Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2025

By Robert Clark

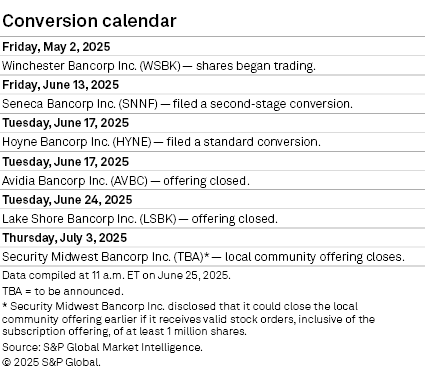

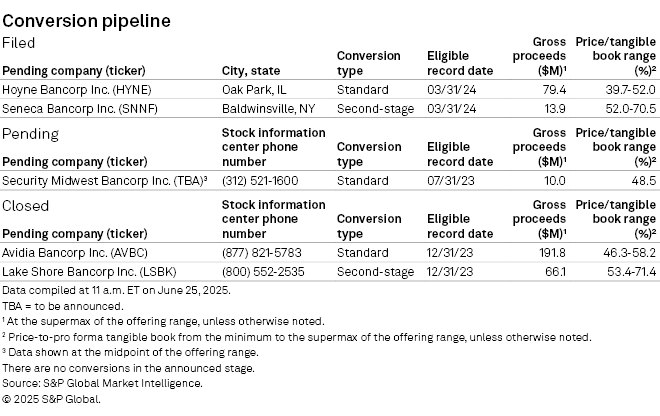

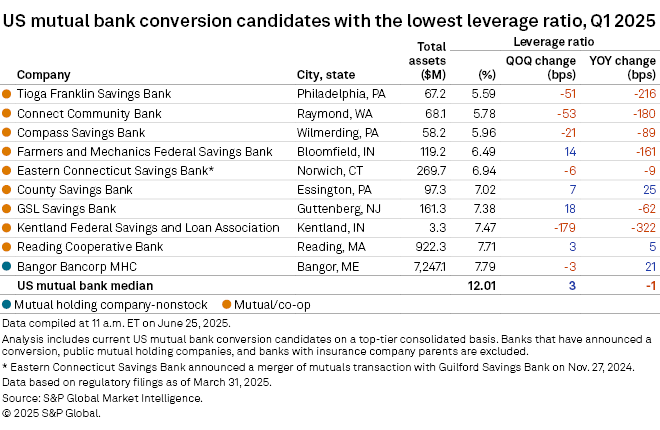

This feature has the latest news from the mutual bank conversion sector. As of June 25, five conversions were in the pipeline.

On June 17, Hoyne Bancorp Inc. filed a registration statement for a standard conversion. The price to pro forma tangible book value as of March 31 is between 39.7% at the minimum of the offering range and 52.0% at the supermax. If the deal prices at the bottom end of the range, it would represent the second-lowest valuation among all US mutual-to-stock bank conversions of the century.

On June 13, Seneca Bancorp Inc. filed a registration statement for a second-stage conversion. Seneca opened a branch in Manlius, New York, on June 2. The company disclosed in the filing that it also plans to open a branch in Clay, New York, where, in 2024, Seneca bought 2.5 acres of land directly across from the future site of a semiconductor fabrication facility to be established by Micron Technology Inc. "This strategic investment positions us to support the economic growth expected in the region and to provide financial solutions to businesses and families as this transformative development takes shape," Seneca said in the filing.

The offerings for Avidia Bancorp Inc.'s standard conversion and Lake Shore Bancorp Inc.'s second-stage conversion closed June 17 and June 24, respectively.

Security Midwest Bancorp Inc. has commenced a community offering for its standard conversion. The offering is scheduled to expire July 3 but could close earlier if the company receives valid stock orders, inclusive of the subscription offering, of at least 1 million shares, which is the midpoint of the offering range.

Whereas cannabis-related banking represents a sizable portion of Security Midwest's balance sheet, Avidia exited the business in 2024. See the April edition of State of the Pipeline for additional data.

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

'We were just too small': Bank industry changes fuel Massachusetts mutual deal

NB Bancorp to acquire Provident Bancorp in $211.8M deal

Eureka Investor Group, Eureka Homestead Bancorp scrap merger agreement

Massachusetts-based Newburyport Bank appoints president/COO

Fifth District Bancorp president/CEO dies

OCC enters agreements with Texas Heritage National Bank, Sterling Federal Bank

Severe regulatory enforcement actions sit at 2-year low so far in Q2 2025

Number of US banks with frequent losses increases in Q1 2025

Eastern Bank, HarborOne briefly paused deal talks due to market volatility

Pulaski Savings Bank's demise is the costliest US bank failure since 2019

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.