Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Jun, 2025

By Kirsten Errick and Garrett Hering

| Homes with solar-fueled batteries can be orchestrated with software to effectively function as utility-scale assets. Source: Justin Sullivan / Getty Images News via Getty Images North America. |

The US Energy Department recently deleted from its website a series of Biden-era reports on nascent clean energy technologies, including two analyses on the potential of "virtual power plants."

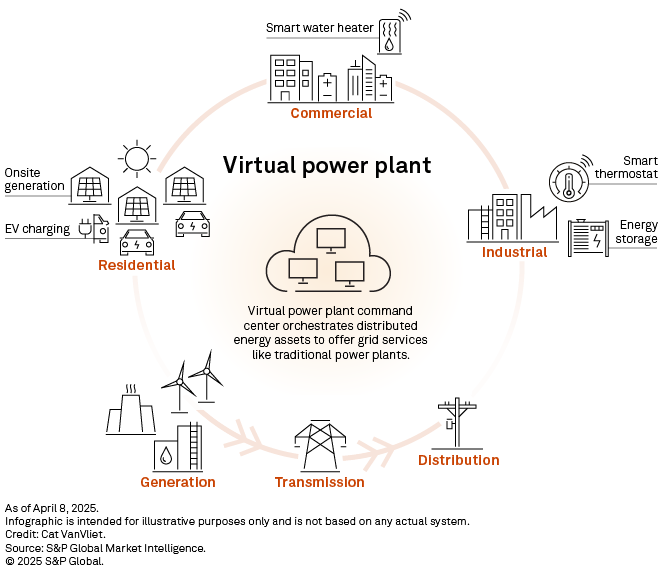

But these remote-controlled fleets of smart thermostats, residential batteries, electric vehicle chargers, heat pumps and other distributed energy resources at homes and businesses have not disappeared. And with multiple gigawatts already networked and helping to keep the lights on during times of grid stress, "virtual" may be a misnomer.

Despite the Trump administration's energy policy pivots toward baseload fossil and nuclear generating stations, virtual power plants (VPPs) continue to emerge as critical capacity cushions for a US electric grid struggling to keep pace with rising demand and weather extremes. US utilities, independent VPP operators and technology suppliers are accelerating efforts to orchestrate small-scale energy assets with software to collectively maintain system reliability and affordability during daily and seasonal demand spikes.

"VPPs are going to keep growing," Ani Backa, vice president of virtual power plants at software and financing specialist Goodleap LLC, told Platts, part of S&P Global Commodity Insights. "I'm not necessarily too concerned about what will happen with this current administration."

"Keep in mind, the industry grew just as much during the first Trump administration as it did during the Biden administration, and all signs point towards it [continuing] to grow over the next four years," said Dana Guernsey, CEO and co-founder of Voltus Inc., which operates virtual power plants with commercial and industrial clients, ranging from Walmart Inc. to Madison Square Garden.

Some distributed energy and VPP providers, however, are concerned that their momentum could stall if the Republican-controlled Congress passes a sweeping budget reconciliation bill that includes deep cuts and early phaseouts for certain clean energy tax credits, including for distributed energy resources, as proposed in both the House and Senate.

But Neil Chatterjee, former chair of the Federal Energy Regulatory Commission and strategic adviser to Voltus, believes Trump and congressional Republicans ultimately will support a broader power mix that includes VPPs.

"The president and his allies are very quickly going to realize we can't win the AI race and bring down the cost of electricity for Americans with fossil fuels alone, that we are going to need every available electron from solar and storage and geothermal and nuclear, all the way to megawatts in the form of demand response, [distributed energy resources] and VPPs," Chatterjee said in an interview. "I actually don't think that the change in administration in this regard is really going to alter those market dynamics."

Eyeing 'VPP revolution'

Chatterjee, who was appointed to FERC by Trump, led the agency when it issued its landmark Order 2222 in 2020, designed to open wholesale electricity markets to participation from aggregated distributed energy resources.

State utility commissions are playing a large role in the VPP rollout at regulated power companies, but "there's a lot that FERC could do," Chatterjee said. "And honestly, a lot of it is just maybe putting pressure on the [wholesale grid operators] where they could advance the ball and not even have to take policy steps."

VPPs are "a great example of how we can be bipartisan with renewable energy," added Blake Richetta, chairman and CEO of Sonnen Inc., an energy storage and VPP subsidiary of oil major Shell PLC.

