Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jun, 2025

By Tom Jacobs and Malik Ozair Zafar

The Progressive Corp. is getting close to toppling State Farm Mutual Automobile Insurance Co. as the biggest auto insurance company in the US.

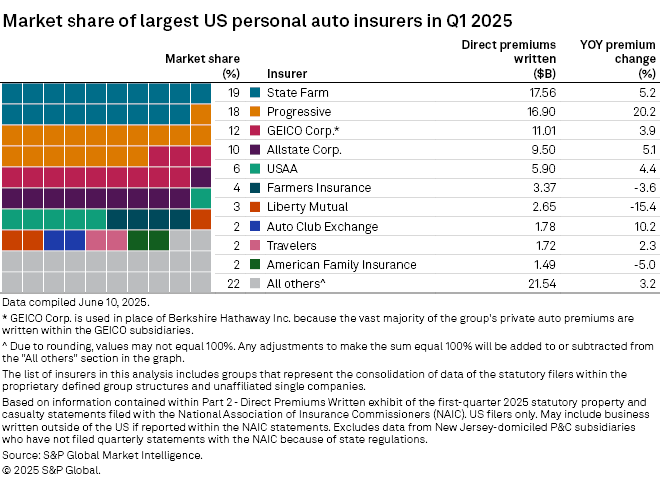

The Mayfield Heights, Ohio-based insurer posted a 20.2% year-over-year surge in direct premiums written in the first quarter to $16.90 billion, representing an 18% market share, according to an S&P Global Market Intelligence analysis of the 10 largest private auto insurers.

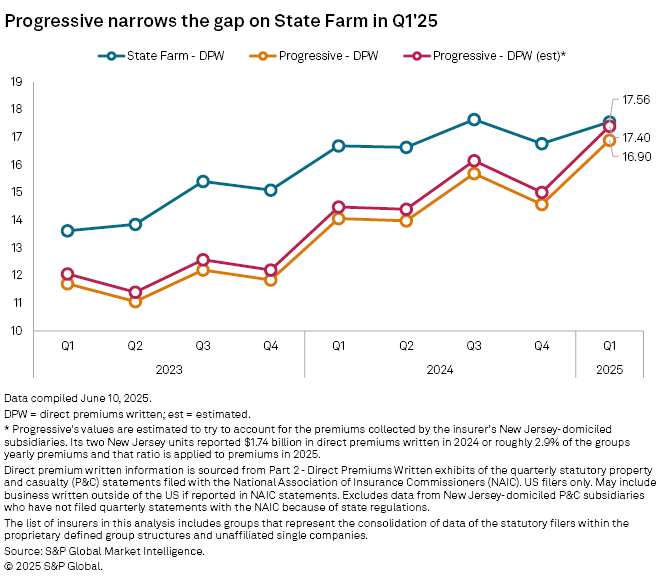

Progressive's total was just $660 million behind market leader State Farm, which booked $17.56 billion in direct premiums written for a 19% market share. That marked the narrowest margin between the top two insurers since the first quarter of 2021, when State Farm had $10.36 billion in direct premiums written, $565 million ahead of Berkshire Hathaway's GEICO Corp.

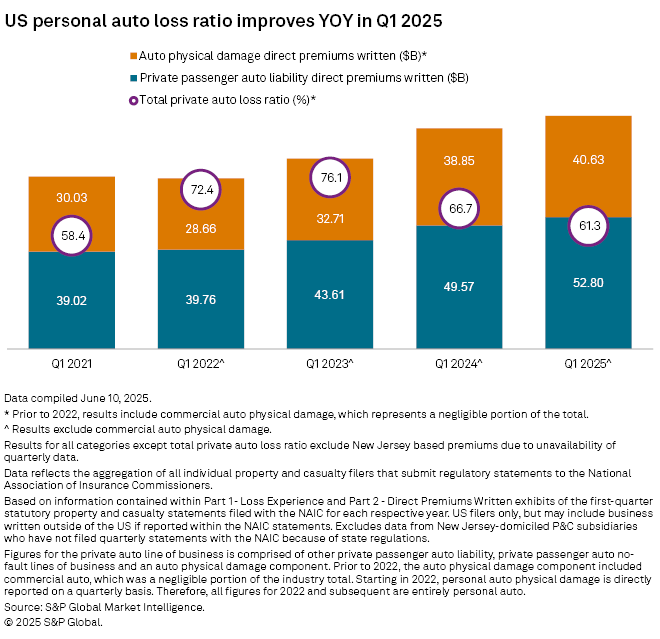

Overall, insurers recorded direct premiums written of $93.43 billion in the quarter, a $5.01 billion increase from $88.42 billion a year ago. The industry loss ratio significantly improved, despite the fallout from the January wildfires in the Los Angeles area. The first quarter's ratio of 61.3% was a 5.4-percentage-point decrease from a year ago and the lowest loss ratio since the first quarter of 2021.

