Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jun, 2025

By Ben Dyson

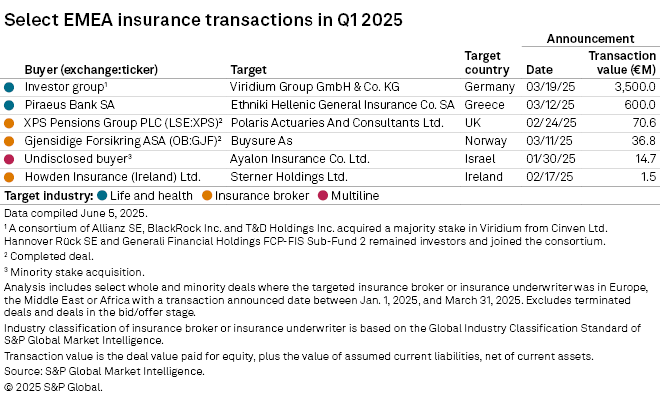

German life insurance consolidator Viridium Group GmbH & Co. KG's €3.5 billion acquisition by a consortium of big-name insurers and asset managers was the largest deal in an unusually quiet first quarter for insurance M&A in Europe, the Middle East and Africa.

The consortium, made up of Allianz SE, BlackRock Inc. and T&D Holdings Inc., agreed in March to buy the majority stake in Viridium held by UK private equity house Cinven Ltd. Existing Viridium shareholders Hannover Re and a fund managed by Assicurazioni Generali SpA's asset management arm have retained stakes in the consolidator. The largest holding among the consortium members belongs to T&D Holdings, which will own 29.9% of Viridium.

The acquisition is expected to free up Viridium to start buying closed books of life insurance business again.

While there was hope for a resurgence of mergers and acquisitions in general in 2025 after a slow 2024, several barriers to dealmaking have arisen. The uncertainty caused by the rapidly evolving import tariffs imposed by US President Donald Trump's administration, for example, is prompting companies to delay investment decisions until the dust settles.

The tariffs and geopolitical uncertainty "are likely to cast a shadow over M&A in the short term," Jana Mercereau, head of Europe M&A consulting at Willis Towers Watson PLC, said in an April 8 report. "Boardrooms may decide to delay deals as they digest the impact on their businesses, switching to wait-and-see mode until the uncertainty eases."

Sluggish quarter

The Viridium takeover was the only deal to top €1 billion in the quarter. The next-largest was Piraeus Bank SA's €600 million acquisition of a 90% stake in Greek insurer Ethniki Hellenic General Insurance Co. SA from private equity house CVC Capital Partners PLC.

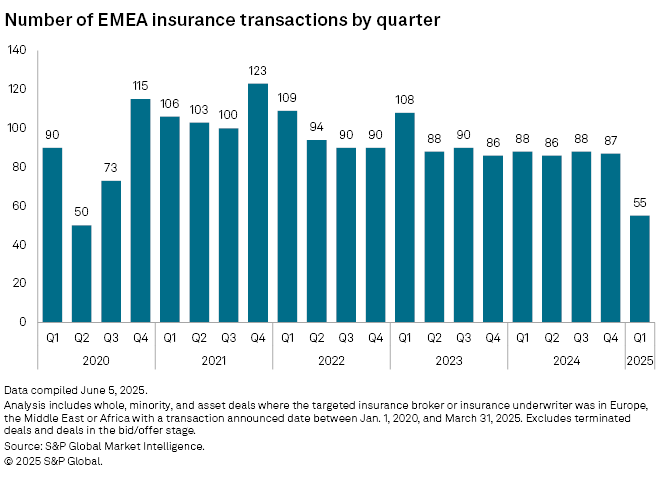

Overall, there were 55 acquisitions of EMEA insurance targets in the first quarter of 2025, S&P Global Market Intelligence data shows. This is down from 88 in the first quarter of 2024 — itself a relatively quiet first quarter compared to the past five years. Recently, the first quarter has typically been one of the most active in a year.

The last time there were so few EMEA insurance transactions in a quarter was the second quarter of 2020, when the COVID-19 pandemic started to dampen mergers and acquisitions activity.

The slowdown is in keeping with transaction trends in the Asian insurance market and among North American insurance brokers.

Despite headwinds for the past three years, many companies still found ways to grow through acquisition, Mercereau said. "A combination of pent-up demand, ample dry powder and strong balance sheets suggest the current chill in dealmaking will begin to thaw in the months ahead," she added.

|

– Read about potential M&A activity in the global insurance sector in In Play Today and a summary of recently announced deals in M&A Replay. – Discover the latest trends in insurance M&A across the Asia-Pacific region and for underwriters and brokers in North America. – Access deep dives into insurance transactions across the globe via our Deal Profile feature. |

UK brokers

For UK insurance broker transactions, which make up a large proportion of quarterly EMEA insurance M&A volume, deal volumes halved to 19 in the first quarter of 2025 from 38 in the same quarter of 2024, according to a report from M&A adviser MarshBerry. The fourth quarter was "unusually busy," partly because an increase in the capital gains tax in the UK may have sped up some deals that would otherwise have waited until 2025, the report said.

However, the report added that it was premature to suggest that 2025 would be "doom and gloom for M&A," noting that there were nine new deals in March, and more announced in April.

It is unclear what overall EMEA insurance deal volume will look like in the second quarter of 2025, but large transactions continued to be announced, including the planned merger between Swiss insurers Helvetia Holding AG and Baloise Holding AG, announced in April. Some large European insurers, such as Dutch insurer ASR Nederland NV, continue to keep their eyes peeled for acquisition opportunities.