Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Jul, 2025

By Gaurav Raghuvanshi and Uneeb Asim

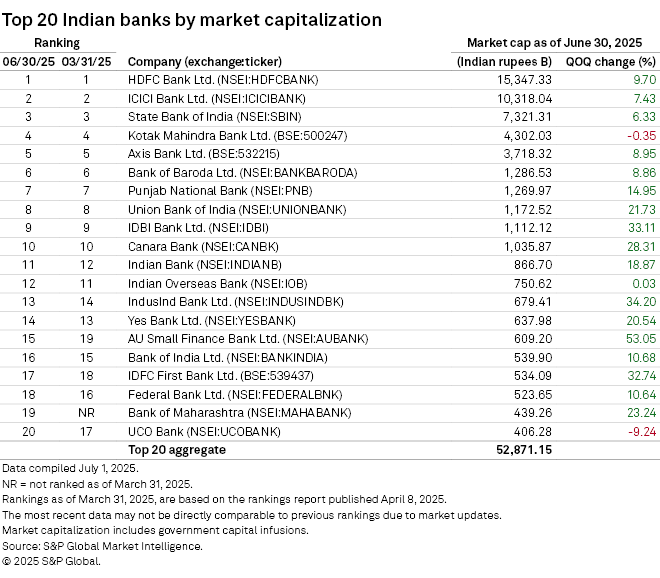

Indian banks gained in market capitalization in the April-June quarter as falling interest rates and liquidity likely attracted investors. However, slowing credit growth and global uncertainties may pose a challenge in the coming months.

According to S&P Global Market Intelligence data, 18 of the top 20 Indian lenders, including India's three biggest lenders, increased their market cap during the second quarter.

HDFC Bank Ltd. added 9.70% in market cap to remain India's biggest bank by the measure. HDFC's private sector peer ICICI Bank Ltd. gained 7.43% in market cap, while State Bank of India, the biggest Indian lender by assets, gained 6.33% in market cap.

Stock gains

India's benchmark Nifty 50 index added 8.5% during the quarter. The Nifty Bank index, which tracks the most liquid and biggest banks in India, rose 11.1% over the same period. Global sentiment for equities improved in recent weeks on hopes that US President Donald Trump's planned tariff measures against key trading partners would be less disruptive to global supply chains than previously thought.

Still, loans and deposit growth in India have slowed, which could pressure bank margins amid falling interest rates. The Reserve Bank of India said on June 25 that credit growth of commercial banks fell to 9.9% year over year in May from 16.2% a year ago. The central bank expects the nation's GDP to grow 6.5% in the fiscal year that started April 1, a pace similar to the previous year. The central bank has cut its benchmark interest rate by 100 basis points since February.

The central bank has also taken a series of measures to boost liquidity in the banking system, including reducing the ratio of deposits that banks must set aside as cash. Banks, too, have cut the interest rates they pay on deposits and have indicated that stress may be peaking in unsecured retail loans, Nomura said in a June 25 note.

"Over the past few months, the RBI has taken significant measures to enhance system liquidity and ease regulations to drive credit growth. We expect system credit growth to improve to 12% by the end of the current fiscal year in March 2026," Nomura said.

Top movers

AU Small Finance Bank Ltd. posted the biggest gain in market cap during the second quarter, up 53.05%. IndusInd Bank Ltd. added 34.20% to its market cap during the quarter, recovering from a sharp fall after the lender admitted to accounting lapses earlier this year.

Kotak Mahindra Bank Ltd., ranked fourth in India by market cap, posted a 0.35% decline. State-owned UCO Bank booked the biggest loss during the quarter with a market cap decline of 9.24%, according to Market Intelligence data.