Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jun, 2025

By Nick Lazzaro

A storefront in Monterey Park, California, displays a sign showing the credit cards it can accept for transactions. Credit card delinquency rates are rising while consumers face the prospect of ongoing inflationary pressure this year. Source: Frederic J. Brown/AFP via Getty Images. |

US consumer spending is robust but faces potential strains from rising credit delinquencies and high interest rates amid uncertainty over inflation.

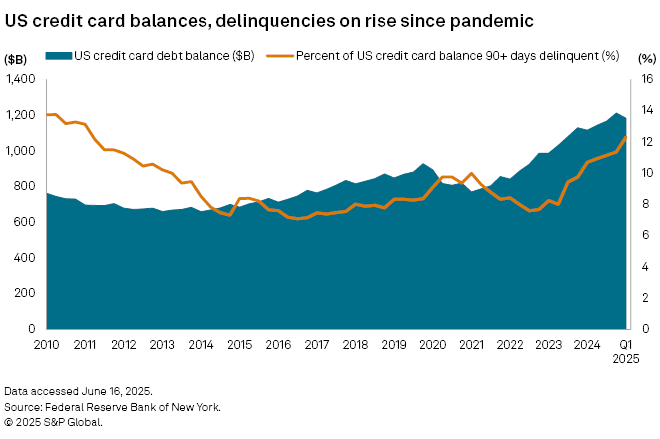

About 12.3% of the $1.182 trillion in credit card debt owed by consumers at the end of the first quarter was seriously delinquent by 90 days or more, the highest rate of delinquency since 2011, according to data from the Federal Reserve Bank of New York. While total credit debt was lower than the reached a record of $1.211 trillion in the fourth quarter, delinquencies have increased since mid-2023.

Household spending and credit usage spiked in the years following the COVID-19 pandemic with support from low interest rates, wage growth, a surging economy and rising asset values. The economic boom allowed consumer spending to overcome the eventual spike in inflation and rising interest rates through 2022 and 2023. However, record credit card debt in the fourth quarter of 2024 and record total household debt in the first quarter may signal growing dependency on credit, putting increased pressure on consumers at a time when already-elevated prices for goods could be pushed up further by the Trump administration tariff policy.

"Even if tariffs are scaled back this year and the trade tensions ease, consumer credit trends still suggest ongoing pressure on US households," Dean Kaplan, president of debt collection agency The Kaplan Group, told S&P Global Market Intelligence. "Interest rates on credit cards remain very high over 22%, which keeps borrowing costly. We're also seeing revolving credit grow faster than usual, meaning more people are relying on credit cards to cover everyday expenses, not just extras."

Inflation has slowly moderated over the last year but remains elevated. Consumer prices increased 2.4% year over year in May, down from the 3.2% year-over-year rise in the consumer price index in May 2024 and the recent peak of 9% in 2022, according to US Bureau of Labor Statistics data. However, in the decade before the pandemic, the annual average for the consumer price index exceeded a 2.4% year-over-year increase only two times — in 2011 and 2018.

The cooler inflation in the May consumer price index was a positive signal for the market as expectations compiled by Econoday called for a 2.5% rise. Yet, there are still more questions than answers for the consumer spending outlook as markets await developments on tariff policy and international trade negotiations, according to Jim Baird, chief investment officer with Plante Moran Financial Advisors.

"If we were to see a meaningful resurgence in inflation, putting more pressure on households, in particular on lower-income households, that would be a negative for discretionary spending," Baird said in an interview. "Recognizing that we've seen credit card balances increase over the last few years, the combination of higher balances and higher interest rates would certainly pinch consumption."

Income support for spending, credit usage

Though warning signs may be emerging in consumer credit conditions, consumers continue to spend amid a stable labor market and steady earnings growth.

"What gives us some confidence is that consumers are still pretty fully employed, and incomes are strong," said Gary Pzegeo, co-chief investment officer for CIBC Private Wealth, in an interview. "That can support a certain amount of credit growth, so we need more time to see if that trend of increasing delinquencies is sustained."

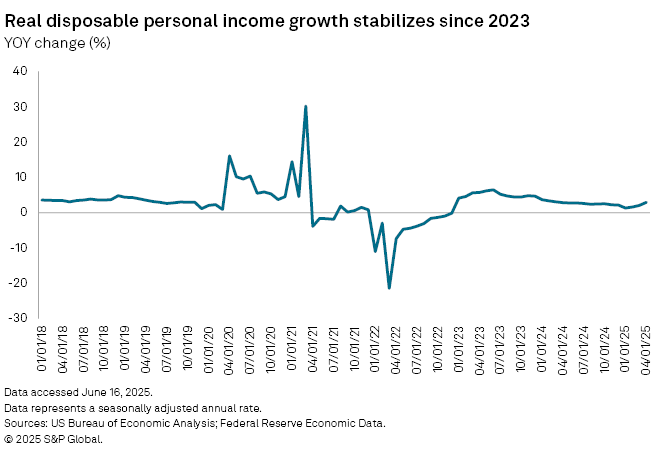

Since the start of 2023, real disposable personal income has grown each month by over 2% on a year-over-year basis in every month except January and February of 2025, according to data from the US Bureau of Economic Analysis. Some months in 2023 saw gains of over 6%.

