Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jul, 2025

By Tyler Hammel and Jason Woleben

Centene Corp. has had a challenging month on Wall Street after the company joined a growing trend of health insurers pulling earnings guidance amid climbing costs, lowering membership and political uncertainty surrounding Medicaid.

The health insurance giant became the second managed care insurer to pull its 2025 guidance, announcing via a July 1 news release that data suggested growth in 22 of the 29 states it operates in is lower than expected and that Affordable Care Act plan morbidity could be "significantly higher."

Plans under the ACA, also known as Obamacare, are offered through a government and private insurer partnership that expands coverage through Medicaid, creating marketplaces for individuals and small businesses to purchase insurance, with the government providing subsidies.

Facing lower marketplace growth and a misreading of the health status of its ACA population, Centene is refiling its 2026 rates to reflect a far less healthy ACA risk pool, according to Blake Madden, a managed care business analyst and publisher of the Hospitalogy newsletter.

"Managed care's decadelong victory lap is officially over," Madden wrote in a July 8 post. "2025 is shaping up as the year the sector relearns that underwriting discipline — and maybe a touch of humility — still matters."

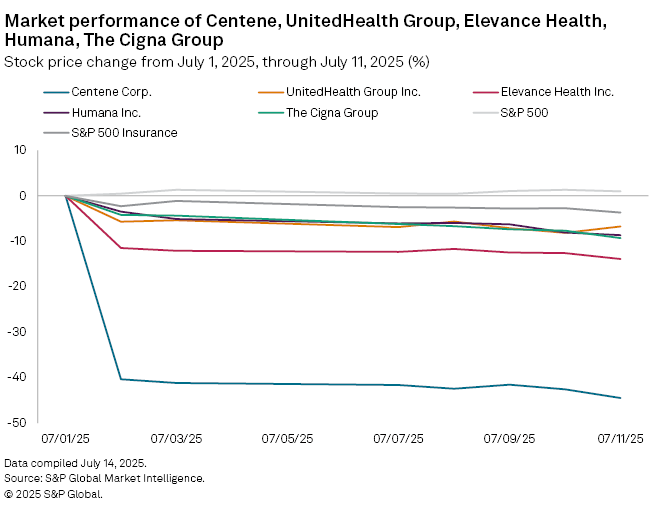

Since the announcement, Centene's stock has tumbled more than 40%. By market close on July 11, the stock traded at $31.44 per share, the sharpest decline of any managed care insurer during the same period.

Among the largest publicly traded US managed care insurers, Centene has the largest Medicaid membership, totaling about 13 million by the end of the first quarter.

UnitedHealth Group Inc., which pulled its earnings-per-share guidance in May and remains the largest US insurer by market capitalization, had about 7.6 million members during the same period.

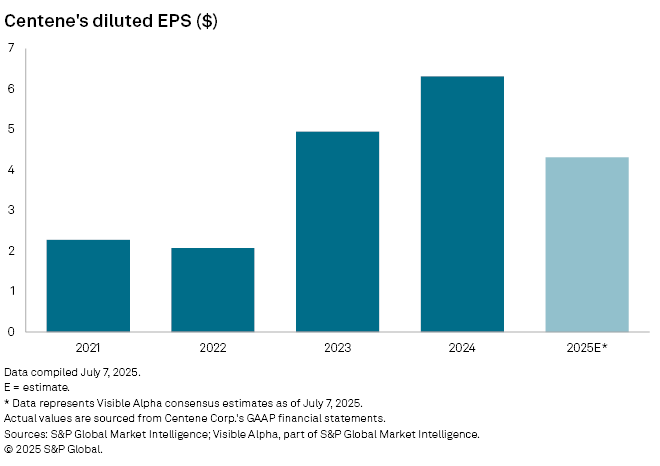

Centene posted first-quarter adjusted diluted EPS of $2.90, up from $2.26 in the first quarter of 2024, and reiterated its 2025 generally accepted accounting principles diluted EPS guidance floor of greater than $6.19 and its 2025 adjusted diluted EPS guidance floor of greater than $7.25. According to a July 7 Visible Alpha estimate, Centene's revised estimate is expected to be about $4.31 per share.

Centene is working to reprice its 2026 rates to reflect a higher morbidity, though challenges remain, according to a research note from J.P. Morgan analysts.

"We believe Centene will have a meaningful path to reprice its book; however, it will be repricing at a time when the ACA Exchange risk pools are potentially worsening, which could make the process more challenging," the analysts wrote. "All of this adds to the degree of difficulty around 2026's outlook as Centene navigates the shifting risk pools in the ACA exchanges."

Given the regulatory uncertainty around the ACA heading into 2026, the J.P. Morgan analysts lowered Centene's rating to "neutral."

Centene did not respond to a request for comment.

Ratings drop

S&P Global Ratings put Centene on CreditWatch Negative on July 7, pointing to how the company's decision to pull its guidance diminished immediate clarity and confidence regarding the health insurer's capital adequacy trajectory and the overall strength of its business operations and execution capabilities.

The rating agency noted that Centene's ACA marketplace, Medicaid and Medicare businesses are falling short of their long-term margin objectives, adding that the insurer is facing elevated legislative and regulatory risks. Additionally, the rating agency sees Centene as one of the most vulnerable insurers to the potential expiration of enhanced ACA subsidies at the end of 2025, as well as the Medicaid budget cuts and regulatory changes outlined in the budget bill recently passed by the Trump administration.

UnitedHealth a bellwether

Perhaps no managed care insurer has struggled more of late than UnitedHealth, which saw its stock take a historic plunge in April following an "unusual and unacceptable" first quarter, according to former CEO Andrew Witty.

Turmoil in UnitedHealth's C-suite began with the assassination of UnitedHealthcare CEO Brian Thompson in early December 2024 and continued with Witty abruptly stepping down in May. Former CEO Stephen Hemsley returned to his old role in May, and the company announced it was pulling its 2025 guidance.

The slide deepened May 15 after The Wall Street Journal reported that UnitedHealth was facing a Justice Department probe into possible Medicare fraud. The company has been beset by similar issues facing other players in the industry in the wake of the COVID-19 pandemic, including rising costs associated with the senior-aimed Medicare Advantage plans and shifts in Medicaid membership.

As of July 9, UnitedHealth's stock had fallen 49.64% since Dec. 4, 2024, more than any other major US managed care insurer.

Medicaid faces cuts

Medicaid plans, which are aimed at low-income families and those with certain disabilities, will face cuts to a still unknown degree after Congress passed President Donald Trump's budget bill, also referred to as the One Big Beautiful Bill Act.

About 10.9 million people will lose health insurance coverage nationwide by 2034 under the tax bill, according to estimates by the nonpartisan Congressional Budget Office, Barron's reported. The law will result in 7.8 million people losing Medicaid coverage when it goes into effect, while another 3.1 million people are expected to lose health coverage due to changes in the ACA marketplaces.

Additionally, about 400,000 individuals will lose insurance coverage due to the termination of a medical provider tax, a move opposed by some Republican leaders in Congress, The Associated Press reported.

The law includes about $3.75 trillion of tax cuts, partially offset by almost $1.3 trillion in reduced federal spending for Medicaid and food assistance.

The cuts come amid a difficult time for the managed care sector, as the lingering impacts of the COVID-19 pandemic continue to cause difficulties on some of the largest healthcare players.

Visible Alpha is a part of S&P Global Market Intelligence.