Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jul, 2025

By Beata Fojcik and Beenish Bashir

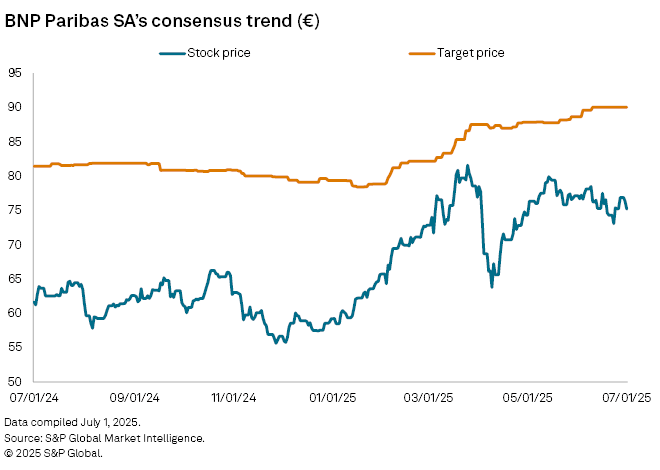

BNP Paribas SA presents the greatest potential for share price growth among major European banks, according to an analysis by S&P Global Market Intelligence.

The French bank's July 1 closing price was 19.7% below the analyst consensus price target, compared with a group median of 6.4%.

Trading at 7.3x its projected 12-month earnings, BNP Paribas is also one of the most affordably valued banks in the sample, alongside fellow French lender Crédit Agricole SA and UK-based Barclays PLC, which have price-to-next 12-month earnings per share ratios of 7.4x and 7.6x, respectively.

Crédit Agricole also had the third-largest implied share price upside in the sample, which included the 20 largest European banks by market capitalization for which three or more analyst recommendations were available.

BNP Paribas, Barclays and Italian lender Intesa Sanpaolo SpA had the highest buy strength in the sample as of July 1, significantly above the group median of 55%. Buy strength is the ratio of "buy" and "overweight" analyst recommendations to total recommendations.

BNP Paribas is looking to achieve a return on notional equity (RONE) of more than 17% by 2028 in its commercial and personal banking business in France. The lender is also forming a new sub-unit encompassing commercial and personal banking businesses in the eurozone, which it said will accelerate cross-selling with other parts of its business.

The French bank also recently finalized the purchase of Axa Investment Managers SA and plans to buy HSBC Holdings PLC's custody and depositary business in Germany as part of a push to enhance its securities services.

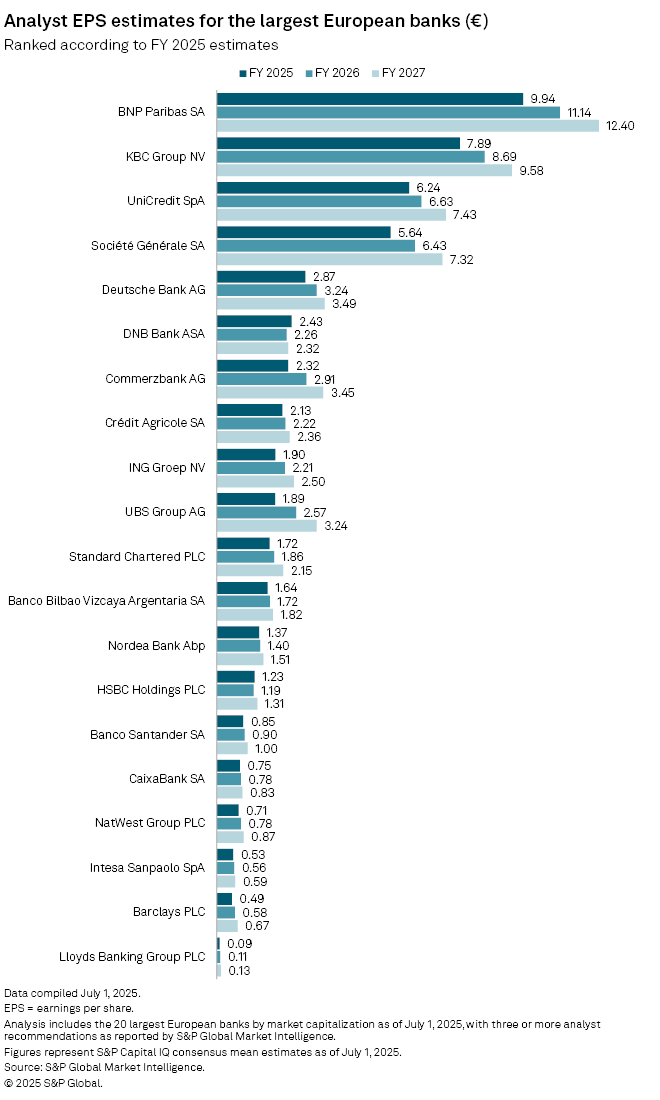

These factors should contribute to a gradual improvement in group profits, Oddo BHF analysts said in June, noting that current valuation multiples do not adequately represent the bank's potential for enhanced profitability and EPS growth. The lender's EPS could reach €9.94 in 2025 and increase further to €12.4 in 2027, according to analyst estimates compiled by Market Intelligence.

BNP Paribas' share price closed at €75.94 on July 7. Similar to other European banks, BNP Paribas' share price was hit in early April by US President Donald Trump's tariff announcements, and although it later recovered, it remains below its early April price levels.

Finnish lender Nordea Bank Abp had the second-highest upside in the sample, at 13.4%. It also had the second-lowest total return over the last year, after Switzerland's UBS Group AG.

Jefferies analysts anticipate a lackluster performance from Nordic banks in the second quarter, with expectations of recovery by year-end. Nordea stands out with a "buy" recommendation and a revised target price of €15.10, up from €13.10, thanks to its robust market position, operational efficiency and active share buyback program, the analysts said in early July.

Norwegian lender DNB Bank ASA had an implied downside of 1.7% to its price target and also exhibited the weakest buy strength, with only 20% of analysts recommending buy or overweight ratings.

Analysts forecast that DNB's EPS will decline by nearly 7% in 2026 to €2.26, marking the weakest performance in the sample. In 2027, the bank's EPS could increase by 2.4% year over year, but this is still the lowest growth rate among the banks.

German lenders Commerzbank AG and Deutsche Bank AG also registered an implied downside to their share prices as of July 1. Commerzbank had the second-highest total return in the sample over the last 12 months, outpaced only by Société Générale SA.

Commerzbank's share price has increased since UniCredit SpA began building an interest in the lender, now at nearly 30%, amid suggestions of a possible takeover bid. To deter a possible deal, Commerzbank introduced a new strategy aimed at enhancing cost efficiency and revenue growth. Analysts forecast the bank's EPS to rise by 25.6% in 2026 and 18.6% in 2027, the second-highest growth among banks in the sample for both years after UBS, Market Intelligence data showed.

Commerzbank and UBS were also the most richly priced banks in the sample, with their forward price-to-earnings ratios at 10.8x and 13.9x, respectively, against a group median of 8.8x.

UBS was the only lender among the top European banks whose market capitalization dropped in the second quarter, both on an annual and quarterly basis. The bank faces up to $26 billion in fresh capital requirements, a recent analysis by Market Intelligence showed.