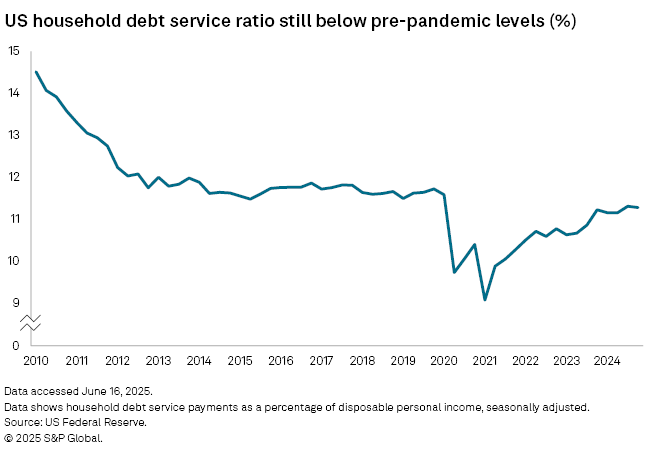

Household disposable income also appears to still be in a comparatively stronger position to handle debt than it was before the pandemic. The share of household debt service payments as a percentage of disposable personal income has risen in recent quarters since a plunge in 2021. However, at 11.3% in the fourth quarter of 2024, this metric is still lower than at any time between 2000 and 2019, according to US Federal Reserve data.

Income metrics may be a stronger indicator of consumer health than recent credit delinquency data, which could be viewed less as an immediate warning and more as an expected cyclical change in the years following the post-pandemic surge in spending and credit card usage, Pzegeo said.

"If tariffs are actually implemented and stay in place for a while, the result should be some near-term inflation on imported consumer goods, and that will have the effect of lowering real income and real disposable income if nothing else happens," Pzegeo said. "If you don't get any increase in wages, if you don't have an increase in employment, the consumer will be in a relatively worse position than it was before tariffs."

However, consumers in the highest income brackets may be supporting ongoing growth in spending, glossing over mounting pressures felt in lower income groups.

"The bottom half of income earners have seen their pandemic-related excess savings whittled away through high inflation," Jay Menozzi, chief investment officer and senior portfolio manager at Easterly Orange, told Market Intelligence. "The personal savings rate has been below average, between 3% and 5%, with many households dipping into consumer credit markets to support their spending."

Other consumer debt

Other debt market segments may also show signs of increased consumer fragility.

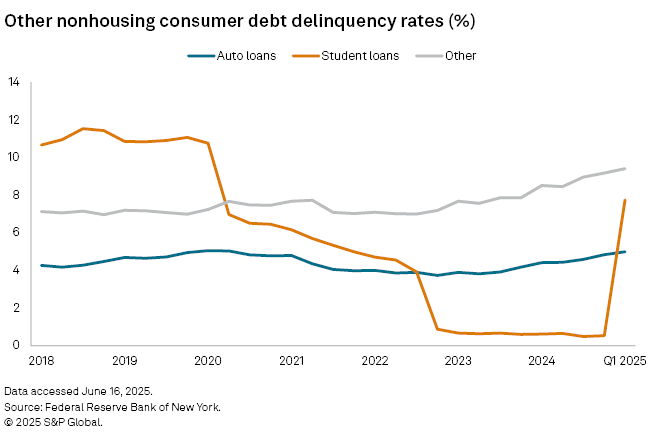

The share of student loan balances designated as seriously delinquent spiked to 7.7% in the first quarter from under 1% in the previous quarter as the US readied to end the pandemic-era pause on required student loan payments this year.

"Some of the prime credit lending underwritten over the last few years has benefited from the suspension of student loan payments and, had those payments been required to be made, the credit scores of affected borrowers would have been lower," Menozzi said. "Hence, some prime consumer credit performance might be negatively impacted going forward."

Delinquencies on auto loans are also creeping up, with a 5% rate in the first quarter representing the highest level since 2011, when excluding delinquencies in 2020 during the early stages of the pandemic. Auto loan credit could weigh more heavily on consumers if vehicle prices rise and necessitate more debt financing in response to the US' recently imposed 25% tariff on automotive imports.

"Tariffs are hitting consumers in the worst place—necessities like vehicles—and many are bridging the gap with risky debt," The Kaplan Group's Dean Kaplan said. "More expensive cars and more expensive credit equals more fragile loans."