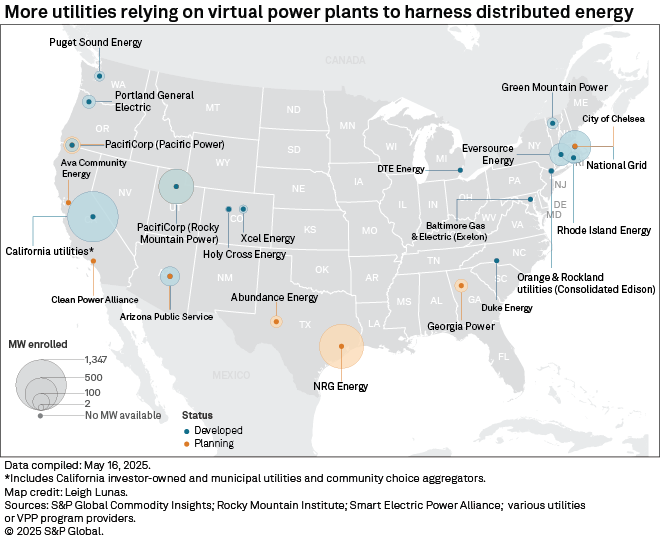

Sonnen is seeing success in rolling out its software-steered portfolios of solar-fueled batteries at residences in Republican-leaning states, partnering with PacifiCorp's Rocky Mountain Power division in Utah and recently unveiling a collaboration in Texas. Sonnen also has VPPs harnessing residential batteries in California, Puerto Rico and Germany. In June, Sonnen announced its first VPP in Canada.

"The VPP revolution is really hitting its stride," Richetta said. "Even in this situation, we can thrive ... and we can get bipartisan support for [the VPP model] because of the attributes of it — being renewable energy done responsibly and thoughtfully, without raising taxes or raising electricity rates and not having just intermittent renewable generation."

Market conditions are facilitating the rise of VPPs, according to executives.

"These are resources that are out there. They're deployed," said Guernsey. "They're not awaiting the interconnection queue, and we aggregate them and we turn them into a source of very-quick-to-stand-up economic energy supply."

VPPs stand on "the merits alone" because they are cost-effective, quick to materialize and can solve existing supply problems, Guernsey added.

"My hot take would be that we see more [distributed resources] and VPPs deployed over the next four years than the last four years due solely to just where the market is and the market product fit of these resources," Guernsey said.

'Sleeping giant'

Approximately 30 GW of virtual power plant capacity is already enrolled in programs across the US, according to a DOE report released just days before the start of Trump's second term. The update of a 2023 analysis reiterated an estimate that the US will see 200 GW of new peak demand by 2030, driven by power-thirsty datacenters, manufacturing, electric vehicles and heating and cooling.

With continued maturity of the business model, incorporation into utility planning and integration into wholesale markets, VPP capacity could rise to 80 GW to 160 GW by 2030, enough to cover 10% to 20% of total US peak demand, the report found.

Ben Brown, CEO of VPP operator Renew Home LLC, sees a scale-up of that magnitude as well within reach. The company, created last year through the combination of Google LLC's Nest Renew business and fellow VPP operator OhmConnect Inc., works with over 100 US utilities and manages about 3 GW of shiftable load at more than five million households, mostly through smart thermostats.

"We want to grow that to 50 GW by 2030," Brown said in an interview.

Some 82 million homes in the US with central heating, ventilation and air conditioning (HVAC) systems represent roughly 70 GW that could be tapped if those units were integrated into VPPs, Renew Home said in a 2024 analysis that called HVAC the "sleeping giant" of peak load shift.

"If those devices are not integrated directly into a shiftable resource with a VPP platform, it is going to create of lot of challenge, but it also creates a huge opportunity because if those devices are then at scale, those are hugely shiftable loads," Brown said.

This summer, Renew Home plans to launch a VPP program in Texas with NRG Energy Inc. The initiative aims to distribute hundreds of thousands of smart thermostats to create a nearly 1 GW VPP by 2035, relying on Google Cloud technology.

Renew Home is working to scale up VPPs as essential grid assets, but "it's really important that it's empowering for homes," Brown added. "In a world of rising energy costs, it is very important to engage a lot of different households with a lot of different preferences ... giving them more options by which they can save money while maintaining comfort."

Home solar and battery system supplier Sunrun Inc. dispatched over 340 MW of stored solar energy on the evening of June 24 to support grid reliability in California, New York, Massachusetts, Rhode Island and Puerto Rico. Over 300 MW of that was in California alone.

"The right way to think about this is a utility-scale power plant [that] provides the same level of services, in fact, even greater level of services," Chris Rauscher, vice president of grid services at Sunrun, said in an interview.

Sunrun prefers the term "distributed power plant" to virtual power plant for its dispatchable residential battery fleet, which includes over 130,000 systems. That accounts for 650 MW of the nearly 1 GW of battery power capacity the company has installed.

"These are power plants and we're now operating them at a scale never before seen in the world," Rauscher said. "And we're doing it to help save the grid. We did it on Tuesday night, all around the country ... and we're going to be doing it all summer long. It's only going to get bigger every year."

But the market for virtual, or distributed, power plants continues to evolve.

"I think the VPP market is like a pimply teenager right now," Rauscher said. "It's starting to become adult size, and we're certainly not in our infancy anymore, but it's not yet full-grown and fully mature, although you can see that very soon it will be fully mature."