Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jul, 2025

By Yuvraj Singh and Beenish Bashir

M&A in Asia-Pacific was in doldrums in May, although high-growth markets such as India and Southeast Asia hold promise for dealmaking later in the year.

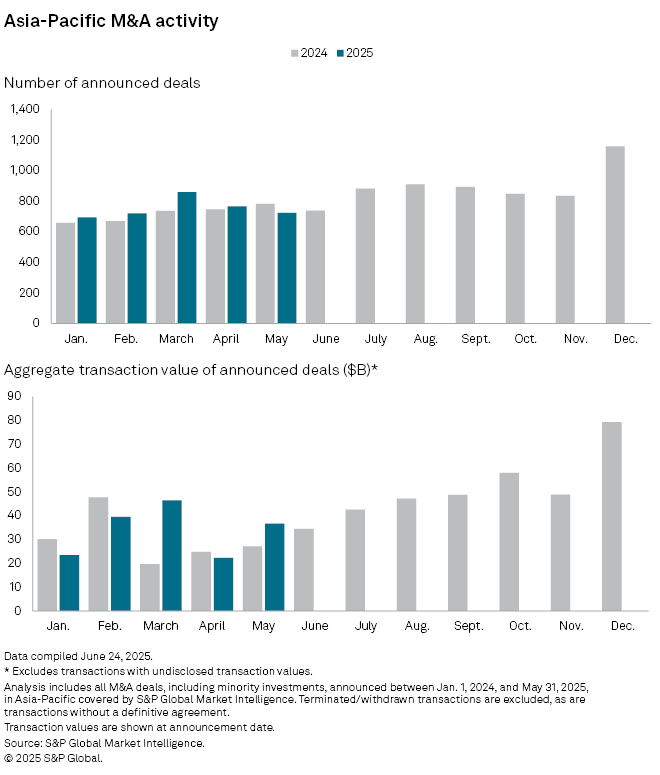

The total number of M&A deals announced in May was 723, compared to 782 deals in May 2024, data from S&P Global Market Intelligence shows. Transaction volumes stayed close to the year-ago period in each of the first five months of 2025, likely an indication that global economic uncertainties are dampening M&A activity.

Growth fundamentals

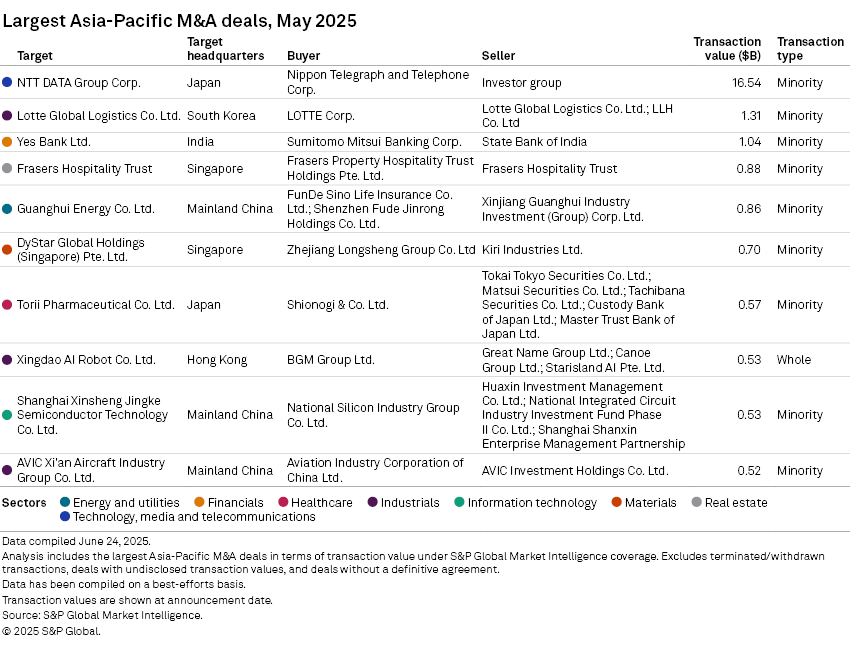

The number of transactions fell for the second consecutive month in May. However, Japan's NTT Inc.'s acquisition of the remaining stake in its subsidiary, NTT Data Group Corp., for $16.54 billion, Asia-Pacific's largest deal in the month under review, boosted the deal value in May to $36.72 billion. Without this transaction, the total deal value in May would have dropped to $20.18 billion from $22.28 billion in April.

"The long-term growth fundamentals across the region — a growing middle class, urbanization and investment in technology, infrastructure and human capital — remain firmly in place, too," said global law firm White & Case LLP in a June 23 paper. "Tariff uncertainty may cause short-term disruption, but over the long term, Asia-Pacific is a buyout market that private equity managers and investors cannot afford to ignore," the firm said.

The global M&A landscape has been significantly disrupted in 2025, with analysts attributing the slowdown to the uncertainty caused by a sweeping series of tariff moves announced by US President Donald Trump. Many multinational firms delayed or shelved M&A plans, wary of potential cost escalations and regulatory barriers. Still, several global equity markets gained this year in a sign of improving confidence. The S&P 500 gained 5% in June to end the month at a record high.

With the July 9 deadline for deals with major trading partners fast approaching, President Trump has doubled down on his hardline stance, warning that countries failing to strike bilateral trade deals with the US will face steep tariff hikes, some as high as 50%.

Struggling to gain momentum

"The initial shock of the COVID-19 pandemic brought dealmaking to a standstill, followed by a sharp rebound and record levels of activity. Since then, however, with higher interest rates and shifting geopolitical and regulatory environments, the pendulum has swung back toward caution," PwC said in a June 24 report.

"Asia-Pacific will present compelling opportunities to deliver strong future returns," according to the White & Case LLP paper. "During the last five years, the buyout space has matured, diversified and become less reliant on the powerhouse Chinese economy to drive deal activity."

China's share has dropped to roughly one-fourth of the region's total, down from its pre-pandemic dominance, as India and Japan emerge as new engines of deal activity. While China remains the region's largest market for M&A, buyers, including private equity firms, now have greater flexibility to deploy capital across Asia-Pacific.

Japanese megabank Sumitomo Mitsui Banking Corp.'s acquisition of a 20% stake in India's Yes Bank Ltd. was the largest financial sector deal. The $1.6 billion transaction included a $1.04 billion buyout of a 13.19% stake held by State Bank of India, the country's largest lender by assets.