Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jul, 2025

By Ranina Sanglap and Beenish Bashir

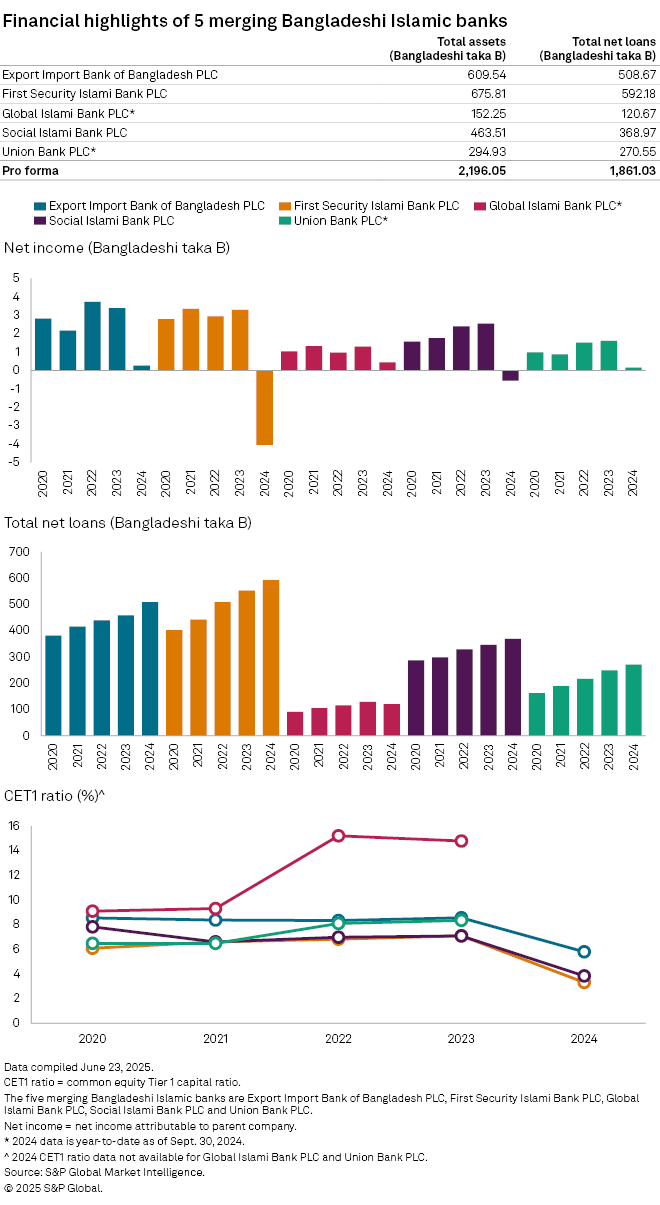

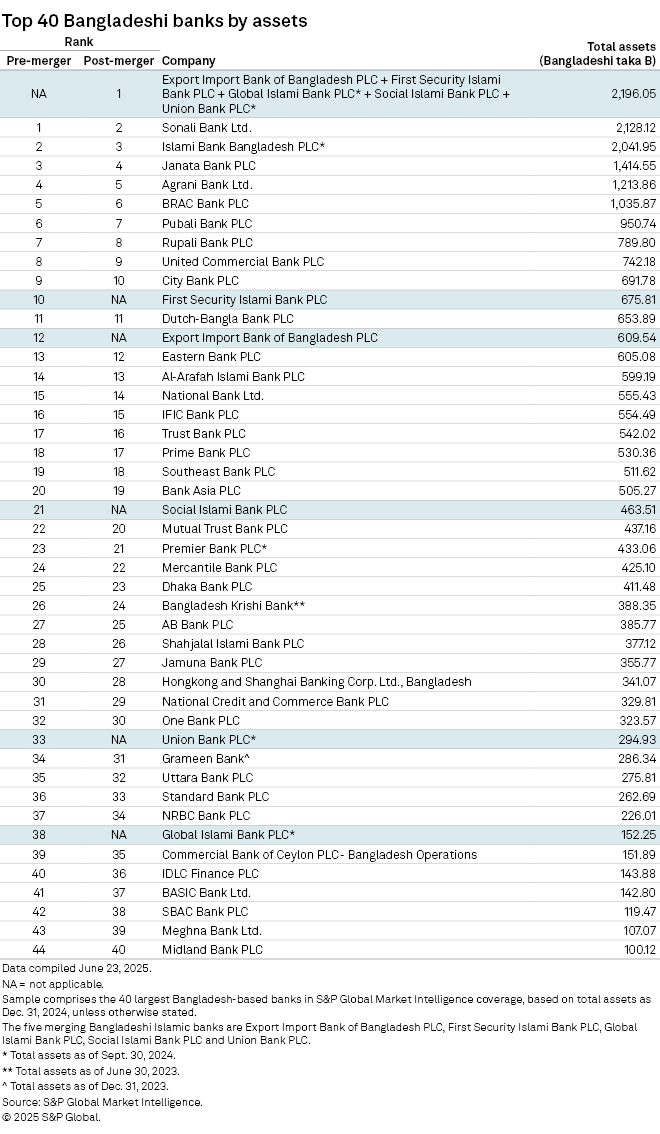

The Bangladesh central bank's proposal to merge five Islamic financial institutions will create the country's largest lender by assets, with 2.196 trillion Bangladeshi taka in assets post-merger, according to S&P Global Market Intelligence data.

Bangladesh Bank proposed the merger between First Security Islami Bank PLC, Social Islami Bank PLC, Global Islami Bank PLC, Union Bank PLC and Export Import Bank of Bangladesh PLC. as part of a larger consolidation of the country's banking sector, according to Bangladesh Bank Governor Ahsan Mansur, The Daily Star reported in June. The merger of the Islamic banks is the first phase in a continuous process of planned consolidation, the governor said.

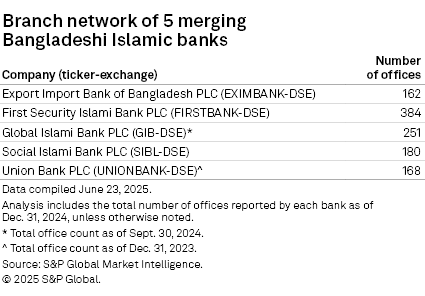

The move will push Sonali Bank Ltd., the largest bank in Bangladesh, into second place. The merged entity will have a network of 1,145 branches, Market Intelligence data shows.

"If properly executed, the proposed merger and restructuring could produce a powerful new banking institution, one capable of challenging not only Islami Bank Bangladesh PLC but also reshaping competition across the entire financial sector," Khan Tariqul Islam, a former banker, told Market Intelligence in an email.

"By preventing the collapse of multiple weak banks, the merger reduces systemic risks within the entire banking sector. This strengthens financial stability and protects the wider economy from potential contagion," he said.

New plan

The central bank announced plans to restructure the banking sector following loan-related allegations against ousted Prime Minister Sheikh Hasina's administration. Hasina has consistently denied any wrongdoing. After Hasina left in August, an interim government was formed under Muhammad Yunus, who was awarded the Nobel Peace Prize in 2006, as chief adviser. In April, Bangladesh Bank Governor Mansur said the government may create two Islamic banks by merging all existing ones. There are 10 full-fledged Islamic banks in Bangladesh.

Islamic banking is an important part of Bangladesh's financial sector. As of January, Islamic banks held 22.74% of total deposits and 21.45% of total assets in the banking sector, according to data from the Bangladesh Bank. The Islamic banking sector saw a moderate increase in deposits to 4.33 trillion taka in January from 4.14 trillion taka in January 2024. However, the deposit market share for Islamic banks fell to 22.74% in January from 23.56% in the prior-year period.