Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jun, 2025

| James King places a testing bar on a solar panel at Elin Energy's solar panel manufacturing facility in Brookshire, Texas. Source: Brett Coomer/Houston Chronicle via Getty Images. |

Solar panel shipments to the US continued their retreat in the first three months of 2025, suppressed by rising import tariffs under the Trump administration and Biden-era incentives that have fueled a significant shift toward domestic manufacturing.

The US imported 6,579 MW of modules in the first quarter, down 56% from a year ago and 18% from the prior quarter, according to the S&P Global Market Intelligence Global Trade Analytics Suite.

That marked the lowest quarterly panel import volume since the second quarter of 2022, when former President Joe Biden temporarily suspended tariffs on crystalline-silicon solar cell and panel shipments from Cambodia, Malaysia, Thailand and Vietnam. Biden's two-year moratorium, which came during a US Commerce Department investigation into whether certain manufacturers were evading tariffs on China, enabled an import surge that peaked in the second quarter of 2024 as the waiver expired.

Anticipation of a fresh round of tariffs on shipments from the four Southeast Asian countries, which are being rolled out under the Trump administration, helped to drive record imports before falling off in late 2024.

"Companies saw the writing on the wall," said Alex Kaplan, principal market analyst for solar at S&P Global Commodity Insights.

As a result, developers stockpiled large volumes of imported modules over the past two years, totaling 35 GW of excess inventory entering 2025, Kaplan said.

First-quarter panel imports also reached their lowest level since Biden signed the Inflation Reduction Act (IRA) in August 2022, which included valuable tax credits that helped to rapidly expand domestic assembly. Module production capacity will exceed demand in 2025, mitigating the impact of tariffs on imported modules, according to Kaplan.

But US-made modules will still rely on imported cells in the short term, now with greater dependence on India, Indonesia, Laos and South Korea, the analyst added.

Some domestic solar manufacturers warned that their recent progress, requiring years of planning and billions of dollars in private investment, will quickly unravel in a renewed flood of panel imports if a House Republican tax bill under consideration in the Senate becomes law.

The IRA's tax credits, combined with targeted solar import tariffs, for the first time created a "unified industrial policy that can actually achieve onshoring," Mike Carr, executive director of the Solar Energy Manufacturers for America (SEMA) Coalition, said in an interview. "All we would ask is, 'Don't change that.' We're really kind of clicking on all cylinders, so don't introduce another complication."

The SEMA Coalition represents companies betting heavily on US solar manufacturing, including First Solar Inc. and Q Cells, a subsidiary of South Korea's Hanwha Solutions Corp.

The Global Trade Analytics Suite, which relies on data reported to the US Census Bureau, shows that US cell imports in the first quarter reached 4,479 MW, more than doubling year-over-year and up slightly from the fourth quarter of 2024.

Malaysia accounted for the largest share of cell imports in the period, at 38%, followed by South Korea at 24.4%, Laos at 10.8% and Indonesia at 8.4%.

With US antidumping and countervailing tariffs on Vietnam, Cambodia, Malaysia and Thailand officially confirmed in May and substantial US module capacity now in place, "I would expect cell imports to rapidly ramp up over the next few quarters from these new countries," Kaplan said.

Rising cell imports are filling a large gap in the domestic photovoltaic supply chain. As of June, the US had 56.5 GW of thin film and crystalline-silicon panel production capacity — up sevenfold since the IRA was enacted — compared with 2 GW of crystalline cell capacity and no operational wafer or ingot production, according to the Solar Energy Industries Association.

Although US module imports declined overall in the first quarter, they increased from Laos and Indonesia compared to the fourth quarter of 2024. Vietnam accounted for 19.9% of module imports in the first quarter, followed by Indonesia at 18.8%, Thailand at 17.3%, Laos at 16.1% and Malaysia at 12.4%.

"We will definitely see supply chain shift, but it's getting harder and harder," said Mike Hall, CEO of Anza RE LLC, a solar and battery storage equipment procurement specialist, pointing to various country- and PV-specific tariffs.

Migrating supply chains out of China to Southeast Asia or countries with which the US had a free trade agreement has become a less viable option, Hall told Platts, part of S&P Global Commodity Insights.

"Now you can't rely on those as being stable in terms of the total import taxes you're paying, so it is getting harder and harder," he said. "There is a lot of momentum around domestic supply."

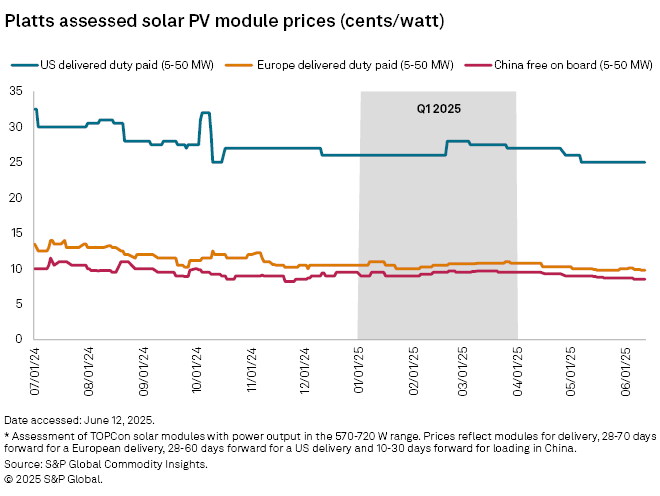

Pricing impacts

Average monthly prices for Platts assessed delivery-duty-paid US solar Topcon modules for 5-10 MW volumes have fallen steadily since March, when prices averaged about 27 cents per watt. Prices in April averaged about 26.85 cents per watt and so far in June have averaged 25 cents per watt, down more than 8% from March.

Prices for crystalline solar cell technology have declined despite imports rising recently ahead of the July 9 deadline on President Donald Trump's 90-day pause on "reciprocal tariffs."

"From a pricing perspective, there's not really a floor," said Carr of the SEMA Coalition.

A global oversupply of PV modules and components driven by China-headquartered companies, including those operating factories in Southeast Asia, continues to push prices lower around the world, he added.

"They’re producing far more than the market" at below the cost of production, Carr said. "One thing that the Chinese government and companies affiliated with it have shown is that they are more than willing to suffer short-term pain for long-term market share gain."

Solar Topcon modules assembled in the US with imported cells have recently been priced around 28 to 34 cents per watt.

S&P Global Commodity Insights reporter Karen Rivera contributed to this story.