Challenging the longtime leader

State Farm has led the US auto insurance market for more than 80 years. The Bloomington, Illinois-based carrier assumed the top spot in 1942, according to the Smithsonian Institution's National Postal Museum, and has maintained its status since then.

While the first-quarter gap that the analysis calculated between State Farm and Progressive was relatively narrow, it shrank even more when two New Jersey-domiciled insurers owned by Progressive, which surpassed GEICO for the No. 2 position in the market in 2022, were added to the equation. S&P Global Market Intelligence calculates Progressive's reported statutory premiums as the sum of all of its reporting subsidiaries. However, the National Association of Insurance Commissioners has not released quarterly statements for insurers' New Jersey-domiciled subsidiaries since the third quarter of 2022.

It has been more than a decade since the NAIC reported details from Progressive's two New Jersey subsidiaries, Progressive Garden State Insurance Co. and Drive New Jersey Insurance Co. State Farm does not have a subsidiary domiciled in the Garden State.

Since 2010, the two Progressive New Jersey units have constituted between 2.7% and 4.1% of the group's annual reported private auto direct premiums written. In 2024, the New Jersey-based subsidiaries reported an aggregate of $1.74 billion in direct premiums written, or 2.9% of Progressive's total private auto premiums for the year.

If the two New Jersey subsidiaries accounted for similar percentages in the first quarter, the group's direct premiums written would have been approximately $17.40 billion. That would have narrowed Progressive's gap with State Farm to $160 million. The calculation closely matches the $17.54 billion in net premiums written that the insurer reported within its first-quarter statements.

Progressive CEO Tricia Griffith during a recent earnings call said "the shopping environment in personal auto has remained very favorable." New personal auto applications set a record for the first quarter, she added.

"Our results were achieved because of both more quotes and higher conversion of those quotes to a sale," Griffith said. "More year-over-year quotes mean our customer acquisition machine is running efficiently and strong conversion in both [distribution] channels suggests a very good price competitiveness."

GEICO maintained its No. 3 ranking in the market with a 12% share on $11.01 billion in direct premiums written, a 3.9% year-over-year increase. The Allstate Corp. was fourth with a 10% market share on $9.50 billion direct premiums written, a 5.1% increase from a year ago, while United Services Automobile Association was fifth with a 6% market share and $5.90 billion in direct premiums written, a 4.4% year-over-year increase.

Loss ratios retreat

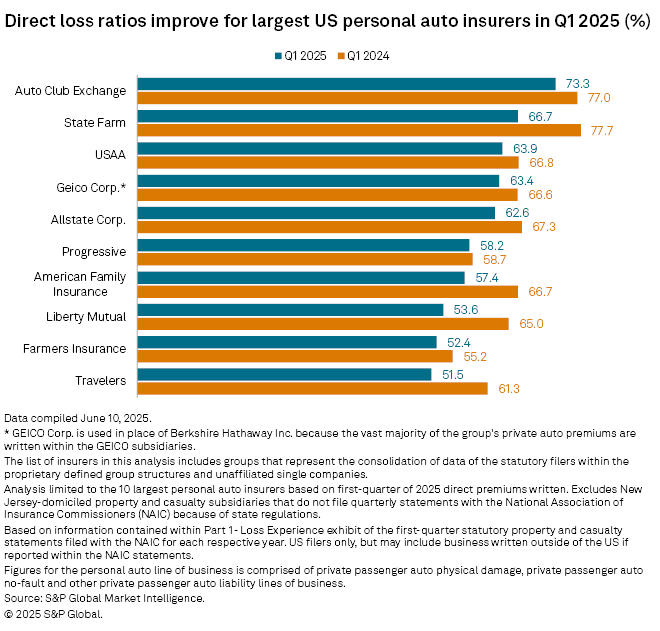

All 10 of the nation's largest insurers in the analysis saw year-over-year improvement in their direct loss ratios. The Travelers Cos. Inc. had the lowest at 51.5%, followed by Farmers Insurance Group of Cos. at 52.4%, Liberty Mutual Holding Co. Inc. at 53.6%, American Family Insurance Group at 57.4% and Progressive at 58.2%.

Auto Club Exchange Group's direct loss ratio was the worst in the group at 73.3%. State Farm had a 66.7% direct loss ratio, and USAA's ratio was 63.9%.

Liberty Mutual's loss ratio declined by 11.4 percentage points, the best improvement of the group.