Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2025

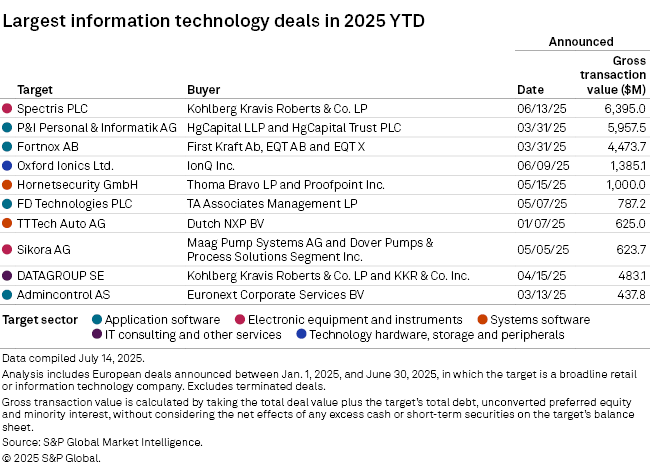

Kohlberg Kravis Roberts & Co. LP's planned $6.4 billion acquisition of London-based precision measurement solutions provider Spectris PLC propelled the European IT sector's deal value to the second-highest year-to-date in June.

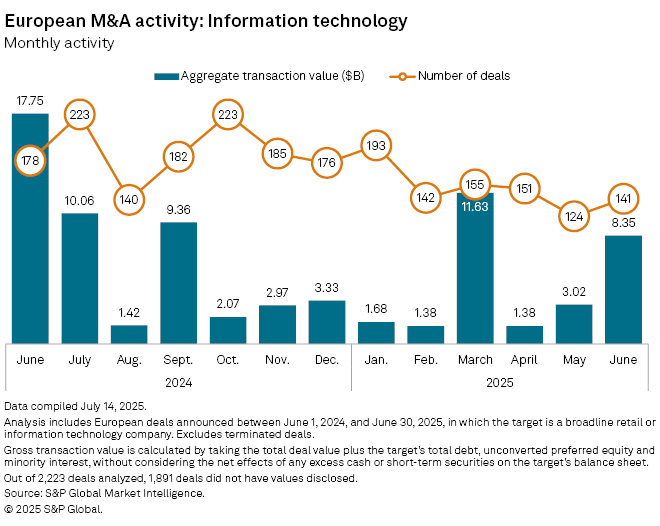

The sector tallied 141 deals with an aggregate transaction value of $8.35 billion in June, according to data from S&P Global Market Intelligence. However, the M&A activity was down year over year as the sector recorded 178 deals worth $17.75 billion in June 2024.

The Spectris deal, which is expected to close in the first quarter of 2026, also emerged as the biggest transaction of the year so far, surpassing the acquisition of German cloud-based HR solutions company, P&I Personal & Informatik AG, by private equity firms HgCapital LLP and HgCapital Trust PLC.

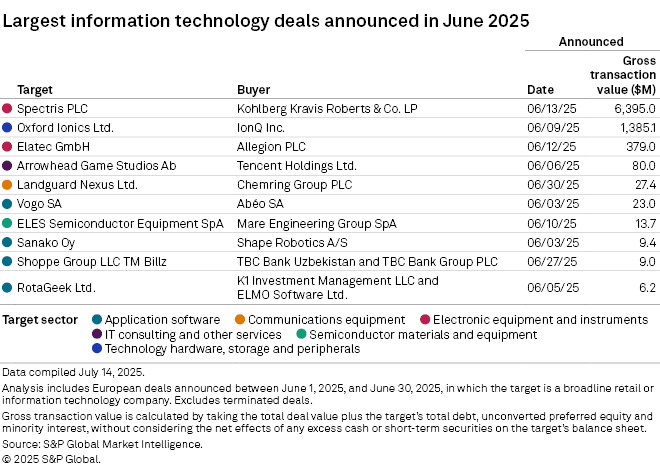

IonQ Inc.'s agreement to acquire UK-based quantum computing systems developer Oxford Ionics Ltd. for $1.39 billion was the second-largest deal for the month under review and the fourth-largest M&A in the European IT sector this year so far.

The merged entity plans to expand its workforce in Oxford to boost the UK's position in quantum computing. The transaction is subject to customary closing conditions, including receipt of required regulatory approvals.

|

– Read about the the M&A value of Europe's IT industry in May. – Use our Transactions Statistics page to run a custom screen of M&A by industry or geography. |

Security products and solutions company Allegion PLC's definitive agreement on June 12 to acquire Elatec GmbH, a radio-frequency identification manufacturer, for $379.0 million was the third-largest deal in June.

The Spectris and Oxford Ionics deals were among the top 10 transactions that constituted a significant portion of the aggregate deal value in June. The other seven transactions ranged between $6.2 million and $80 million.