Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jul, 2025

By Nick Lazzaro and Umer Khan

Non-US revenue for a group of S&P 500 companies climbed in the first quarter after dipping in the previous quarter, according to S&P Global Market Intelligence data.

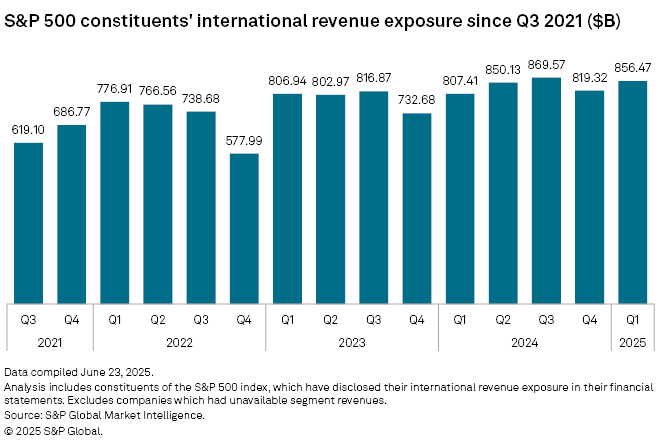

Cumulative international revenue totaled $856.47 billion in the first quarter among 268 S&P 500 companies that disclosed international sales in earnings reports for the period. The quarter's revenue rose from $819.32 billion in the fourth quarter of 2024, as adjusted.

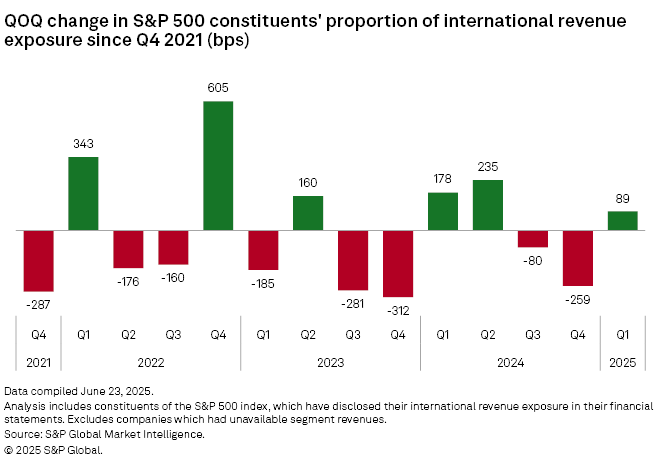

The decrease in international revenue during the fourth quarter followed three consecutive quarters of increases. The increases during 2024 sent international revenue up to $869.57 billion in the third quarter of 2024, the highest total since at least the third quarter of 2021.

The international revenue increase in the first quarter coincided with strong S&P 500 company earnings. Shortly after the end of the first quarter, the US on April 2 proposed a new slate of tariffs on most of its global trading partners. The tariffs have since been delayed, but uncertainty over the future direction of trade policy continues to cloud international trade and business conditions.

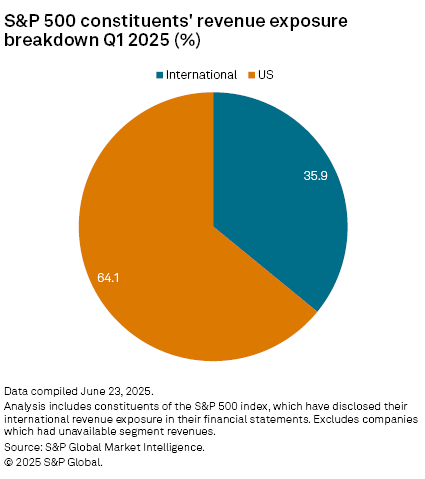

Overall, 35.9% of the revenue reported by the group of S&P 500 companies with reported international exposure was associated with sales outside of the US during the first quarter. This share of international revenue was 89 basis points higher than in the fourth quarter of 2024.

While trade policy could pressure international revenue in the coming quarters, a weaker US dollar may provide a tailwind, allowing US companies with sales overseas to benefit from competitive pricing. Sales in foreign markets with stronger currencies would also generate more dollars after currency conversion.

The dollar began the year on solid footing as the US dollar index, a measure of the dollar against a basket of other widely traded international currencies, surged over the last three months of 2024. The index has since dropped to 97.25 as of June 27, a three-year low from 109.25 at the start of the year.