Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jul, 2025

By John Wu and Marissa Ramos

IPOs in India will likely regain momentum after a steady first half, thanks to favorable equity market conditions and a healthy pipeline of planned share sale deals.

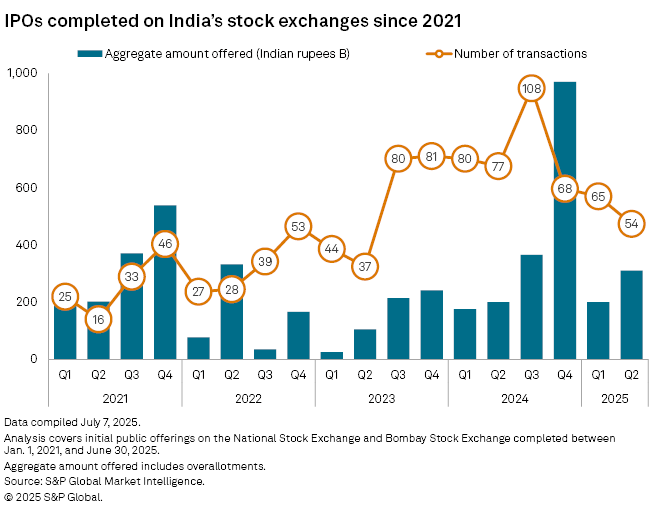

During the first six months of 2025, India welcomed 119 IPOs, raising an aggregate of 511.50 billion Indian rupees, according to data compiled by S&P Global Market Intelligence. Funds raised in IPOs in the same period in 2024 amounted to 376.82 billion rupees via 157 new listings, the data shows. Indian exchanges closed 2024 with a total of 1.713 trillion rupees raised via 333 new listings.

The overall amount raised in 2024 was boosted by the listing of the local unit of Hyundai Motor Co., the biggest IPO on record in India. The Korean auto giant sold $3.3 billion of Hyundai Motor India Ltd. shares in October 2024, The Wall Street Journal reported.

"After a slower start to 2025 compared to 2024 — due to ongoing equity market volatility driven by global and domestic factors — the primary market is showing signs of recovery, with a healthy pipeline of IPOs lined up over the next three to six months," EY analysts commented in an email to Market Intelligence on June 27.

India remains the fastest-growing economy in the world. The Reserve Bank of India expects the nearly $4 trillion economy to grow 6.5% in the fiscal year ending March 31, 2026, matching the pace recorded in the previous fiscal year. The central bank cut its benchmark interest rates by an unexpected 50 basis points in June after it assessed the inflation outlook to be benign. The steep cuts — the Reserve Bank of India has reduced rates by 100 bps since February — are expected to support economic activity and encourage companies to raise funds.

After a dip, India's benchmark equity index was back near an all-time high in September 2024. After the latest rate cut, the Nifty 50 Index closed at 25,476 on July 9, a year-to-date gain of 7.7%.

India's dynamic stock market, coupled with favorable economic indicators, continues to bolster investor confidence. Retail investors are participating more actively, and there is a healthy pipeline of companies from the supply side, according to EY.

Megadeals

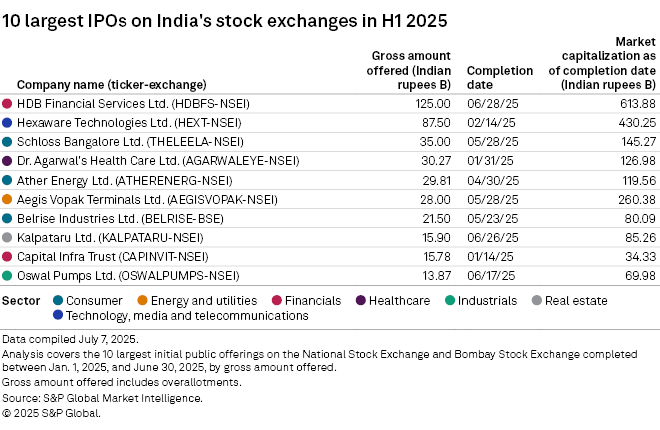

HDB Financial Services Ltd., a nonbank subsidiary of HDFC Bank Ltd., debuted on the National Stock Exchange of India Ltd. with a 125 billion rupee IPO in June, the biggest so far in 2025. Data shows that among the top 10 deals, three involved consumer discretionary companies, while two were financial firms.

Meanwhile, Credila Financial Services Ltd., an education loan provider and a former unit of HDFC Bank, filed draft papers for a 50 billion rupee IPO with the Securities and Exchange Board of India (SEBI) on June 27, while Anthem Biosciences Ltd. submitted its red herring prospectus on July 9.

Several companies in quick commerce, consumer finance and hotels that filed their draft prospectuses with the SEBI in prior years, including Oravel Stays Ltd., Fabindia Ltd. and Hero FinCorp Ltd., may also revive their listing plans.

"Should macro conditions stabilize, the second half of the year is expected to see a revival in IPO activity," said EY. "Investor appetite remains strong for well-priced, fundamentally sound offerings, positioning the market for a potential pickup in new listings."

Financial technology, AI-driven enterprises and industrial tech firms continue to show strong growth potential in India's IPO market, according to EY.

"The macro backdrop for many of the sectors is likely to improve over the next 12 months, and that is largely coming from a very active RBI," Prashant Periwal, portfolio manager for emerging market equities at BlackRock, told Market Intelligence during a June 24 conference. Lower interest rates and more liquidity in the system will basically spur the growth, Periwal said.

According to Periwal, the broad market downturn in the first quarter was probably not the best time for companies to plan IPOs. "But we see the market kind of revive."

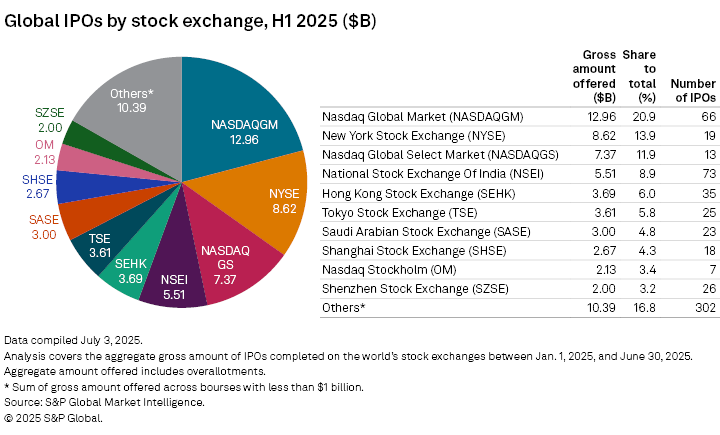

The National Stock Exchange of India ranked fourth on the global IPO league table with fundraising at $5.51 billion, according to Market Intelligence data. It came after the Nasdaq Global Market, NYSE and the Nasdaq Global Select Market, comprising 8.9% of the worldwide aggregate IPO fundraising in the first half of 2025.

As of July 11, US$1 was equivalent to 85.80 Indian rupees.