Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2025

By Bea Laforga and Beenish Bashir

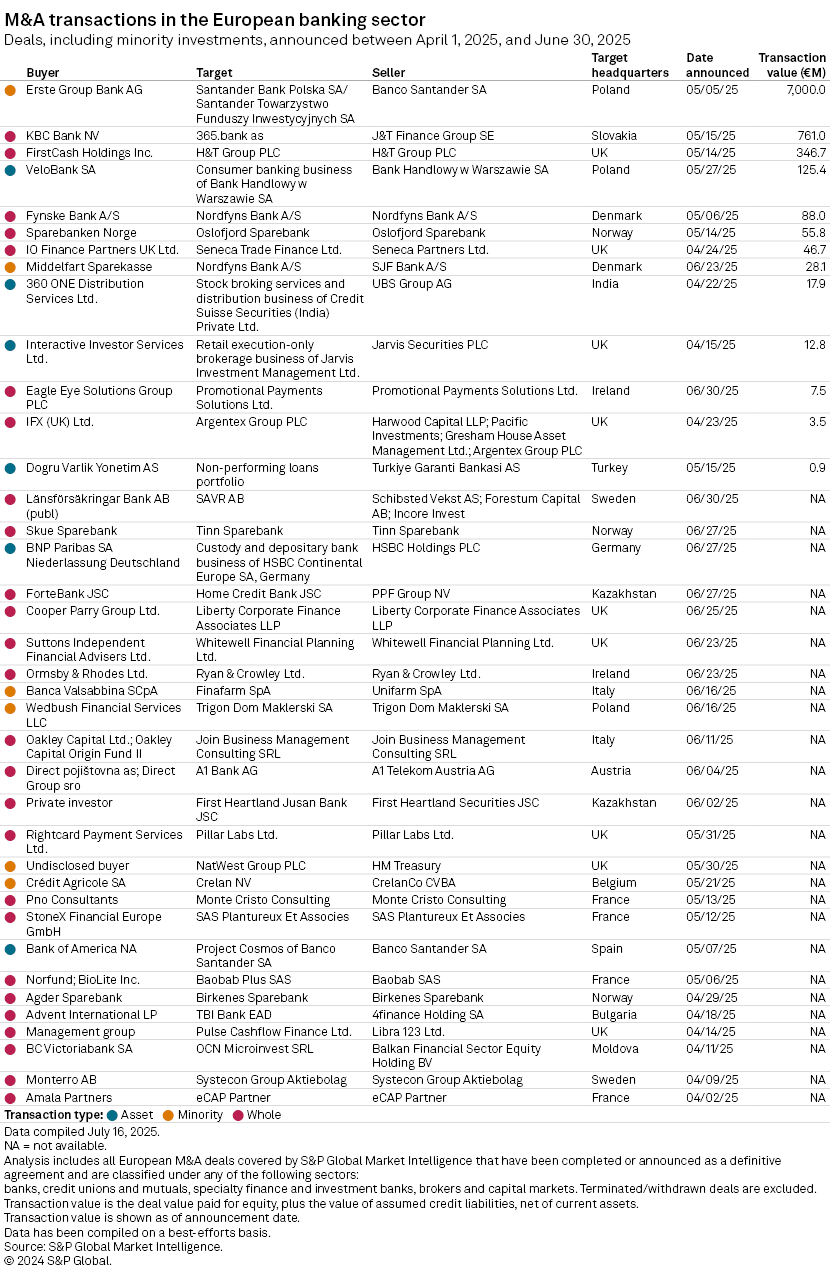

Erste Group Bank AG's €7 billion acquisition of a controlling stake in Banco Santander SA's Polish business was the sole big-ticket European bank deal in the second quarter as M&A activity among lenders nearly halved year over year.

The Austrian bank made its first foray into Poland with its purchase of a 49% stake in Santander Bank Polska SA, the country's third-largest bank by assets. The all-cash deal, set to close by the end of 2025, also involves Erste acquiring a 50% interest in asset manager Santander Towarzystwo Funduszy Inwestycyjnych SA.

The deal is expected to boost Erste's total loan book to €131 billion and expand its customer base in central and Eastern Europe outside Austria by 50% to about 18 million.

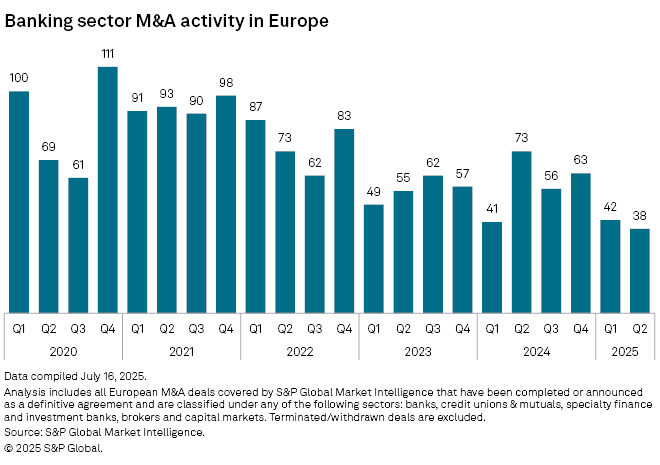

This was the only billion-euro bank deal among the 38 announced in the second quarter, which was down from 73 deals a year earlier and the lowest quarterly tally in the past five years, according to S&P Global Market Intelligence data.

Belgium-based KBC Group NV recorded the second-biggest deal with its acquisition of a 98.45% stake in Slovak lender 365.bank a. s. from J&T Finance Group SE. The €761 million deal will strengthen KBC's position in Slovakia, where it already operates in through its Ceskoslovenská obchodná banka a.s.

Some notable deals during the quarter involved large banks divesting assets and businesses overseas, such as UBS Group AG offloading certain businesses in India to 360 One Wam Ltd.

HSBC Holdings PLC agreed to sell its custody business in Germany to BNP Paribas. The UK-headquartered group has been divesting noncore assets in Europe and the US as it increases focus on Asia.

Domestic consolidation continued in the Nordic region. Deals announced during the second quarter included Denmark-based Fynske Bank A/S' proposed combination with Nordfyns Bank A/S and a potential merger between Norway-based lenders

– Access the deal profile page for the Erste Group-Santander Bank Polska transaction.

– See KBC Bank NV's detailed M&A history.

On cross-border deals, US buyers were particularly active with Texas-based FirstCash Holdings Inc. purchasing UK-based pawn store operator H&T Group PLC and Los Angeles-based investment bank Wedbush Financial Services LLC

Another notable transaction during the quarter was the UK government's exit of NatWest Group PLC nearly 17 years after bailing out the lender in the wake of the Global Financial Crisis. Through share sales, dividends and fees, the HM Treasury had recouped about £35 billion from its holding, about £10.5 billion less than what was spent to rescue the bank.