Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jul, 2025

By Samantha Lipana and Beenish Bashir

IPO activity in the Gulf region rose year over year in the first six months of 2025 despite volatile market conditions driven by shifts in US trade policies.

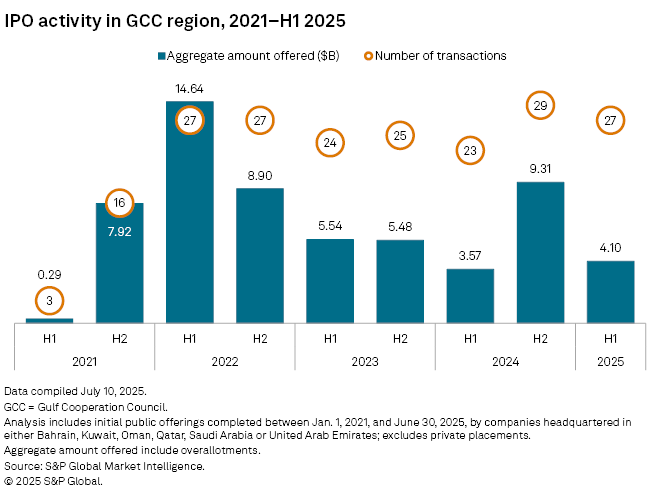

The number of IPO transactions in the Gulf Cooperation Council (GCC) increased to 27 in the first half of the year, raising $4.10 billion in capital, up from 23 transactions and $3.57 billion in funds raised during the same period a year ago, according to S&P Global Market Intelligence data.

The resilience of first-time share sales in the region was supported in part by GCC governments' continued privatization efforts.

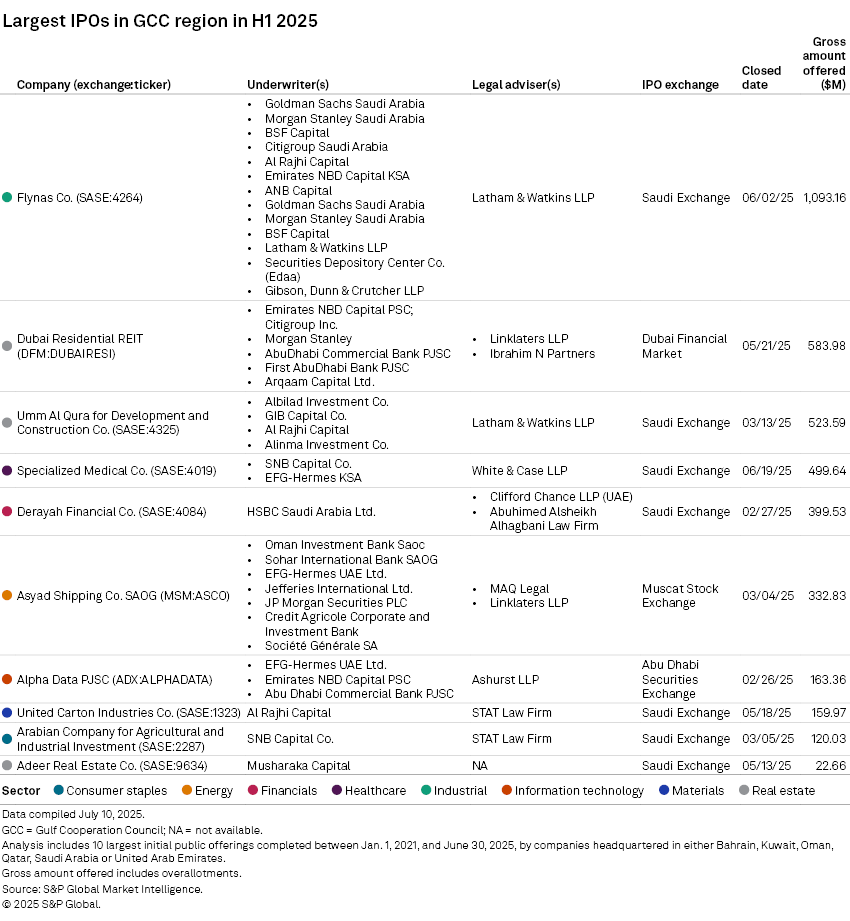

Saudi Arabia led the GCC region's IPO activity, hosting seven of the 10 largest IPO transactions in the first half. Airline operator Flynas Co. had the highest gross amount offered, raising $1.09 billion from the free float of 30% of its share capital on the Saudi Exchange.

Three listings from the real estate sector were among the 10 largest IPOs in the region, led by Dubai Residential REIT, which secured roughly $584.0 million for the sale of 1,625,000,000 units in May.

Demand and growth prospects for commercial real estate in the GCC, particularly in the United Arab Emirates and Saudi Arabia, remain resilient despite global headwinds as the region continues to be attractive for the ultrarich, S&P Global Ratings said in a July 16 industry credit outlook update.

