Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jun, 2025

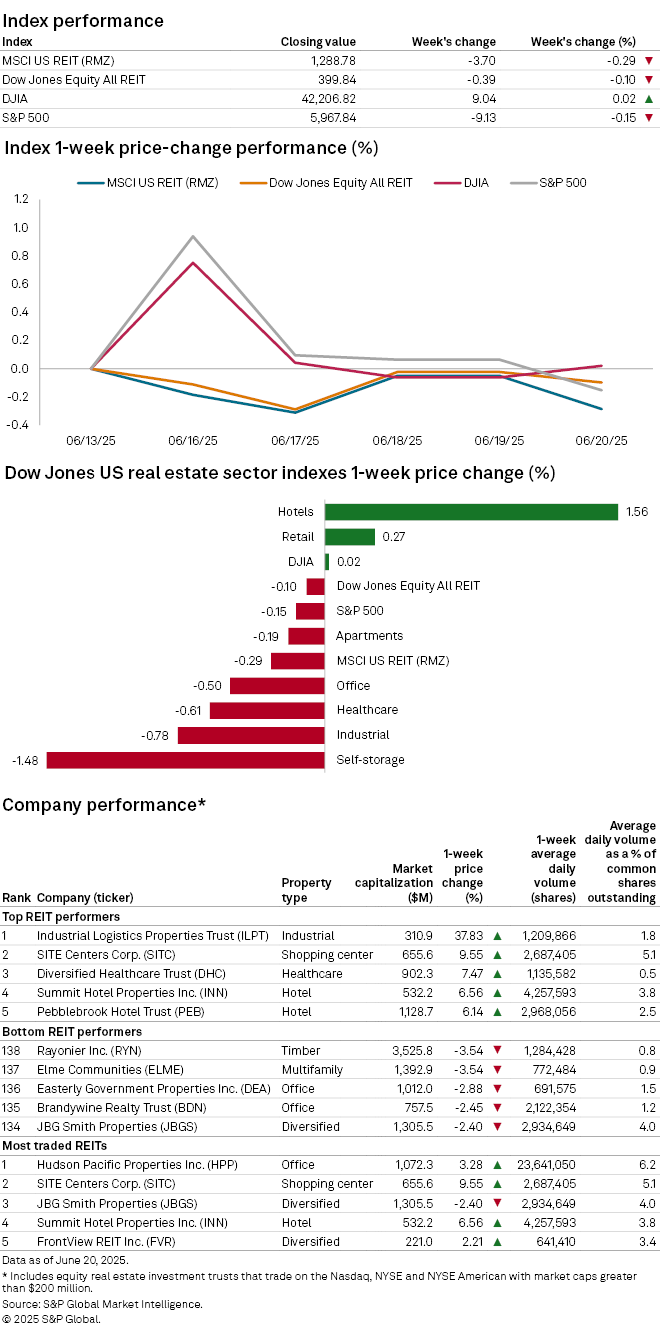

Share prices for US real estate investment trusts closed the week ended June 20 largely flat.

The Dow Jones Equity All REIT index fell a slight 0.10% over the week, compared to a 0.15% decline for the S&P 500 and a very slight 0.02% increase for the Dow Jones Industrial Average.

By property sector, the self-storage REIT index logged the largest decline over the week, down 1.48%. The industrial and healthcare REIT indexes followed next with declines of 0.78% and 0.61%, respectively. On the other hand, the hotel and retail indexes logged increases over the week, up 1.56% and 0.27%, respectively.

Industrial Logistics Properties Trust closed the week with the largest share-price increase, up 37.83%. The industrial REIT's share price surged following its June 16 press release, where the REIT announced that it priced $1.16 billion of five-year, interest-only fixed-rate mortgage financing, secured by a portfolio of 101 industrial properties located on the US mainland and Hawaii. The financing proceeds, along with $75 million of cash, will be used to fully repay the REIT's $1.235 billion of floating-rate mortgage debt due in October 2025, secured by substantially the same portfolio of properties. According to the REIT's CFO, Tiffany Sy, annual cash savings from the refinancing are expected to be approximately $8.5 million, or 13 cents per share.

Shopping center REIT SITE Centers Corp. and healthcare REIT Diversified Healthcare Trust followed next with share-price increases of 9.55% and 7.47%, respectively.

Timber REIT Rayonier Inc. and multifamily REIT Elme Communities logged the largest share-price declines for the week, both down 3.54%. Office REIT Easterly Government Properties Inc. rounded out the bottom three for the week with a share-price decline of 2.88%.