Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jun, 2025

By Brian Scheid and Umer Khan

After an initial jump early this year, US initial public offering activity stumbled as President Donald Trump announced new, higher tariffs on nearly all global trading partners. Activity now appears poised for recovery, said Mike Bellin, IPO services leader at PwC US.

"I think we're seeing a resurgence in IPO activity," Bellin said in an interview. "We expect the market to keep growing."

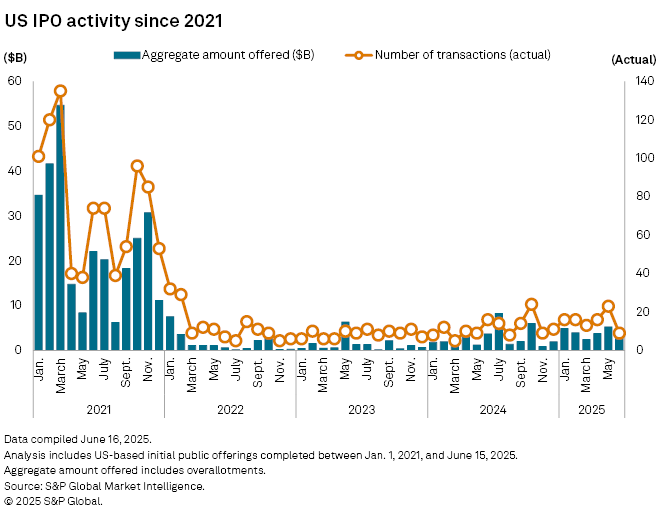

US IPO activity started this year relatively strong, with 32 IPOs and an aggregate $8.83 billion offered in January and February, compared to the 20 IPOs and $3.74 billion offered in the first two months of 2024, and the 16 IPOs and $2.00 billion offered during those two months in 2023, according to S&P Global Market Intelligence data.

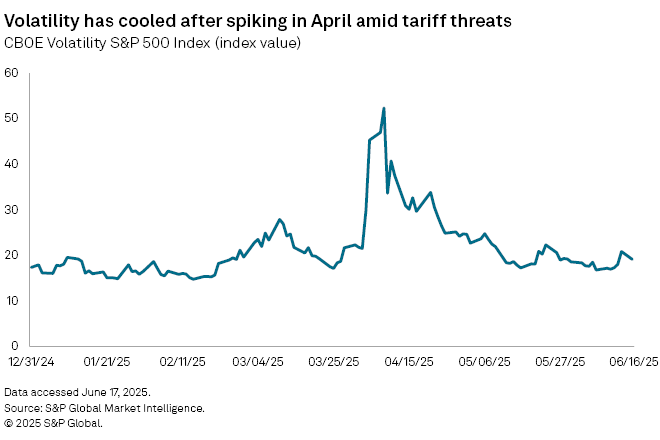

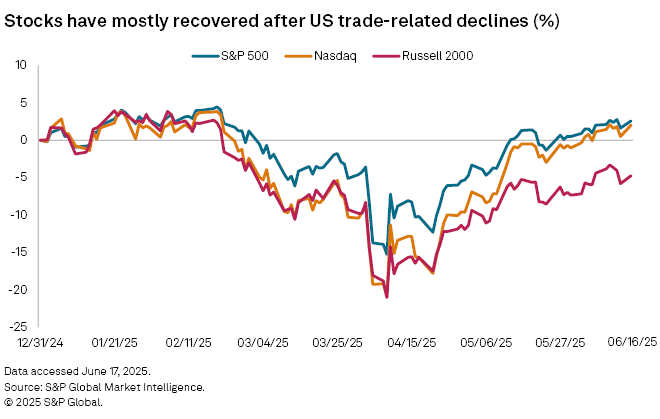

However, Trump intensified tariff announcements, inflation remained steady but above the Fed's 2% target, and as market volatility surged, IPO activity cooled.

There were just 13 IPOs launched in March and 16 in April, with a total aggregate value of $6.16 billion. May, however, saw 23 IPOs with an aggregate value of $5.22 billion and through the first two weeks of June there have already been nine IPOs with a value of $3.29 billion, already higher than the value in March, the data shows.

Bellin said IPO activity, while nowhere near 2021 levels, is exhibiting strong momentum as the stock market has rallied, uncertainty appears to be in relative decline and investors increasingly see the bull market persisting.

After Trump announced a new wave of tariffs on April 2, many IPOs that were underway paused as market volatility spiked. Many of those frozen projects are now back underway, Bellin said.

This momentum, however, is largely focused on the companies viewed with the most near-term profitability, such as AI-focused companies, financial technology companies, crypto infrastructure providers and digital health platforms, Bellin said.

"I do think that momentum is selective momentum, it's not doors wide open," Bellin said.

Rather than taking chances on smaller tech companies, investors are now focused on companies with growth, scale and clear profitability.

"They want growth, but not at profitability's sake," Bellin said.