The company said it expects its SCB to decline to 3.4% from 6.1%.

Its estimated pre-provision net revenue in the test jumped to $39.7 billion from $16.6 billion, while trading and counterparty losses combined with other losses and gains fell to $7.8 billion from $20.6 billion. The latter components reflect the change in methodology on private equity holdings.

JPMorgan Chase & Co. leads the group in terms of the dollar amount of its actual CET1 above its prospective requirement, at $71.06 billion, Market Intelligence data shows. The bank announced a new $50 billion share repurchase program.

The bank "had announced a sizable plan last year at this time, as well, though we are not altering any of our repurchase assumptions until we hear more in a couple weeks with earnings about any changes to the company's buyback appetite," Piper Sandler analysts said in a July 1 note.

JPMorgan Chase has been increasing repurchases to keep its surplus from growing larger, including a net $7.1 billion of stock in the first quarter. However, the bank has expressed qualms about buybacks at what it views as elevated valuations.