Unfavorable tariffs, however, could pose a threat to the sector as they weaken market sentiment and economic growth, potentially affecting investment, spending and consumption in the region, Ratings said.

The GCC region's IPO pipeline is expected to remain strong, according to the EY Global IPO Pulse Survey conducted with institutional investors in June. However, for the broader global IPO market, the outlook for the rest of the year remains cautiously optimistic. A potential rebound "hinges on more cooperative trade frameworks, accommodative monetary policy, controlled inflation and geopolitical de-escalation," EY said.

While geopolitical turbulence tempered early optimism for the global IPO market for 2025, the long-term outlook is "promising," Stuart Newman, Global IPO Centre Leader at PwC UK, wrote in a July report.

"We have seen signs of a selective reopening of IPO markets in the US and China/Hong Kong and a continued supply of IPOs in India and the Middle East," Newman noted, cautioning that a market recovery will highly depend on global macroeconomic and geopolitical stability.

Lukewarm equity, debt issuances

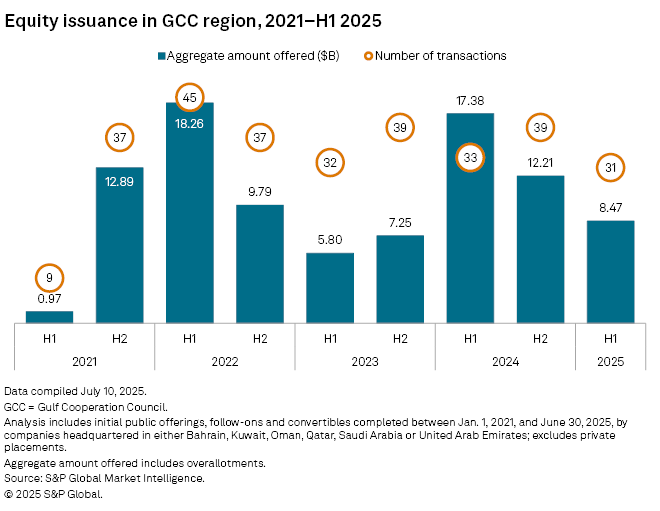

Equity issuance volumes fell to 31 transactions in the first six months of 2025 from 33 deals in the same period of 2024, Market Intelligence data shows. Proceeds raised from equity issuances for the period plunged 51% year over year to $8.47 billion.

GCC equity markets took a hit in early April with the announcement of US tariffs but have since recovered. The Israel-Iran conflict also briefly impacted GCC markets in June, though not by much, as most of the region's equity markets are dominated by companies in the banking and industrial sectors, which are usually less exposed to the direct effects of geopolitical turmoil, Marmore MENA Intelligence wrote in a July market report.

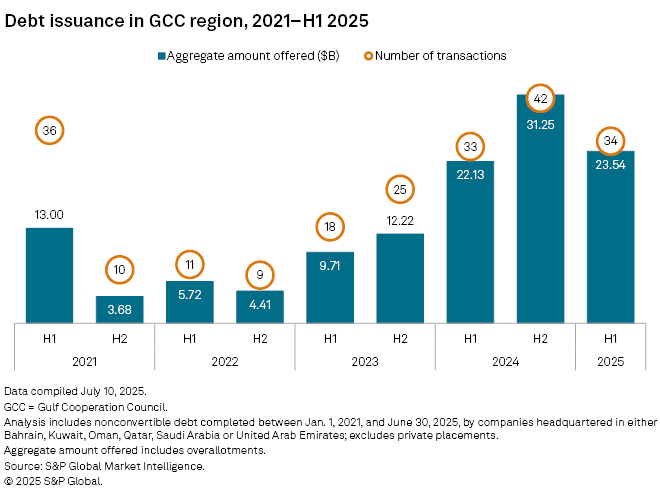

Debt issuances in the region were also muted in the first half, with 34 transactions versus 33 a year ago. The aggregate amount offered reached $23.54 billion, compared to $22.13 billion in the year-ago period.

Saudi Arabia emerged as the most active bond issuer nation in the Middle East and North Africa region, followed by the UAE and Qatar, Zawya reported July 7, citing data from the London Stock Exchange. Corporate issuers raised 55% of the total proceeds from bond offerings during the period, while government and agency issuers accounted for 26%, according to the report.

"There is great diversification in the breadth of issuers, whether sovereigns, corporates, or banks, when it comes to debt issuances, and that's one of the standout stories of H1," Khaled Darwish, HSBC's head of debt capital markets for the central and Eastern Europe, the Middle East and Africa, told Zawya.

Issuers have also tapped into a wide range of markets, including sukuk and Formosa, active Tier 1 markets, local currency markets in Saudi Arabia, and digital bonds, Darwish added.